The Depreciation Calculator is a readily available Excel template designed to compute Straight-Line and Diminishing Balance Depreciation on Tangible or Fixed Assets. This tool offers a comprehensive solution for accurately determining the depreciation rates and schedules associated with these methods.

The template presents the depreciation rate for the straight-line method, taking into account the scrap value of the asset. Furthermore, it meticulously displays the year-over-year depreciation amount in accordance with the Diminishing Balance method.

Straight Line Depreciation means:

“Straight Line method depreciates an asset uniformly over the period of its usability. The Straight-line method of depreciation applies even cost throughout the life of the fixed asset.”

Diminishing Balance Depreciation means:

“The declining balance method reduces an asset’s value by the amount it depreciated in the previous years. It calculates the new depreciation based on that lower value. Hence, it is given the name as the diminishing balance method.”

Depreciation Calculator Excel Template

The Depreciation Calculator Excel Template has been thoughtfully crafted, incorporating predefined formulas to streamline the calculation process. By inputting a few key values, users can effortlessly compute depreciation according to both the Straight-Line and Diminishing Balance methods.

Click here to download the Depreciation Calculator Excel Template.

Click here to Download All Accounting Excel Templates for ₹299.

You can also download other templates like Cash Flow Statement, Trial Balance and Profit and Loss Account.

Let us understand the contents of this template and how to use it.

Contents of the Depreciation Calculator Excel Template

This template comprises two distinct sections: Straight-Line Depreciation Calculation and Diminishing Balance Depreciation Calculation.

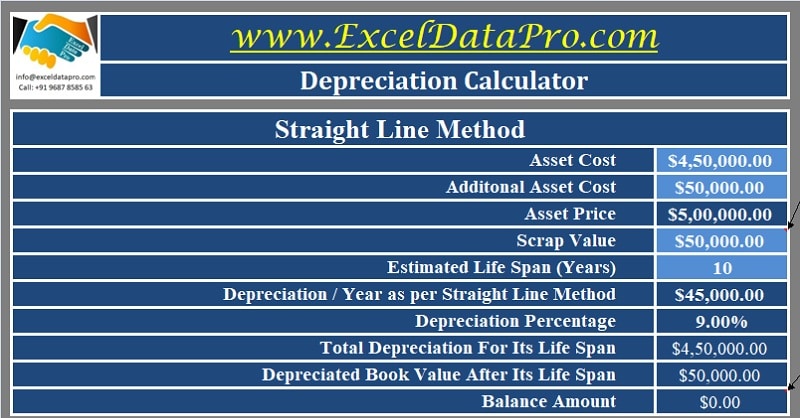

Straight-Line Depreciation Calculation:

In this section, the template calculates the straight-line depreciation. It is calculated based on Asset value, scrap value and life of an asset.

Here, asset value is the asset price in addition to the additional costs associated with an asset. These costs include fixtures, transportation, insurance, etc.

Insert the Asset Cost and Additional Asset Cost in the given cells and it will automatically calculate the total Asset Price for you.

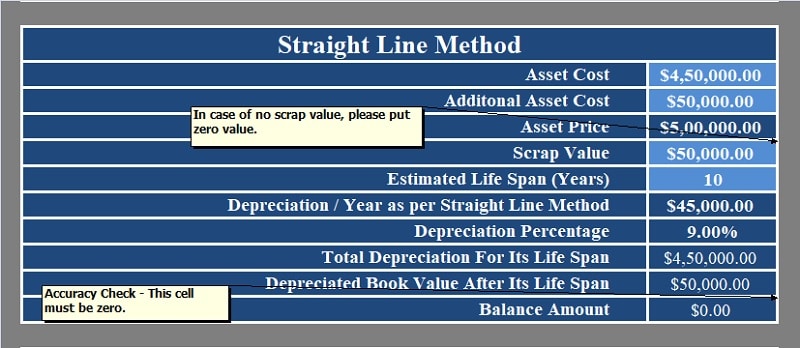

Enter the Scrap Value and Life Span for the asset and 0 if an asset is completely written off. When asset scrap value is 0 the template will calculate the depreciation on complete asset value.

By providing the aforementioned details, the following results are generated:

Depreciation per Year

Depreciation Percentage

Total Depreciation for the asset’s lifespan

Book Value after the asset’s lifespan

Additionally, a balance amount is displayed for accuracy verification, which should always be zero, representing the Scrap Value minus the Book Value at the end of the asset’s lifespan.

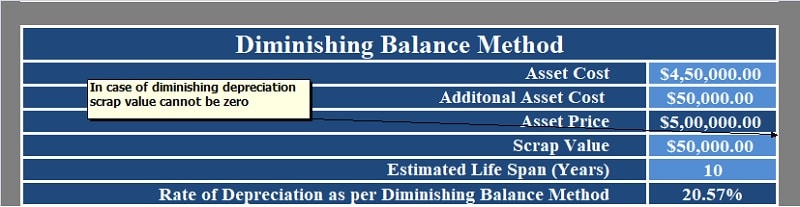

Diminishing Balance Depreciation Calculation:

Similar to the above section, enter Asset Cost and Additional Asset Cost to obtain total Asset Price.

The Scrap Value and Life Span asset must also be provided. It is important to note that in the Diminishing Balance method, the Scrap Value cannot be zero.

The template calculates the Rate of Depreciation applying the following formula:

1 – (Scrap Value/Asset Value) ^ (1/Life Span)

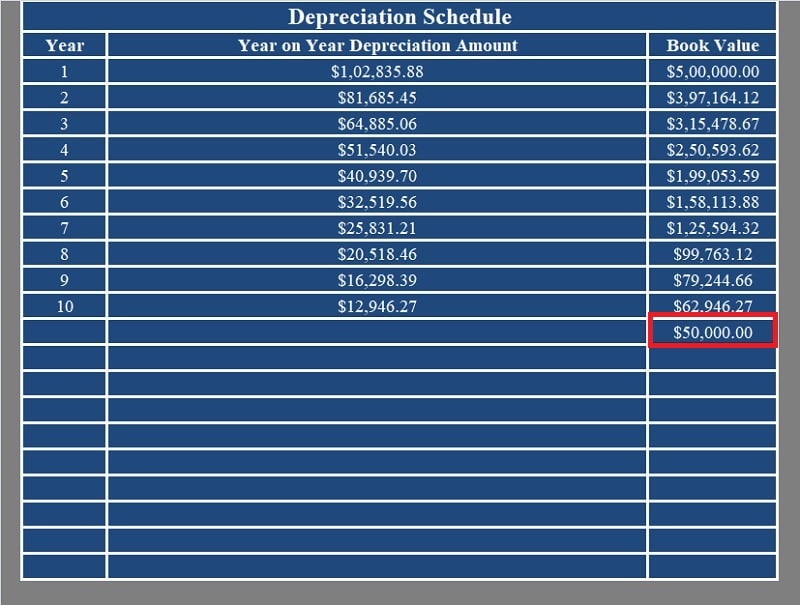

Subsequently, the template displays the depreciation schedule for the Diminishing Balance method. It applies the calculated depreciation rate to the closing asset value for each year.

The depreciation is calculated using the following formula:

Book Value of Each Year X Depreciation Rate

This process continues until the asset’s value reaches the Scrap Value amount.

The Depreciation Calculator Excel Template is a valuable resource for accounting professionals, assistants, and small-to-medium enterprise owners, facilitating accurate and efficient depreciation calculations for tangible and fixed assets.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.