Definition – SECA Tax

SECA stands for Self-Employed Contribution Act. Self-Employment Contribution Act is a law which mandates the self-employed small business owners to pay 15.3% Self-Employment Tax on their net income which covers their own Social Security, Medicare, and OASDI expenses.

SECA is similar to FICA taxes that are applicable to salaried/waged individuals. The only difference here is that in FICA half of the contribution is made by the employer and half by the individual. Whereas in SECA, the individual is both; the employer and the employee, all 15.3% is borne by him.

The best part of SECA is that you can claim the deduction of 50% of Self-Employment taxes paid on your Income tax return. If you file a Form 1040 Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Who must pay for SECA Taxes?

You must pay self-employment tax and file Schedule SE (Form 1040) if either of the following applies.

- Your net earnings from self-employment (excluding church employee income) were $400 or more.

- You had church employee income of $108.28 or more.

Source: www.IRS.gov

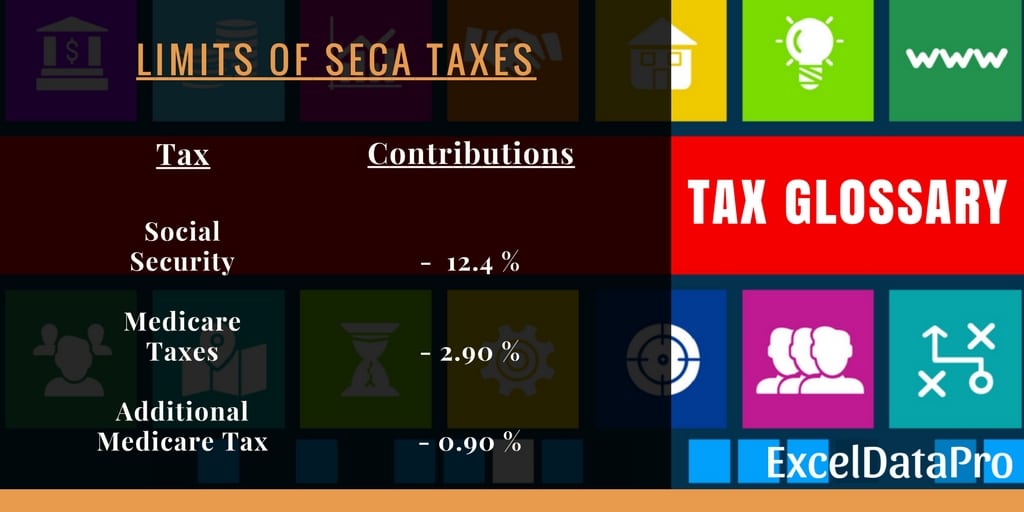

SECA Tax Rates and Limits

SECA taxes include three parts:

- Social Security Tax

- Medicare Tax

- Additional Medicare Tax

1. Social Security Tax

A self-employed individual will pay 12.4% of the net income as social security tax. Social Security tax is only assessed on the first $127,200 of earned income.

2. Medicare Taxes

A self-employed individual will pay 2.9% of the net income as Medicare tax. Social. Like the social security taxes, there is no cap for Medicare taxes. The rate applies to your total earned income, no matter how high it is.

3. Additional Medicare Tax

Similar to FICA, 0.9% additional Medicare Tax is also applicable to self-employed individuals for any income above $200,000 (single filers) or $250,000 (married filing jointly).

The below image projects the above data in a tabular form:

How To Calculate Self-Employment Tax?

Follow these easy steps to calculate your Self-Employment Tax:

Step 1: Multiply your net income by 92.35% so that you get the net income for self-employment tax calculation. This is nothing but the employer contribution deduction of 7.65%.

Step 2: Multiply the answer derived from step 1 with 12.4%. You will get your Social Security Tax amount.

Step 3: Multiply the answer derived from step 1 with 2.9%. You will get your Medicare Tax amount.

Step 4: This step is only applicable if your income is above $ 200,000. Multiply the answer derived from step 1 with 0.9%. You will get your Additional Medicare Tax amount.

Step 5: Add Results of Step 2 and Step 3 and divide by 2. This will be your Tax-deductible portion.

As a self-employed individual, you may have to file Estimated Taxes quarterly. You can use these estimated tax payments to pay your self-employment tax. Refer to the Estimated Taxes page and Publication 505, Tax Withholding and Estimated Tax for more details.

We have created some useful tax calculators like Simple Tax Estimator, Itemized Deduction Calculator, 401k Calculator etc.

Now MAC operating system users can download the above templates in Apple’s Numbers Application also from the link below:

Federal Income Tax Apple Numbers Templates

These templates can help you easily calculate your federal income tax. These templates are free to download and easy to use with no limitations.

Disclaimer: Interpretation of the above topic is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply