The Investment Tracker is a ready-to-use Excel template designed to facilitate investment planning and tracking, including the calculation of Return on Investment (ROI), over a period of 10 years.

Users are prompted to input their wealth creation objective and define the proportion of their income to be allocated towards spending. This process is repeated on a monthly basis for a duration of either 5 or 10 years, contingent upon the established goal. Additionally, users are required to insert their anticipated yearly return from the investment.

The template automates the calculation of accumulated wealth at the conclusion of each year, as well as at the 5-year and 10-year milestones.

It is advisable to prioritize wealth creation at the onset of one’s career. By implementing prudent savings allocation and sustainable spending habits, individuals can amass a substantial amount of wealth.

Furthermore, this approach can facilitate early retirement planning.

This template is specifically designed to plan investments derived from savings on a monthly basis over a 10-year period. Users are encouraged to allocate a specific portion of their salary towards meeting essential needs and discretionary wants, while investing the remaining funds to accumulate wealth.

Table of Contents

Investment Tracker Excel Template

We have developed a user-friendly Investment Tracker Excel Template, replete with predefined formulas and formatting, enabling users to effortlessly track their investments on a monthly and yearly basis.

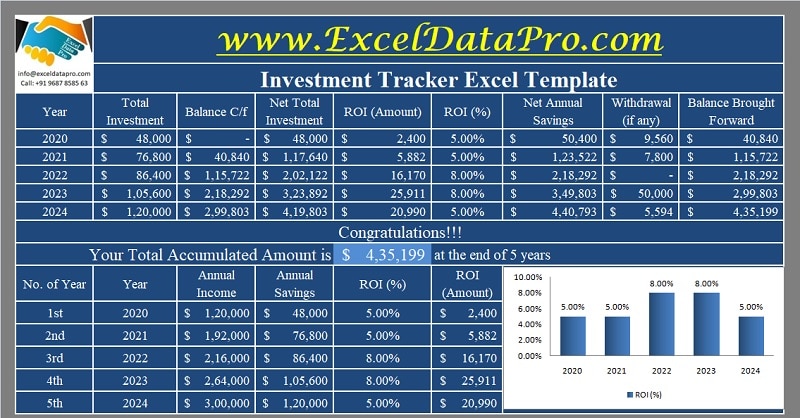

The template not only displays the ROI percentage for each individual year but also showcases the accumulated monetary value at the end of the 5-year and 10-year periods, against your defined goal.

Click here to download the Investment Tracker Excel Template.

Click here to Download All Personal Finance Excel Templates for ₹299.In addition to the above, you can also download other personal finance templates like Savings Goal Tracker, Household Budget, Credit Card Payoff Calculator and Personal Income Expense Tracker from our website.

Let us discuss the contents of the template and how to use it.

Contents of Investment Tracker Excel Template

This template consists of 7 sheets: Investment Planner (2 Sheets), Investment Tracker (3 Sheets) and Summary (2 Sheets)

Investment Planner

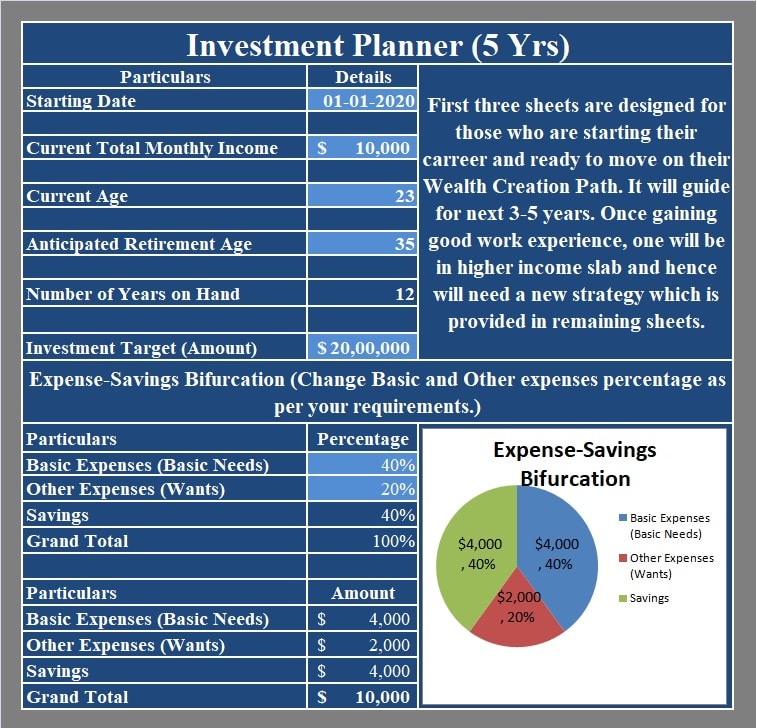

The investment planner section solicits basic information from the user, including their current salary, age, anticipated retirement age, and investment target.

Insert your current salary, current age and the age when you plan to retire along with your desired amount you want to have at the time of retirement. It will automatically calculate the difference of years from current age to retirement age.

Furthermore, this section allows users to allocate a percentage of their income towards meeting essential needs and discretionary wants, with the remaining portion designated for investment over the subsequent 5-year period.

The template presents these allocations in both percentages and monetary figures, supplemented by a graphical representation of the user’s income and expenses distribution.

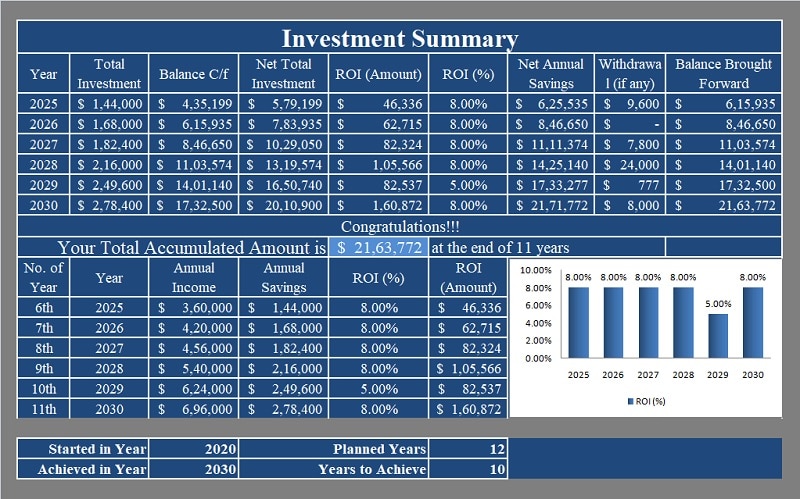

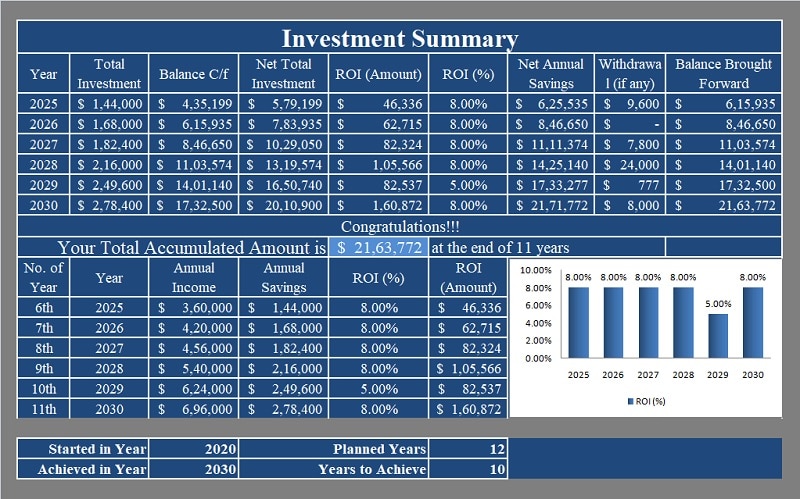

An additional sheet within the template mirrors the first Investment Planner sheet, intended for use upon the successful completion of the initial 5-year investment period.

While the columns remain consistent, the balance carried forward from the preceding 5 years is automatically populated.

Investment Tracker

This segment comprises three sheets, the first encompassing a 5-year period, while the latter two span 3 years each.

Each sheet is divided into five corresponding yearly sections, displaying monthly income and savings for the entirety of the year (January-December).

Users are required to input the annual return obtained from their investment, upon which the template automatically calculates the corresponding ROI.

![]()

Any withdrawals made during the investment period can be entered in the designated withdrawal cell, which will consequently reduce the net savings amount.

It is noteworthy that the balance carried forward cell is absent in the first year but present in the remaining four years, where the balance from the previous year is automatically carried over to the subsequent year.

![]()

Additionally, the template generates income versus savings graphs for each year, visually representing the total income and total savings for the respective year.

Upon successfully completing the initial 5-year investment period, users are encouraged to continue monitoring and tracking their investments until their wealth goal is achieved.

The remaining 6 years are divided into two separate sheets, each encompassing 3 years of investment records.

Summary

The summary sheet provides an overview of monetary activities across all 5 years, including total income received, amounts allocated towards essential needs and discretionary wants, savings accumulated, and the corresponding ROI.

Furthermore, this sheet presents a graphical representation of the ROI earned on the investment for each year, enabling users to identify the periods or investment types that yielded superior returns.

At the culmination of the 10-year period, an additional summary sheet is provided, encompassing the subsequent 5 years and displaying the total amount accumulated during the entirety of the 10-11 year period, contingent upon the user’s defined goal.

Investment Tips For Maximum Returns

To maximize returns on investment, users are advised to adhere to the following tips:

- Clearly define their investment goal.

- Prioritize spending on essential needs over discretionary wants.

- Maintain a debt-free status, with any existing debts being promptly addressed as a top priority.

- Invest in retirement accounts.

- Diversify their portfolio by investing in stocks and equity markets.

- For individuals with limited initial capital, it is recommended to accumulate funds through mutual funds or Systematic Investment Plans (SIPs) before venturing into stock and equity investments.

- Adopt a contrarian investment approach, being greedy when others are fearful and fearful when others are greedy.

- Maintain a long-term perspective on investment returns, eschewing short-term thinking.

- Consistently conduct thorough research and analysis of a company’s business operations before investing.

- Avoid investing in companies with excessively high debt levels.

We extend our gratitude to our readers for their continued support, demonstrated through their engagement on various social media platforms by liking, sharing, and following our content.

Readers are encouraged to share any queries or concerns in the comment section below, and we shall endeavor to provide comprehensive assistance.