Definition – FICA (Federal Insurance Contribution Act)

FICA is the abbreviation of Federal Insurance Contribution Act. Federal Insurance Contribution Act is a tax provision of IRC that mandates the employer to withhold the employee’s contribution to Social Security and Medicare taxes from their paycheck and pay it along with employer’s contribution to IRS.

FICA taxes are composed of the old-age, survivors, and disability insurance taxes. They are also known as social security taxes.

In addition to social security taxes, FICA also consists of the hospital insurance taxes which are known as Medicare taxes. An additional Medicare tax is also applicable above the threshold.

Social Security Collections are utilized to provide monthly benefits for retired or disabled workers and their dependents. Whereas the Medicare collections are used to cover health and hospitalization.

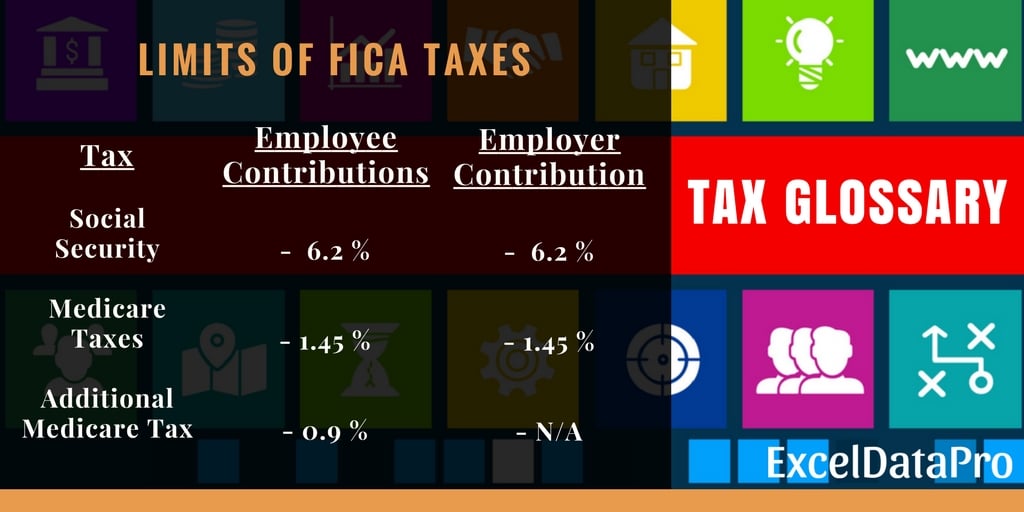

Limits of FICA Taxes

Let us bifurcate the amount of FICA taxes paid by an employer and the employee in total. There are three types of taxes:

- Social Security Taxes

- Medicare Taxes

- Additional Medicare Taxes

Each of the above has different limit and threshold. Let us discuss them in detail.

1. Social Security Taxes

Total 12.4 % is collected as Social Security Taxes. Only 6.2 % is collected from your paycheck and the rest 6.2 % is contributed by your employer. The threshold for the year 2017 is $ 127,200.

2. Medicare Taxes

Total 2.9 % is collected as Medicare Taxes. Out of which 1.45 % is collected from the paycheck of the employee and the rest 1.45 % is contributed by the employer. THere is no threshold limit for Medicare expenses.

3. Additional Medicare Taxes

Under the Affordable Care Act, an Additional Medicare Tax of 0.9 % levied on employees who earn more than $200,000 a year. This limit for the married couple filing jointly is $250,000. This tax is totally borne by the employee and there is no contribution from the employer.

The image below gives describes the above information in tabular form:

Responsibilities Of An Employer Related To FICA Taxes

There are two responsibilities of an employer in relation to the FICA taxes:

- Withhold the correct amounts of FICA taxes (social security and Medicare taxes) of his employees and send them to the government.

- Pay your matching contribution to the government as an employer.

Refer to Publication 15, (Circular E), Employer’s Tax Guide, for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide, for agricultural employers.

We have created some useful tax calculators like Simple Tax Estimator, Itemized Deduction Calculator, 401k Calculator etc.

Now Apple MAC users can download the above templates in Apple’s Numbers Application also from the link below:

Federal Income Tax Apple Numbers Templates

These templates can help you easily calculate your federal income tax. These templates are free to download and easy to use with no limitations.

Disclaimer: Interpretation of the above topic is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply