Savings Goal Tracker is a ready-to-utilize Excel template designed to assist individuals in planning their savings for multiple purposes based on their income sources and expenditures. This tool is intended to streamline the process of financial planning and goal-setting.

Furthermore, it facilitates the planning of a monthly allotment for various purposes, enabling users to allocate funds effectively. Additionally, it serves as a tracking mechanism for monitoring the amounts deposited towards each designated purpose on a monthly basis. This feature promotes accountability and provides a clear overview of progress towards financial objectives.

Moreover, the template offers a comprehensive view of the disparity between income and expenses, highlighting any deficit that may impede the attainment of savings goals. By presenting this information transparently, users can make informed decisions and adjustments to their financial strategies as required.

Why Saving is Important?

- Achieving financial independence is a paramount objective, and consistent saving is instrumental in attaining this goal.

- Accumulating assets or securing funds for mortgage payments is facilitated through disciplined saving practices.

- Saving enables individuals to effectively manage and eliminate debt, fostering financial stability and freedom.

- Establishing an emergency fund through regular saving equips individuals to handle unforeseen expenses without compromising their financial well-being.

- Elevating one’s standard of living and achieving desired lifestyle goals often necessitates a concerted effort to accumulate savings over time.

- Planning and funding enriching experiences, such as well-deserved vacations, requires diligent saving habits.

- Preparing for retirement, or even early retirement, is contingent upon consistent saving and prudent financial planning throughout one’s working years.

- Funding higher education or developing new skills frequently demands a substantial financial commitment, which can be facilitated through strategic saving.

- Acquiring equipment or resources necessary for business operations may require significant capital, which can be sourced through dedicated savings efforts.

- Establishing a startup or entrepreneurial venture typically necessitates a substantial financial reserve, underscoring the criticality of saving.

Tips to Save More Out of Your Hard Earned Money

- Developing financial literacy is an essential first step towards effective saving and wealth accumulation.

- Clearly defining financial goals provides direction and motivation for consistent saving practices.

- Crafting a comprehensive budget and integrating savings plans is crucial for allocating funds effectively.

- Continuously seeking opportunities to augment earnings through additional income streams can accelerate the rate of savings.

- Avoiding debt traps is imperative, as interest payments can severely impede savings growth.

- Limiting or avoiding unnecessary credit card usage can prevent the accumulation of high-interest debt, thereby preserving funds for savings.

- Exercising discipline in distinguishing between essential needs and discretionary desires can promote more judicious spending habits, allowing for greater savings potential.

- Investing in skills development and education can unlock new career opportunities and potential income streams, ultimately facilitating increased savings capacity.

- Adopting a long-term mindset and focusing on wealth accumulation through strategic investments can yield compounding returns, amplifying overall savings over time.

Savings Goal Tracker Excel Template

We have created a simple and easy Saving Goal Tracker Template to manage your income-expenses, plan your savings goals and track the progress of your saving goals.

Click here to download Savings Goal Tracker Excel Template.

Click here to Download All Personal Finance Excel Templates for ₹299.You can download other financial analysis templates like Credit Card Payoff Calculator, Savings Goal Tracker, Income Tax Calculator FY 2018-19 and Loan Amortization Template.

Let us discuss the contents of the template in detail.

Contents of Saving Goal Tracker Excel Template

This template consists of sections:

- Saving Planner

- Income Register

- Expense Register

- Actual Savings Register

- Saving Tracker Chart

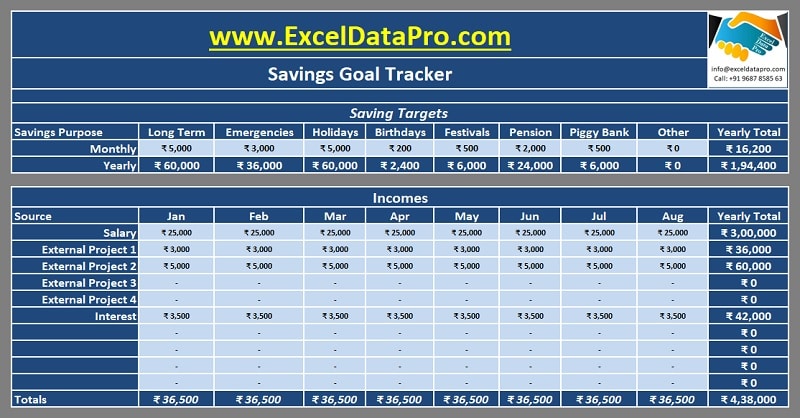

Savings Planner

The Savings Planner section allows users to define and allocate funds towards various savings objectives, such as long-term goals, holidays, mortgage payments, vehicle purchases (e.g., cars or motorcycles), and other personalized purposes. Users can specify a desired monthly contribution for each designated purpose, ultimately calculating an average yearly savings target.

Insert the desired amount against the respected column.

This section encourages a proactive approach to saving by prompting users to plan their savings commitments before allocating funds for other expenditures. By prioritizing savings at the outset, individuals can develop a habit of conscientious financial management and increase the likelihood of achieving their goals.

The template provides separate columns for monthly and yearly allocations, streamlining the process of calculating annual savings targets based on monthly contributions. This feature ensures transparency and simplifies tracking progress towards long-term objectives.

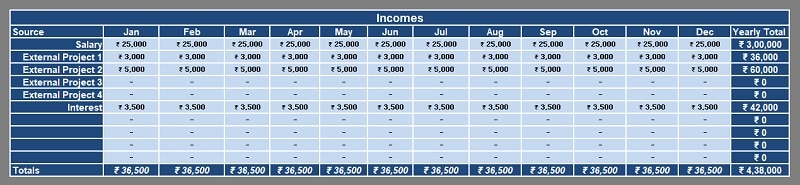

Income Register

The Income Register is designed to capture all income streams, including salary, external projects, interest income, rental income, and any other relevant sources.

Users can record their monthly income from January to December, ensuring a comprehensive overview of their financial inflows. modify or add income categories according to individual circumstances

the Income Register automatically calculates monthly totals and provides a cumulative line total, enabling users to assess their overall income at a glance.

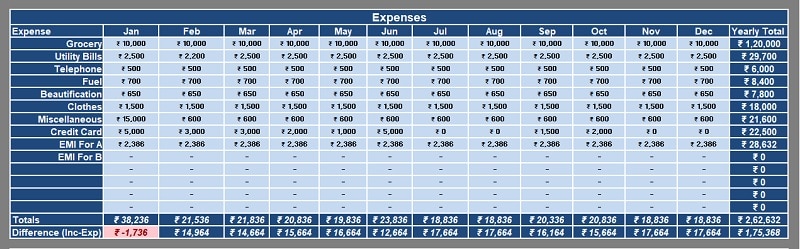

Expense Register

Complementing the Income Register, the Expense Register serves as a comprehensive log for tracking monthly expenditures across various categories.

You have to record each expense made by you during the month. It includes grocery, fuel, utility bills, telephone, EMI’s, credit card payments, and any other relevant outflows.

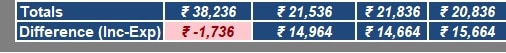

Moreover, the Expense Register provides a dedicated row displaying the difference between income and expenses, highlighting any surplus or deficit for the given period. As you can see in the image, the first month shows the amount in red.

It means that month you have spent more than your income. There will be no money to save. Usually, this does not happen, but just given for an example.

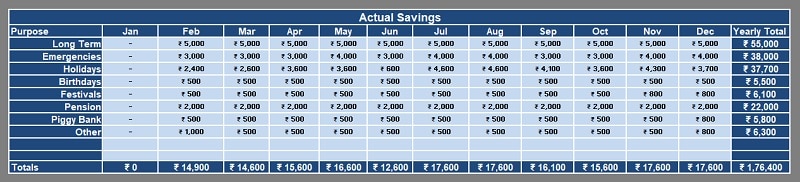

Saving Goal Tracker

After planning, earning and spending, its time to save. So, execute the plan that you made.

Important Note: Make sure you spend in limit so that you have enough money to save for your goals. It is recommended that this step should be taken before spending.

Disburse the amount to respective accounts so that you can have a check anytime you want. Soon after the disbursement, record them in this section.

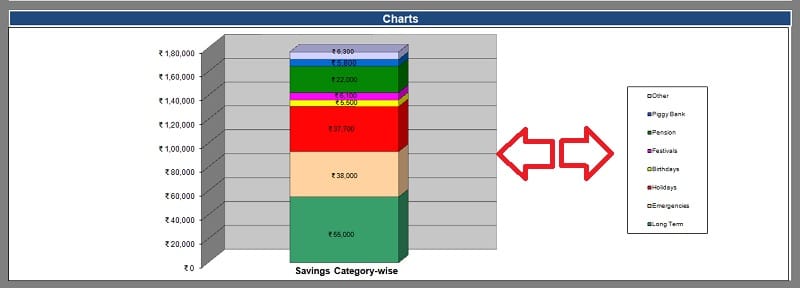

Saving Goal Tracker Charts

We have created a column graph that will display the progress of your savings goal. It display the amount each of your saving goals has reached in graphical form.

This savings goal tracker will help you easily plan your savings, make you debt-free and give you financial freedom.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.