We have created InvoiceCRM, an online software for Simplified GST Invoicing and Effortless GSTR Filing. You can create your invoice in less than a minute and get your CSV file in just one click.

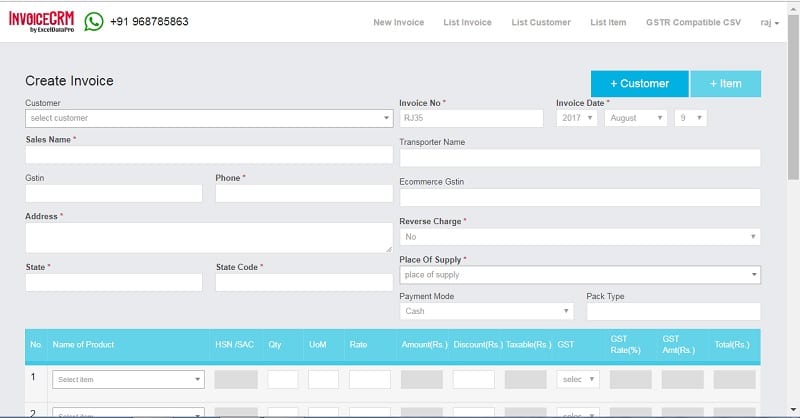

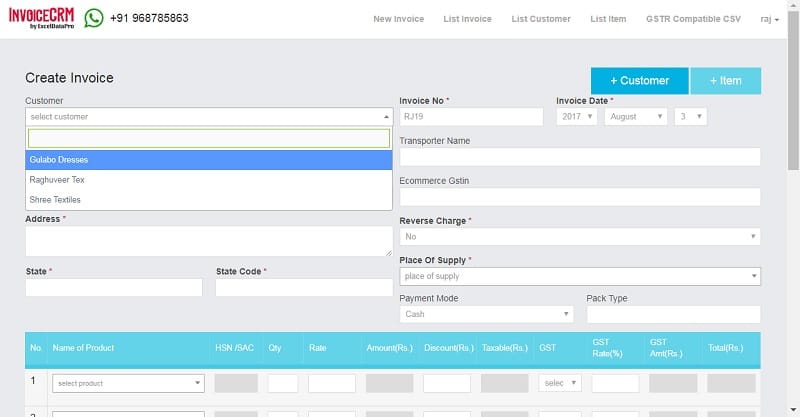

First Look:

Create your invoice anytime and anywhere.

Being Indian, we usually have a tendency to try things before I buy. Thus, you can use the demo version of the software by clicking on the link below:

Once you are satisfied by the demo you can buy the software from the buy now link given at the top of the demo page.

Let us discuss the working of the software in detail.

Simplified GST Invoicing

You can issue your invoice in just 3 easy steps:

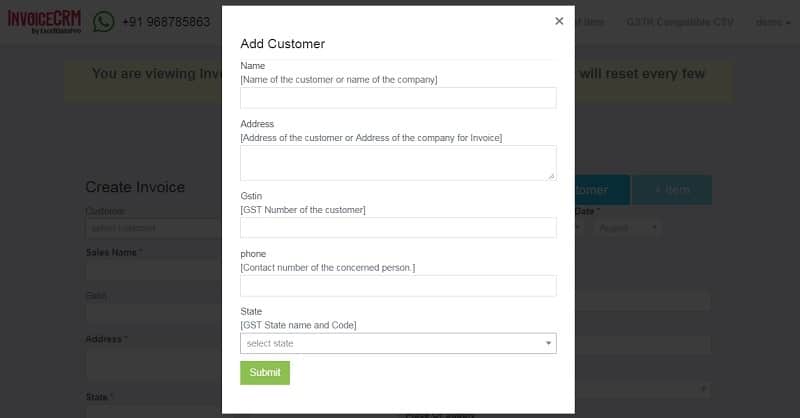

1. Adding Customers

Click on the +Customer button on the top right side of the screen. a new window will open.

Add customer details like customer name, address, GSTIN, phone number, State and State Code.

This is only one-time entry and it gets stored in Customer master.

These entries will be displayed in the drop-down list when you issue another invoice.

You can add as many customers you want to add.

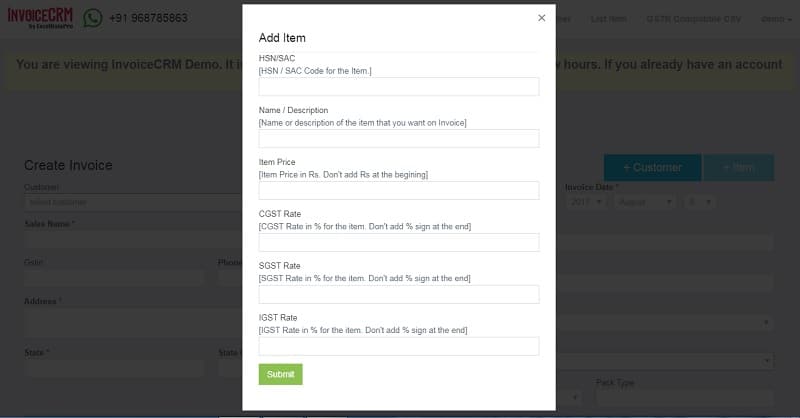

2. Adding Invoice Items

Click on the +Item button on the top right side of the screen. a new window will open.

Add item details like HSN/SAC code, item description, price and applicable GST tax rate (CGST, SGST or IGST).

This is only one-time entry and it gets stored in Items master.

All the entries made here will be displayed in the drop-down list when you issue another invoice.

You can add as many items you require.

3. Issuing Invoice

Select already added customer name from the drop-down list. It will auto fill all the fields.

Choose Place Of Supply(POS) from the drop-down list.

Select already added items from the drop-down list. It will auto fill the fields.

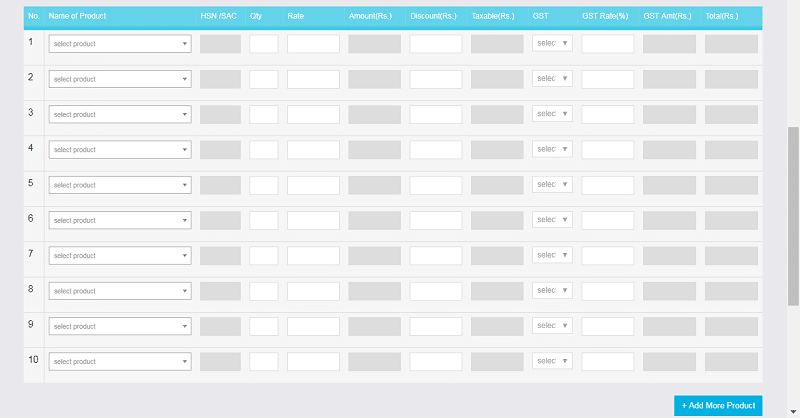

Enter quantity and select the applicable tax from the list. CGST+SGST or IGST.

You can add up to 10 invoice items. If there are more than 10 invoice items, you can click on the Add items button. This will add 5 items at a time.

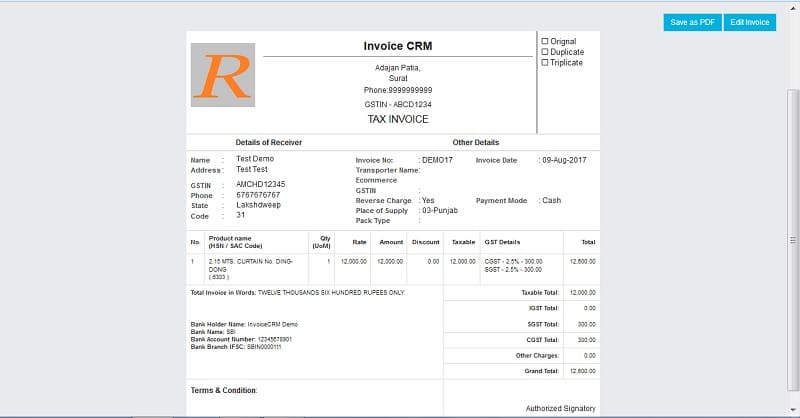

Click on Submit button and your invoice is ready.

Saving the invoice in pdf format can be done by clicking Save as PDF button.

If you want to edit invoice, you can go to edit screen in just one click on the button of Edit Invoice

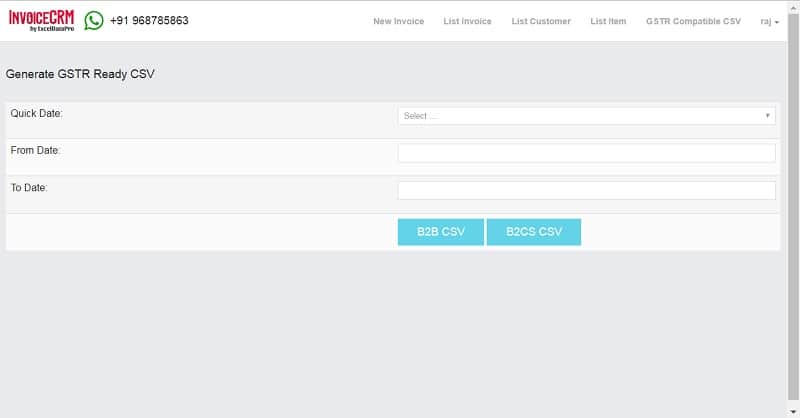

Effortless GSTR Filing

People find GST filing a hectic job due to its manual entry and other technical reasons of converting files to CSV etc.

Issue your invoices in InvoiceCRM and your data gets accumulated on the cloud.

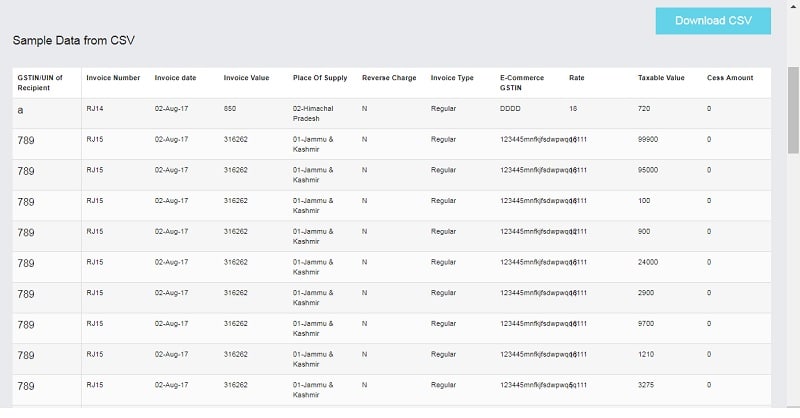

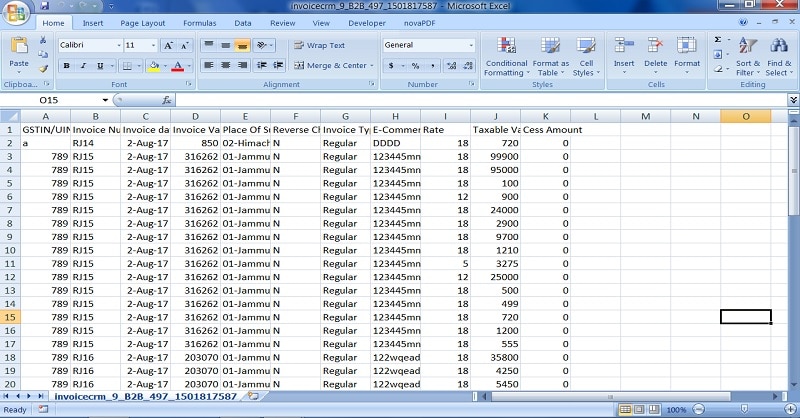

At the end of the month, select quick dates or choose manual dates if required for downloading CSV for B2B or B2Csmall type of transactions.

The system will display CSV data for selected dates. Click on the button to download the CSV.

Upload this CSV file to the GST portal.

Before we decided to work on this solution, we discussed it with many individual customers from different industries, tax consultants, accountants and also Chartered Accountants.

During the whole process of creating and testing this solution, we focused mainly on only one thing and that was the simplification of the process.

The software is live now. Try it and Buy It. You will surely like it.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Hi Fahim,

What is the cost of Invoice CRM, required for my sister who has occasional exhibition cum sale at various galleries around Andheri …!!!

Thanks

Sushil

Please check mail. All details forwarded to your email.

please give me complete excel gst bill ,inward out ward ,

You can find all type of GST documents like invoices, vouchers, and reports on the following link:

https://exceldatapro.com/templates/gst-templates/

It is a nice article explaining GST invoicing and GSTR Filing. I was looking for the same.

Glad to know you liked it.

WHAT IS THE PRICE FOR MAKING INVOICES THROUGH INVOICE CRM. THANKS

Yearly Rs. 2499