In this article, we will discuss the Traditional IRA Calculator which will be helpful to you to decide the amount of savings you need to invest for your retirement goals.

IRA stands for Individual Retirement Account.

A Traditional IRA is a type individual retirement account. Investing in traditional IRA helps you grow your earnings tax-deferred.

In traditional IRA, you are entitled to the tax deduction in contribution year for that particular year.

You pay taxes on your investment gains only when you make withdrawals during your retirement years.

To know more about Traditional IRA from IRS website click on the link below:

We have created a ready to use excel template for Traditional IRA Calculator with predefined formulas. You just need to input a few details and the calculations are done automatically.

This Calculator helps to set your retirement goals and choose the amount to invest in IRA to achieve those retirement goals.

Click here to Download Traditional IRA Calculator Excel Template

You can also download other related templates like Business Net Worth Calculator, Startup Cost Calculator, and Income Statement Projection in Excel.

Let us discuss the contents of the Traditional IRA Calculator.

Contents of Traditional IRA Calculator

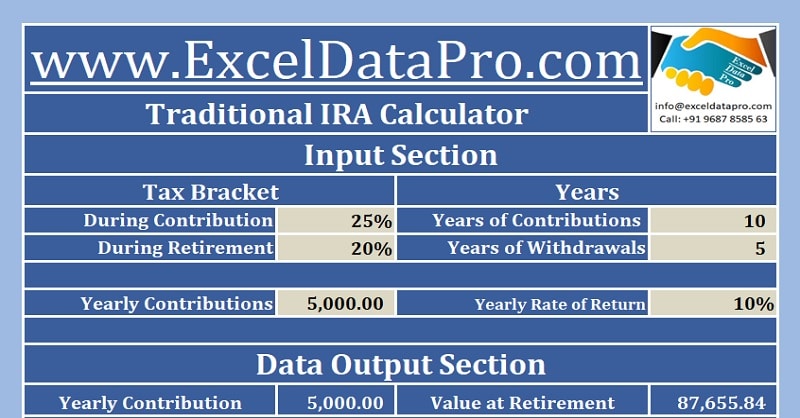

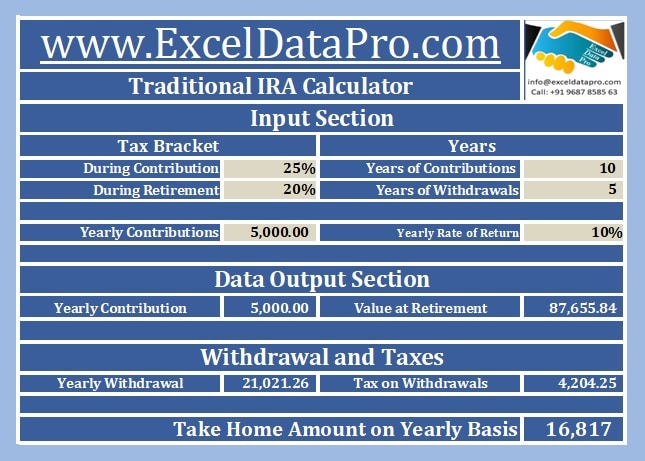

This calculator consists of 3 sections:

- Header Section

- Data Input Section

- Data Output Section

1. Header Section

As usual, the header section of the heading of the sheet ” Traditional IRA Calculator”. If you are a company, you can put your logo and company name on top.

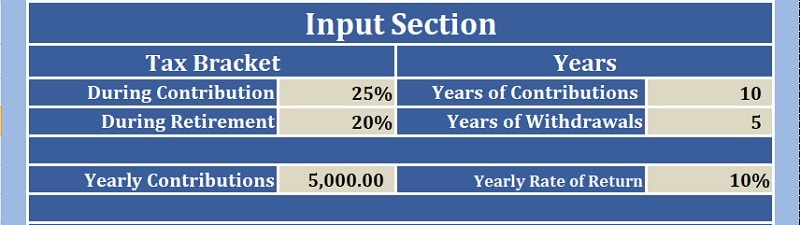

2. Data Input Section

The data input section consists of multiple details. In this section, you need to provide the following details:

Tax Bracket: Under this subheading, enter your current tax bracket and estimated tax bracket at the time of retirement.

Our sheet shows a lower rate of tax bracket during retirement. Tax brackets are decided by federal authorities and thus it is better to choose a feasible bracket. Because we don’t know what will happen during these ten years of contribution.

Years: Enter the number of years you want to contribute along with the number of years of withdrawals.

Years of contribution means the number of years you will pay for your retirement plan. Sooner the better. It is preferable that you plan IRA as soon as you begin your careers.

Years of Withdrawal are the number of years you will withdraw your invested money along with the gains on your investment.

Yearly Contributions: Yearly contributions means the amount you will invest on yearly basis.

If you plan for $ 5,000 as yearly contribution it is $ 417 per month.

Yearly Rate of Return: As per your retirement goal you need to choose the investment plan. Different plans have a different yearly rate of return.

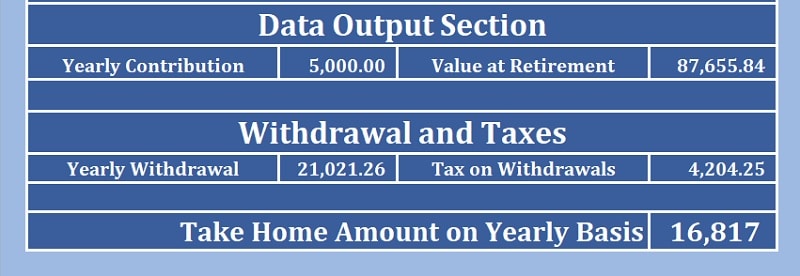

3. Data Output Section

Data output section consists of results of the above-entered values in respective cells.

Yearly Contributions: This amount is derived by linking the cell D9, It displays your contribution amount.

Value At Retirement: It is the total amount you will have at the time of retirement.

Value at retirement is calculated using the FV function of excel. The formula applied here is =FV($G$9,$G$6,-D12, 1).

Yearly Withdrawal: After ten years, as you opted for 5 years of withdrawal, you will get an amount every year for 5 years.

Formula: =PMT($G$9,$G$7,-G12,0,1)

Tax on Withdrawals: As mentioned earlier, you need to pay the then prevailing taxes on withdrawals in traditional IRAs. We had estimated an amount of 20%.

Take Home Amount: Take home yearly amount = Withdrawal – Tax % during retirement.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply