The Credit Card Payoff Calculator is an Excel template designed to assist individuals in calculating the number of installments required to pay off their outstanding credit card balances. This powerful tool not only facilitates the calculation of payments based on two distinct payment modes but also computes the difference in interest that one will incur under each mode.

Additionally, this Excel template incorporates a comprehensive Credit Card Payment Log spanning an entire year, enabling users to manage payment details and other relevant information. The Credit Card Payment Log section has been thoughtfully designed to accommodate a wide range of data entries, including current usage, cash advances, and any associated late fees or fines, ensuring a comprehensive overview of one’s credit card management.

How to Easily Pay Your Credit Card Debt?

Follow these simple and easy tactics to avoid or pay off your credit card debt:

- Use a credit card when necessary.

- Plan your spending. ensuring that credit card expenditures do not exceed one’s ability to pay off the balance in full.

- Prioritize the selection of credit cards with the most favorable interest rates to minimize the financial burden of carrying balances.

- Spend on things that are necessary and not what you want.

- In the case of multiple credit cards, consistently make minimum payments on each account to maintain good standing.

- Make a payment plan and stick to it.

- Plan expenditures to facilitate the timely payment of outstanding balances.

- Explore and implement either the Avalanche Method or the Snowball Method, whichever proves more convenient for paying off accumulated debt.

- Consider the utilization of a Balance Transfer Card, which can potentially yield savings on interest charges.

Read the below guide to managing your credit card efficiently

How To Manage Your Credit Card Efficiently?

Credit Card Payoff Calculator Excel Template

We have created a simple and easy Credit Card Payoff Calculator Excel Template that helps you calculate the duration of payoff and also the interest amount to be paid against each payment mode.

Click here to download Credit Card Payoff Calculator Excel Template.

Click here to Download All Personal Finance Excel Templates for ₹299.You can download other templates like Savings Goal Tracker and Loan Amortization Template.

Contents of Credit Card Payoff Calculator Excel Template

This template consists of 2 sheets:

- Credit Card Payoff Calculator.

- CC Payment Log.

Credit Card Payoff Calculator

This sheet of the template is designed to calculate the number of months required to pay off one’s debt based on the chosen payment mode.

There are three primary methods for making payments:

- Paying the minimum amount due.

- Paying a proposed amount exceeding the minimum.

- Making a full payment.

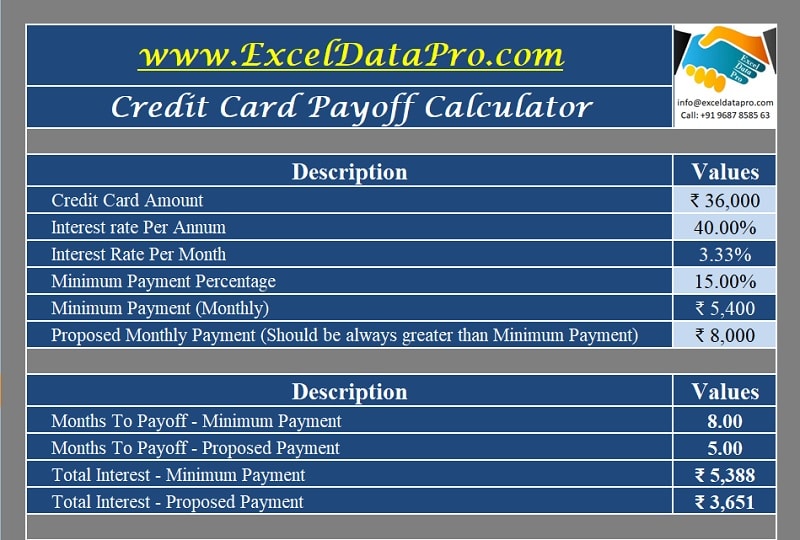

It is important to note that paying only the minimum amount will prolong the repayment tenure and result in higher interest payments.

Conversely, paying a proposed amount higher than the minimum will reduce both the interest charges and the overall repayment period.

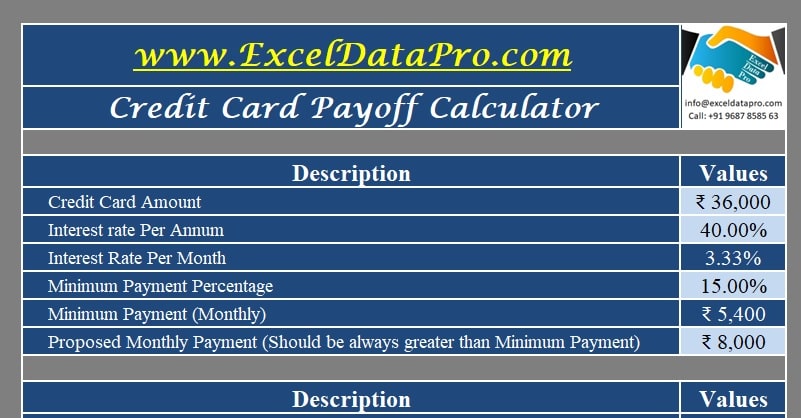

You need to enter the following details:

Credit Crat Amount

Interest Rate Per Annum

Monthly Minimum Percentage

Proposed Monthly Payment

Important Note: The proposed monthly payment should always be higher than the minimum amount.

When you enter the above figures, the template automatically calculates the following:

Interest Rate Per Month

Monthly Minimum Payments

Months To Payoff – Minimum Payment

Months To Payoff – Proposed Payment

Total Interest – Minimum Payment

Total Interest – Proposed Payment

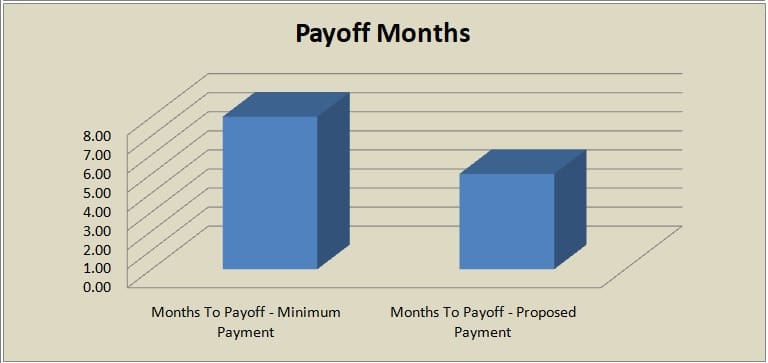

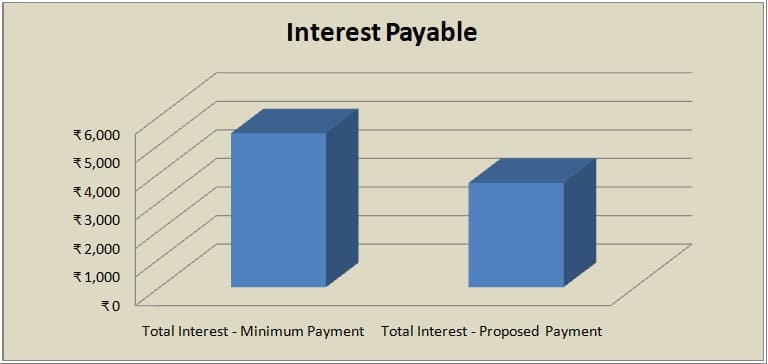

Furthermore, the template provides a visual representation of the above data in graphical format, including a Payoff Months Graph and an Interest Payable Graph.

Payoff Months Graph

Interest Payable Graph

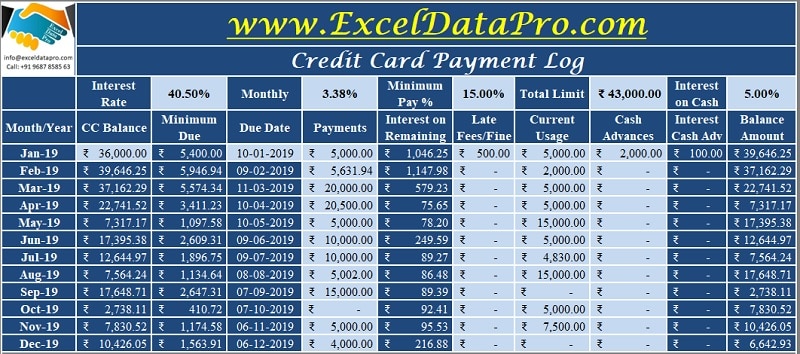

CC Payment Log

The Credit Card Payment Log is a comprehensive tool designed to manage payment data, usage information, and interest calculations for an entire year.

Initially, users must enter the Per Annum Interest Rates, Monthly Interest Rates, Minimum Payable Percentage, Total Card Limit, and Interest on Cash Advances.

The CC Payment Log includes the following column headers:

CC Balance: Users must enter the outstanding amount against the month they wish to begin tracking. Only the first entry is required, as subsequent months will carry forward based on usage and interest calculations.

Minimum Due: TThis field is automatically populated according to the percentage inserted in the top row.

Due Date: The date on which the payment is due.

Payments: Actual payments made.

Interest on the remaining Amount: This field is auto-populated.

Late Fees/Fines: Users can enter any applicable late fees or fines.

Current Usage: The amount of credit card usage for the current month.

Cash Advance: Users can insert any cash advance amounts withdrawn.

Interest on Cash Advances: Interest on cash advances is automatically calculated based on the provided percentage.

Balance Amount: This field is auto-calculated. It is the sum of all the amounts used and pending from the payments.

Balance = Outstanding – Payments + Interest on Remaining + Late Fees/Fines + Current Usage + Cash Advances + Interest on Cash Adv.

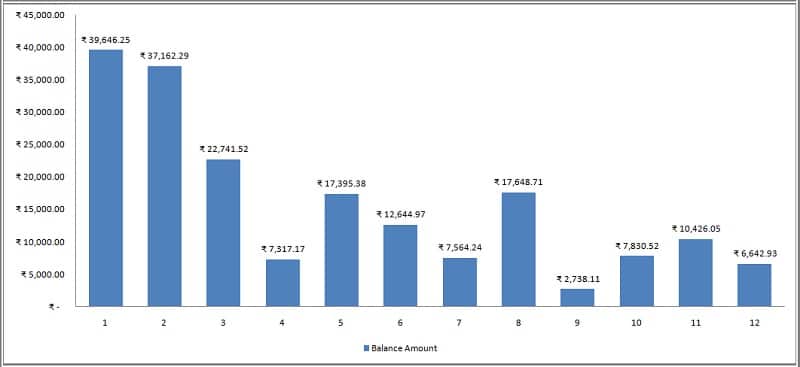

In the end, it also displays the graphical chart of your payments and your payable credit card balances.

This template is a valuable resource for individuals, companies, credit managers, and other professionals involved in credit card management and debt repayment planning.

We extend our gratitude to our readers for their continued support, engagement, and active participation across various social media platforms.

If you have any queries or require further assistance, please do not hesitate to share them in the comment section below. We will be more than happy to provide the necessary support and guidance.

Leave a Reply