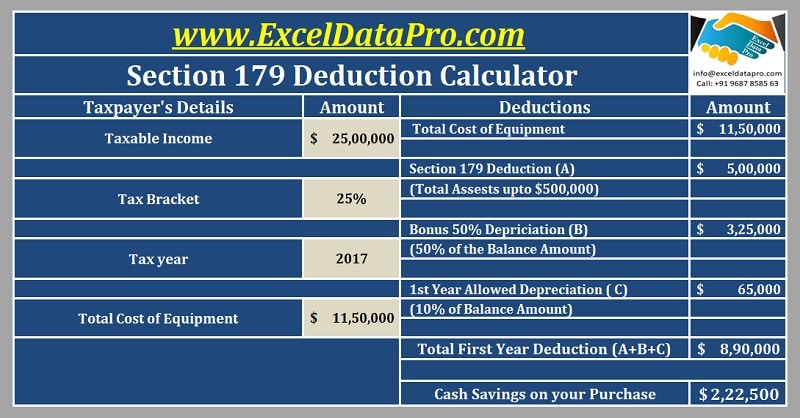

Section 179 Deduction Calculator is an excel template to help you calculate the amount you could save on your tax bill by taking the Section 179 Deduction.

As we all know Section 179 deduction is an immediate expense available to business owners on the purchase of business equipment during the tax year instead of depreciating or capitalizing over multiple years.

This initiative was taken by the government to encourage the small and medium businesses to save money on the tax bill and use it for business enhancement.

Many taxpayers have taken benefit of it and you should also go for it.

To take advantage of these high Section 179 limits for 2017, the equipment must be purchased and put into service by midnight 12/31/2017.

There is a good news for the preceding years, the limits for the year 2018 has been increased to $ 10,00,000 (1 mn).

The limit in the year 2017 is $ 5 00,000 with the threshold limit of total equipment to be $ 2 mn.

Keeping in mind all the above points, we have created Section 179 Deduction Calculator with predefined formulas.

You just need to enter a few amounts and you tentatively know that how much amount you could save on your tax bill. It is a very simple and easy to use this calculator.

Click here to download Section 179 Deduction Calculator.

To download Section 179 deduction calculator in Number for Mac users click on the link below:

Section 179 deduction calculator in Number

We have created some useful templates in excel to help simplify the process of calculating your federal income tax.

Click on the link to download the templates like Simple Tax Estimator, Itemized Deductions Calculator, 401k Calculator and Child Tax Credit Calculator etc.

Let us discuss the contents of the template in detail.

Contents of Section 179 Deduction Calculator

Section 179 Deduction Calculator consists of 2 sections:

- Taxpayer’s Details

- Section 179 Deductions

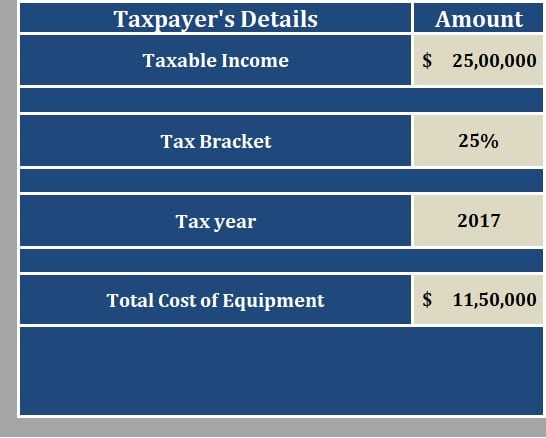

1. Tax Payer’s Details

Taxpayer’s section consists of following:

Taxable Income: Enter your taxable income here in this cell. The purpose to provide taxable income here is that according to section 179 (b) (3), the deduction amount shall not exceed the aggregate amount of taxable income of the taxpayer.

Thus, if the deduction amount is above the taxable income then section 179 deduction cannot be available.

Tax bracket: You need to enter the tax bracket in the second cell on the left. This will help us calculate the amount you saved on tax.

Tax year: Applicable Tax year. Please keep in mind the calculator is designed according to the limits and threshold of the year 2017 for Section 179 deductions.

Total Cost of Equipment: Enter the total cost of equipment for which you are planning to claim the Section 179 deduction.

Only 4 things need to be provided in Section 179 Deduction Calculator to calculate the amount of available benefit.

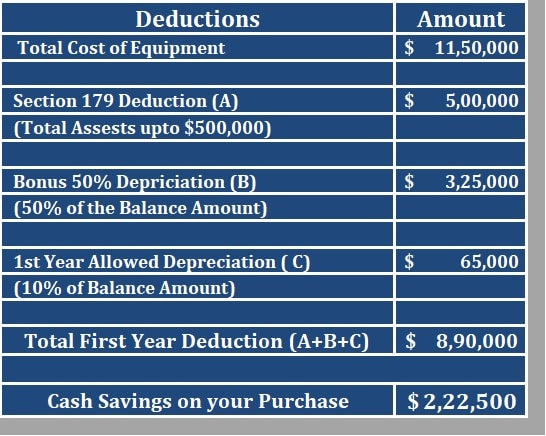

2. Section 179 Deductions

When you have entered the above amounts in the taxpayer’s details section, Section 179 Deduction will calculate the total amount of deduction.

Total Amount Of Deduction = Section 179 Deduction + Bonus Depreciation + Allowed Depreciation

Where:

Section 179 Deduction = Cost of Equipment up to $ 5,00,00.

Bonus Deduction = 50% of the Value left after deducting $ 500,000.

If the value of the equipment is less than $500,000 then the bonus depreciation will not be available as the total value of the asset is shown as an expense.

1st year Allowed Depreciation = 10% of the balance amount remaining after deducting $ 500,000.

Similar to Bonus Depreciation, the first year depreciation is also not available if the amount is below $ 500,000 as the total value of the equipment has been written off as an expense.

Disclaimer: Interpretation of the above topics is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant before going for section 179 deductions.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply