The Loan Comparison Calculator is a pre-designed Excel template that enables users to evaluate multiple loan scenarios and make an informed decision by selecting the most advantageous option. The comparison is predicated on four distinct criteria: interest rate, installment amounts, repayment duration, and total repayment sum.

This tool not only presents a graphical representation of the comparisons but also incorporates an EMI (Equated Monthly Installment) calculator and a loan amortization schedule with provisions for loan foreclosure or prepayment.

Choosing between multiple loans is very confusing sometimes and if you are new, then it just becomes more confusing. Many times, the lender makes it more complicated by using difficult terminology instead of simple terms.

Selecting the most suitable loan from multiple options can be a perplexing endeavor, particularly for those who are unfamiliar with the process. Lenders often exacerbate the confusion by employing complex terminology instead of straightforward language.

Table of Contents

Loan Comparison Calculator Excel Template

The Loan Comparison Calculator Excel Template addresses this issue by providing a user-friendly interface that simplifies the decision-making process.

Furthermore, the template also provides a loan amortization schedule for all scenarios. The template compares the loans on the basis of interest to be paid, total repayment amount, repayment duration and installment amount.

Click here to download Loan Comparison Calculator Excel Template

Click here to Download All Personal Finance Excel Templates for ₹299.In addition to the above, you can also download other personal finance templates like Savings Goal Tracker, Household Budget, Credit Card Payoff Calculator and Personal Income Expense Tracker from our website.

Let us understand the contents of the template and how to use this template.

Contents of Loan Comparison Calculator Excel Template

This template consists of 3 sheets; Loan Details Sheet, Amortization Schedule, and Loan Comparison Calculator.

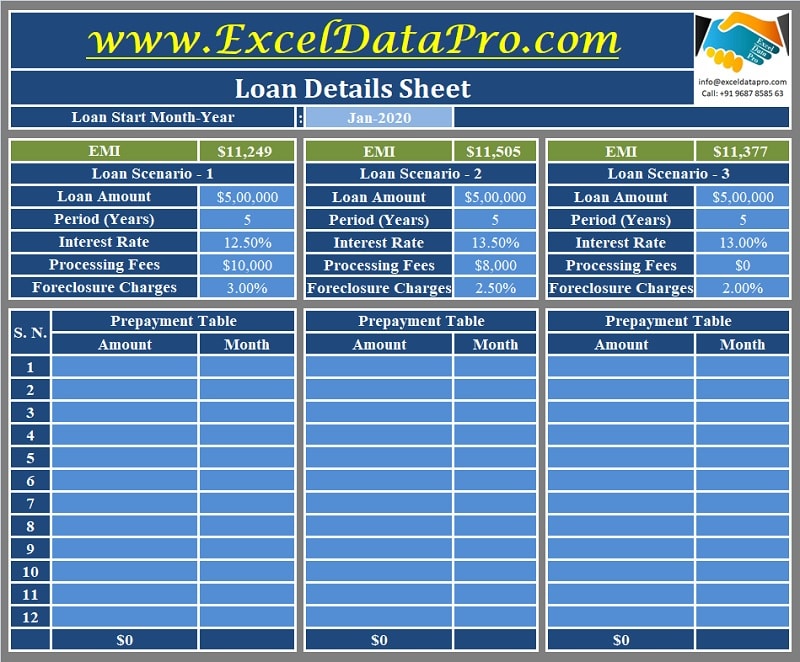

Loan Details Sheet

Users are required to provide the following details for each loan:

- Loan Start Month

- Loan Amount

- Period (Years)

- Interest Rate

- Processing Fees

- Foreclosure Charges

The prepayment table can be utilized during the loan repayment period. If any payments exceeding the EMI are made, they should be recorded in this table.

Prepayments can have a significant impact on the loan’s overall cost and duration. When a prepayment is made, foreclosure charges may be applicable as it reduces the number of installments or the loan tenure.

For instance, if a borrower opts for a personal loan and manages to accumulate a substantial sum during the third year, they may consider early settlement.

If multiple prepayments are made the foreclosure charges are applicable to the total amount. EMI/Installment amount is calculated for each loan at the top and displayed in green boxes.

Thus, fill the same for all the loans you want to compare. You can compare up to 3 loans on this sheet. IF you want to compare more, then you need to insert the column accordingly. If you need any help we will be happy to help you.

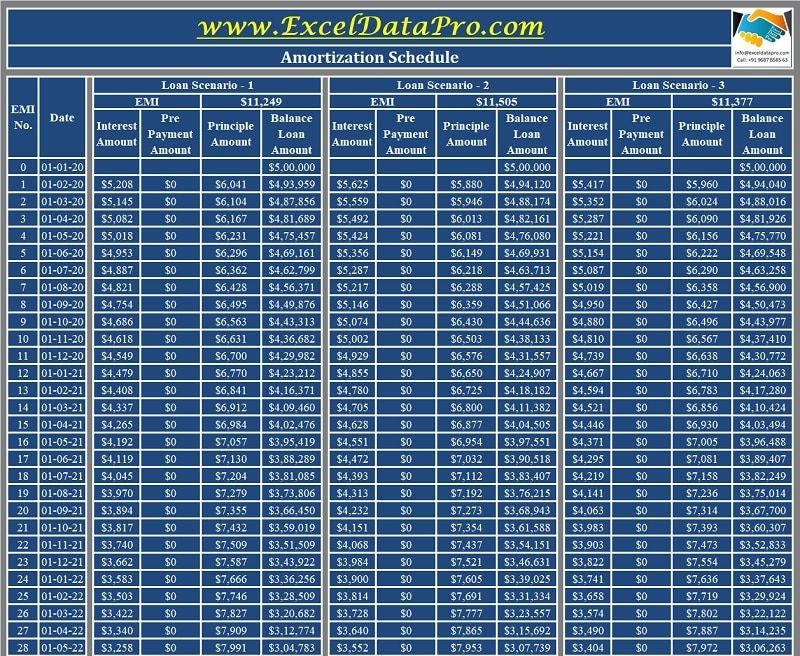

Amortization Schedule

Users do not need to make any entries in this sheet. The Amortization Schedule displays the EMI serial numbers and dates on the right. Additionally, it provides a comprehensive month-wise repayment schedule until the loan amount reaches zero.

This schedule is presented for all three loan scenarios, according to their respective tenures. The table includes the following columns:

Interest Amount

Prepayment Amount

Principle Amount

Balance Loan Amount

This sheet can calculate loan installments for up to 30 years, displaying the amortization schedule for all three loan scenarios.

