GCC VAT Payable Calculator is an excel template with predefined formulas for easy computation of VAT liability. Output VAT less of Input VAT is GCC VAT Payable.

UAE, Qatar and Saudi Arabia are all set to start implementing GCC VAT from Jan 2018. Bahrain, Oman, and Kuwait have also signed the agreement but implementation dates are yet to be announced.

The taxable person collects VAT on Sales from his customers. Adjusts the Credit Notes and Debit Notes issued to customers during the tax period.

A taxable person obtains recoverable VAT input on purchases that are used for business purpose. This recoverable input reduces the tax liability.

In addition to that, the taxable person has to pay VAT under reverse charge mechanism at the time of import etc.

Thus, VAT Payable = VAT Output – VAT Input

Taking into consideration the above points we have created an excel template for GCC VAT Payable Calculator for all 6 GCC Countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE).

The user just needs to enter the details of sales, purchase, imports etc and the template will automatically calculate the GCC VAT payable for you.

Click here to download GCC VAT Payable Calculator For All 6 GCC Countries

You can also download other templates like VAT Invoice Template, VAT Credit Note Template, and UAE Invoice Template in Arabic etc.

You can download the pdf copies of GCC VAT Agreement, UAE VAT Law and Saudi VAT Law from the links given below:

Let us discuss the contents of GCC VAT Payable Calculator in detail.

Contents of GCC VAT Payable Calculator

GCC VAT Payable Calculator consists of following 4 sections:

- Header Section

- Input VAT Calculation Section

- Output VAT Calculation Section

- VAT Summary Section

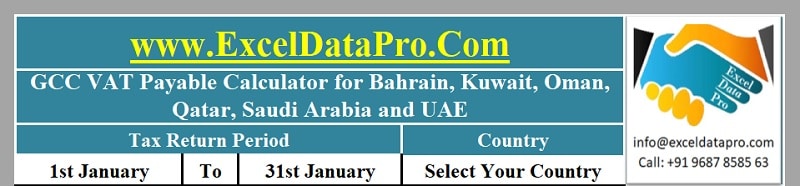

1. Header Section

Generally, the header section consists of the company name, the company logo and heading of the sheet “GCC VAT Payable Calculator”.

Additionally, it consists of Tax period for which the calculations are being done.

As this template is for all 6 GCC countries, the user needs to select his desired country. When the user selects the country, the template will automatically change the currency in all places.

A drop-down list has been created using the data validation function and the cells in which the currencies are displayed are configured using multiple IF statements.

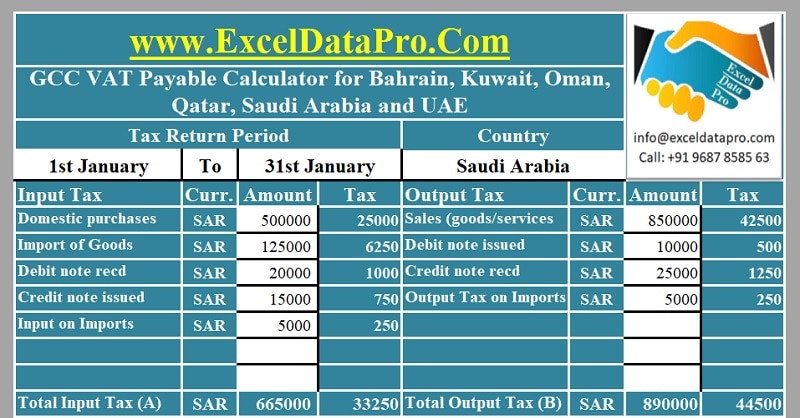

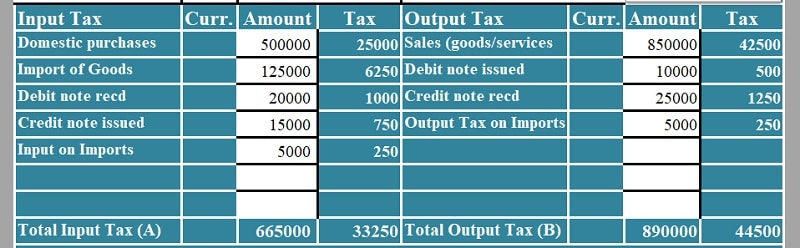

2. Input VAT Calculation Section

Input VAT calculation section consists of different subheadings like domestic purchases, imports, debit notes, credit notes and input VAT on imports.

Enter the respective amounts of the above-mentioned items in the respective cells.

VAT across GCC countries is 5 %. There is no need to enter the 5% VAT amount as it is configured with predefined formula.

At the end, the total of input VAT is given. This cell is configured using the SUM function.

3. Output VAT Calculation Section

Output VAT calculation section consists of subheading like sales, debit notes, credit notes, out paid on imports etc.

You need to enter the respective amounts of the above-mentioned items in the respective cells.

Similar to the Input VAT Calculation section, the Tax Column here also is configured and will automatically calculate.

Subtotal of Output VAT is given at the end.

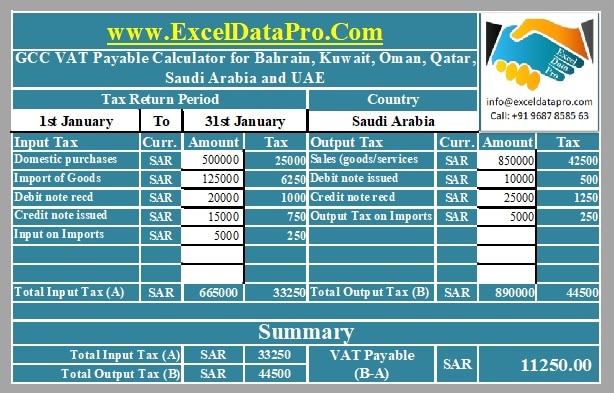

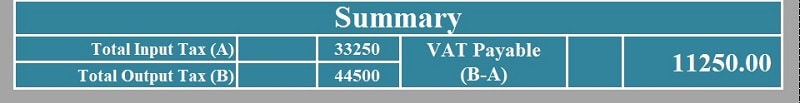

4. VAT Summary Section

The summary section gives you your VAT payable amount. Simple mathematical calculations are used.

Total of Output VAT (B) – Total OF Input VAT (A) = VAT Payable.

In case the amount of VAT payable is negative then it means that you have balance with the tax authority and this balance can be carried forward to next tax period.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply