The Purchase Return Book Template is a meticulously designed tool available in Excel, Google Sheets, and OpenOffice formats. This template facilitates the efficient management and documentation of purchase return transactions, providing a structured approach to recording these important business processes.

Table of Contents

What is a Purchase Return Book?

The Purchase Return Book, also referred to as the Return Outward Book, is a crucial subsidiary account ledger that documents goods returned to suppliers. This financial record plays a vital role in maintaining accurate inventory and financial records.

Typically, goods are returned to suppliers due to various reasons, including substandard quality, quantity discrepancies, or untimely deliveries. Purchase returns, or returns outwards, are an integral aspect of business operations that require careful documentation.

It is imperative to record Purchase Return entries on a daily basis in individual supplier accounts. These entries should be posted to the debit side of the supplier’s account within the creditor’s ledger. This practice ensures that creditor accounts remain current and accurately reflect the financial position of the business in relation to its suppliers.

Purpose of Purchase Return Book

The main purpose of the return outward book is to record the goods return transactions for purchases made on credit.

A company returns goods because:

- Receipt of defective or damaged goods

- Goods might have been damaged during the transit.

- Discrepancies in quantities compared to invoice specifications

- Late deliveries that may impact business operations

- Quality variations from agreed-upon samples or specifications

- Non-compliance with contractual agreements

Thus, the buyer issues a debit note for the goods returned. Every entry in this book is made based on debit notes issued by us to suppliers.

What are Debit Notes?

A Debit Note is a formal document that serves to debit the account of the supplier in conjunction with purchase returns. Essentially, debit notes function as goods return invoices, containing crucial details such as quantity, product specifications, and reasons for return.

When a debit note is issued, the supplier’s account is debited in the buyer’s books of account, while the supplier credits the buyer’s account in their own financial records. This reciprocal accounting ensures consistency and accuracy in financial reporting for both parties involved in the transaction.

Maintaining regular and accurate purchase return records is essential for avoiding discrepancies in creditor accounts. It is important to note that the amount of Accounts Payable decreases with each purchase return, reflecting the reduced financial obligation to suppliers.

Journal Entries of Purchase Return

Return of goods is recording in books of accounts with the following journal entries:

| Particulars | Amount |

|---|---|

| Creditors A/C | Debit |

| To Purchase Return A/C | Credit |

Purchase Return Book Template (Excel, Google Sheet, OpenOffice)

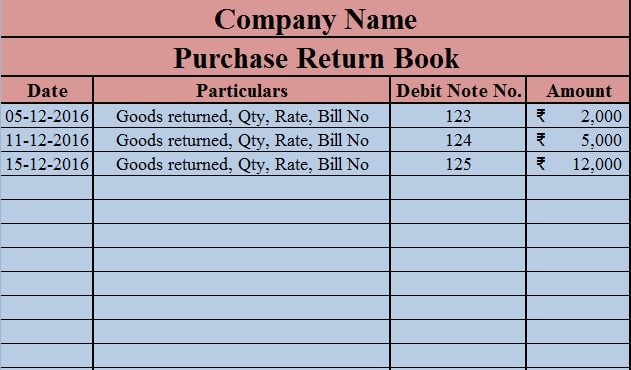

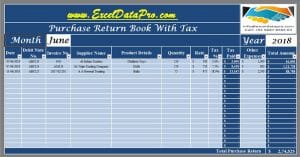

We have created a Return Outward Book Template for easy accounting. You can customize it according to your needs as and when required.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

Apart from that, you can also download other accounting templates like Cash Flow Statement, Accounts Payable Ledger, and Accounts Receivable Statement.

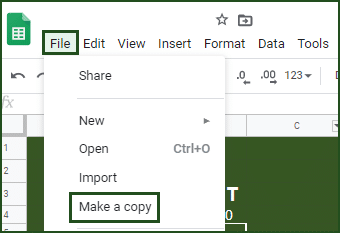

Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Let’s discuss the contents of this template in detail.

Contents of Purchase Return Book Template

Return Outward Book Template contains two sections as mentioned below: Heading Section and Data Input Section.

Heading Section

Enter Company/Business Name in the first row. Cells A1 to D1. Merge these cells.

Enter heading of Purchases Return book in the second row. Cells A2 to D2. Merge these cells.

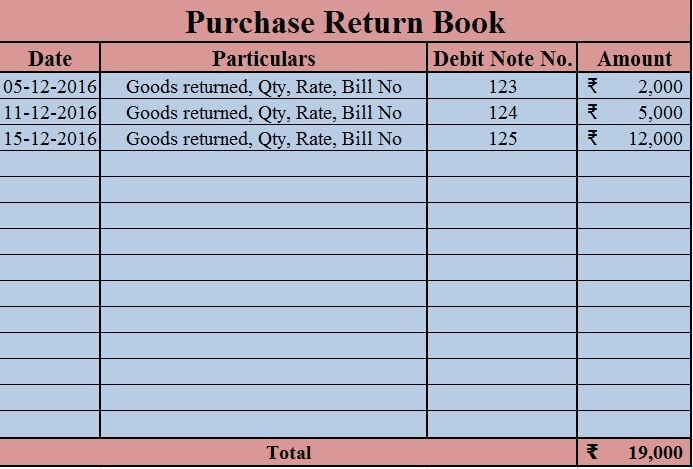

Data Input Section

The third row consists of subheadings for data input. These include date, particulars, debit note number, and amounts. See the image below:

Row5 to Row 17 is the data input section. In this area, you need to enter the date return, the name of the supplier along with product details, debit note number, and the amount.

Merge Cell A18 to C18. This cell displays the subheading of the total. Cell D18 contains the total amount of Purchase return. The formula applied here is =SUM(D4:D21).

Purchase Return Book Templates With Tax

We thank our readers for liking, sharing, and following us on different social media platforms, especially Facebook.

If you have any queries or questions, share them in the comments below and I will be more than happy to help you.

Frequently Asked Questions

Why is the purchase return credited?

Purchase returns are credited to offset the debit balance of the Purchases account. This accounting treatment provides a clear view of net purchases and helps in accurate financial reporting. The Purchase Return account, maintained as a separate ledger, allows for easy tracking and analysis of all returns in one consolidated location.

Is the purchase return an expense or revenue?

From an accounting perspective, purchase returns and allowances are considered a contra-expense account. When goods are returned, the transaction results in a debit to creditors and a corresponding credit to purchase returns and allowances. This accounting treatment effectively reduces the accounts payable balance by the value of the returned goods.

Which types of goods we can record in purchase return records?

Only goods directly related to a business’s core operations and intended for resale can be recorded in purchase return records. This limitation ensures that the Purchase Return Book accurately reflects transactions pertinent to the primary business activities. Ancillary purchases or goods not intended for resale should be recorded separately to maintain the integrity of the purchase return records.