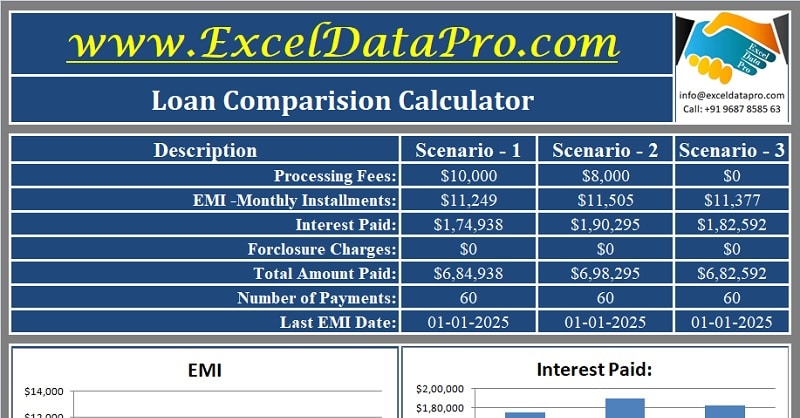

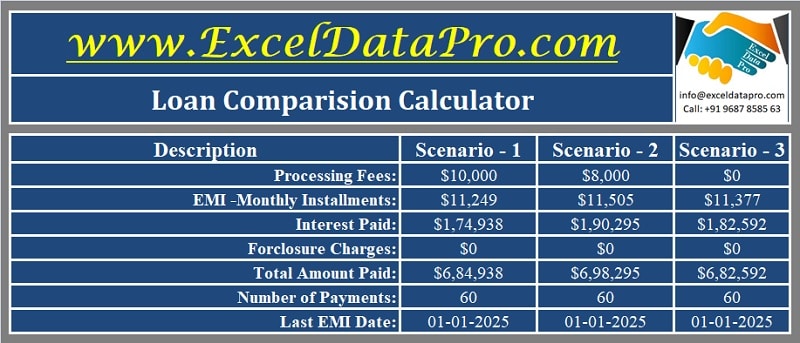

Loan Comparison Calculator

This sheet consists of a table that displays the summary of all three loans. It consists of the following details:

Processing Fees

EMI-Monthly Installments

Interest Paid

Foreclosure Charges

Total Amount Paid

Number of Installments

Last Date of EMI

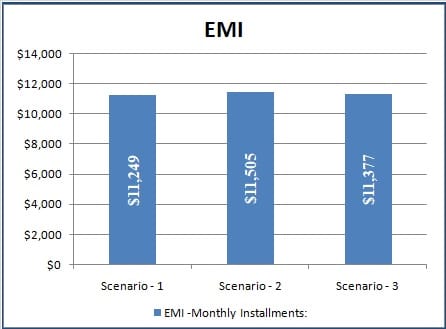

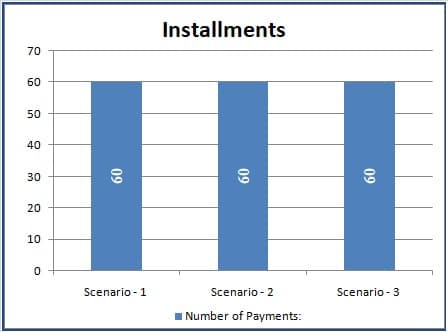

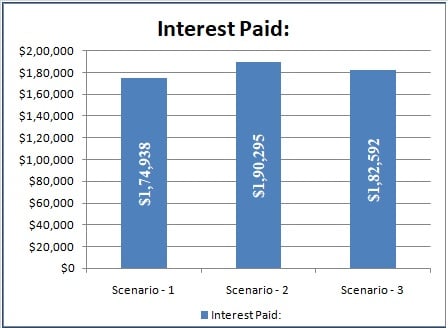

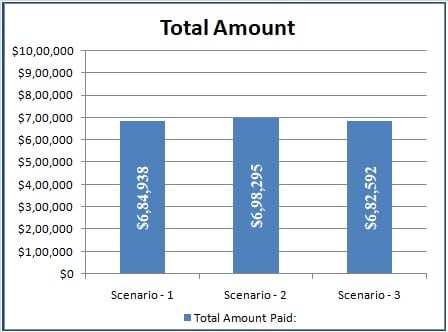

The final sheet offers a graphical representation of the loan comparison, enabling users to visualize the differences across four key criteria: Number of Installments, Installment Amount, Interest Amount, and Total Payment Amount.

Total interest paid is the amount paid including the processing fees, principal amount, interest amount, and foreclosure charges if applicable.

Loan Comparison Charts

The last sheet consists of a graphical representation of the loan comparison. It compares on the following 4 criteria: Number of Installments, Installment Amount, Interest Amount and Total Payment Amount.

EMI Graph

Number of Installments Graph

Total Interest Amount Graph

Total Payment Amount Graph

We extend our gratitude to our readers for their continued support, engagement, and advocacy across various social media platforms.

If you have any queries or require further assistance, please share them in the comment section below. We will be more than happy to address your concerns and provide additional guidance.

Leave a Reply