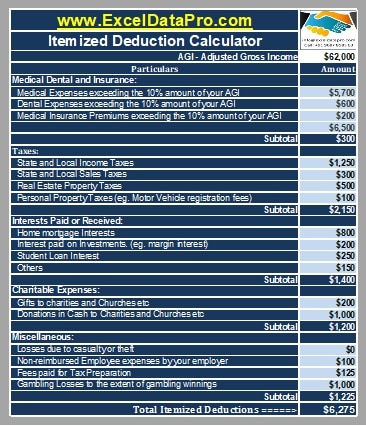

Itemized Deductions Calculator is an excel template. It helps the taxpayer to choose between Standard and Itemized Deductions.

A taxpayer needs to choose between itemized or standard deduction while filing the federal tax returns.

The standard deduction is a fixed dollar amount to be deducted from taxable income with no questions asked. Whereas the itemized deductions are actual amounts of deductions claimed.

When deciding between standard and itemized deductions the following points must be considered:

- Total of the all the itemized deductions should be higher than the standard deduction amount.

- You must have proper documents to support the claim whenever demanded by the IRS.

- If you have faced losses due to a federally announced natural disaster/casualty or a victim of theft during the tax period.

- When you have paid high mortgage interest payments or real estate taxes on your home during the tax period.

To know more about itemized deductions click on the link below:

We have created an Itemized Deductions Calculator with predefined formulas. This template helps you easily estimate your itemized deductions.

Click here to download the Itemized Deductions calculator Excel Template.

To download the same calculator in Numbers click the link below:

Itemized Deduction Calculator Apple Numbers Template

You can download other excel templates like Simple Tax Estimator, Traditional IRA Calculator, Roth IRA Calculator and much more for easy calculations.

Let us discuss the contents of the template in detail.

Contents of Itemized Deductions Calculator

Itemized Deductions Calculator consists of 2 main sections:

- Header Section and

- Calculation Section.

Header Section

Usually, the header section consists of the name of the company, company logo and heading of the template ” Itemized Deductions Calculator”.

Additionally, it consists of your Adjusted Gross Income. To easily calculate your adjusted gross income you can use our Adjusted Gross Income Calculator.

Calculation Section

The calculation section consists two columns; Particulars and amounts. The particulars section has all types expenses reported under Itemized Deductions. The amounts columns contain the respective amounts of expenses.

These expenses have been categorized into 5 different types:

- Medical, Dental and Insurance

- Taxes

- Interest Paid Or Received

- Charitable Expenses

- Miscellaneous Expenses

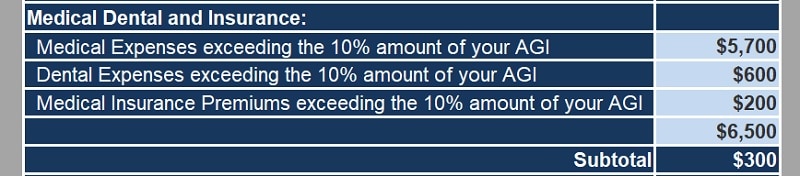

1. Medical, Dental and Insurance

This category reposts the medical, dental and insurance premium expenses that are above 10 % of your Adjusted Gross Income(AGI) as the laws.

You need to enter your actual expenses. With predefined formulas, it will automatically subtotal the amounts and calculate the amount higher than 10% of your AGI.

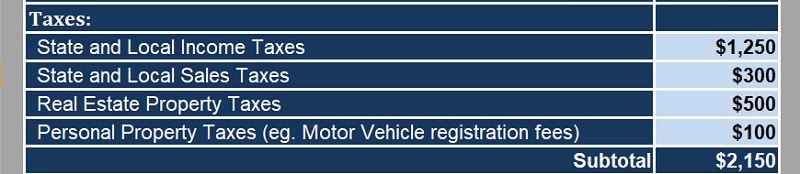

2. Taxes

State and local income taxes, State and local sales taxes, real estate and other personal property taxes are reported in this head.

Enter the actual amounts and it will automatically sum up the total for you.

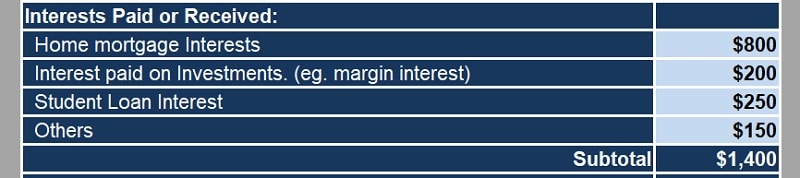

3. Interest Paid or Received

This category reports the home mortgage interests paid, student loan interest, interests paid or received on investments and other interest related expenses.

Just enter the amounts in the respective cells and it will sum them up.

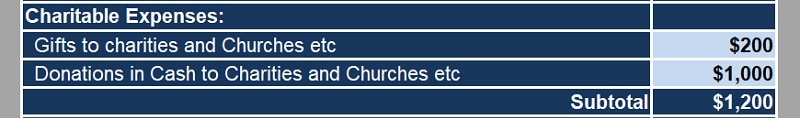

4. Charitable Expenses

Donation of in the form of gifts or in form of cash amount are reported under this category. Similar to the above categories enter the respective amounts and totals will automatically appear.

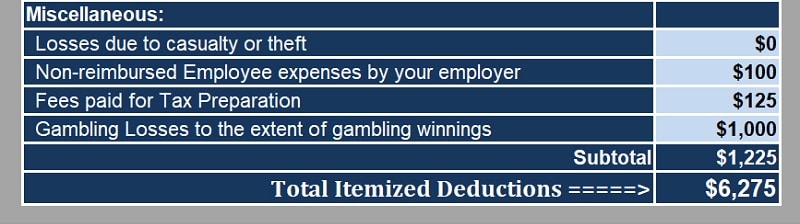

5. Miscellaneous

Under the miscellaneous category, expenses related to losses due to theft or casualty, non-reimbursed employer expenses, tax preparation fees and losses to the extents of gambling winning are reported.

Entering the respective amounts will calculate the totals for you.

At the end, adding the subtotals of all categories gives you the amount of Itemized deductions.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply