The Checkbook Register Excel Template is a comprehensive, pre-formatted document available in Excel, Google Sheets, and OpenOffice Calc. This versatile tool is designed to assist individuals and businesses in efficiently tracking and reconciling their bank accounts.

By utilizing this template, users can maintain a vigilant oversight of their financial transactions, thereby minimizing the risk of incurring unnecessary expenses such as interest charges or penalties.

Table of Contents

What Is A Checkbook Register?

A Checkbook Register serves as a critical financial document for maintaining accurate records of bank balances for both personal and commercial accounts. In essence, it functions as a ledger, meticulously documenting all monetary inflows and outflows associated with a specific checking account. This systematic record-keeping facilitates the process of bank reconciliation, ensuring that one’s personal records align with the official bank statement.

The significance of a Checkbook Register in financial management cannot be overstated. It provides users with a clear and concise overview of their financial status, enabling them to monitor the sources and destinations of their funds, as well as maintain an up-to-date awareness of their current balance.

Purpose of Maintaining A Checkbook Register

Many a time, it happens that bank officials commit some mistakes. If you maintain Checkbook Register, you can identify those errors and get them corrected.

Additionally, you can also prevent bouncing back of checks due to the unavailability of balance. Thus, avoiding unnecessary fees charged on your account.

Checkbook Register Template

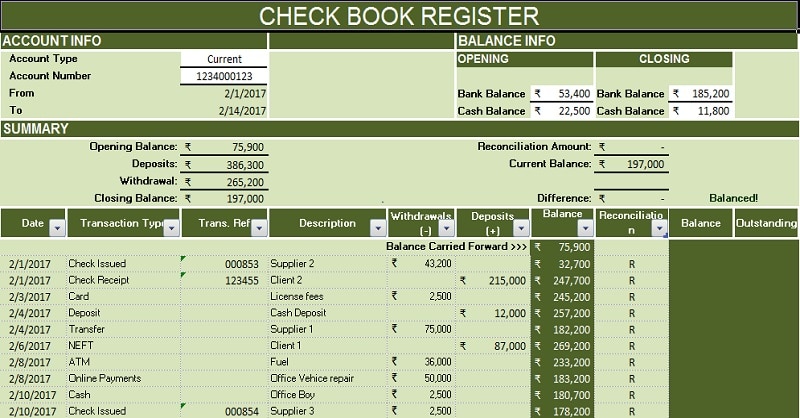

We have created an easy to use Checkbook Register Excel Template with predefined formulas. Just insert your bank transaction daily and easily reconcile at the end of every month.

This template can be helpful to individuals, accounting professional,s, and students. You can use this template to keep a track of all your income and expenditures.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

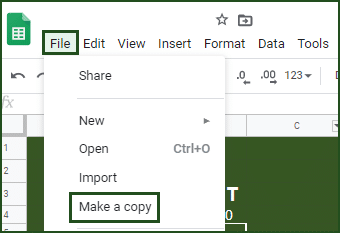

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Additionally, you can download other accounting templates like Accounts Payable Template with Aging, Accounts Receivable Template with Aging, and Cash Flow Template.

Content of Checkbook Register Template

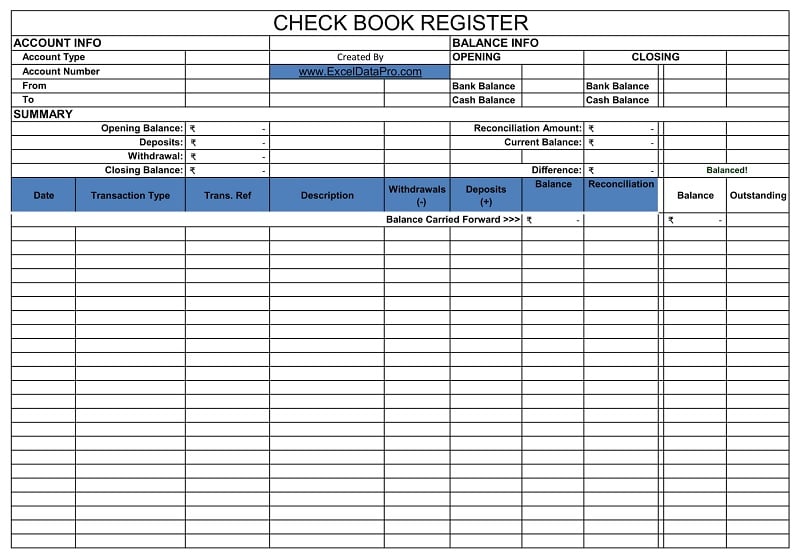

This template consists of 2 worksheets: Datasheet and Checkbook Register

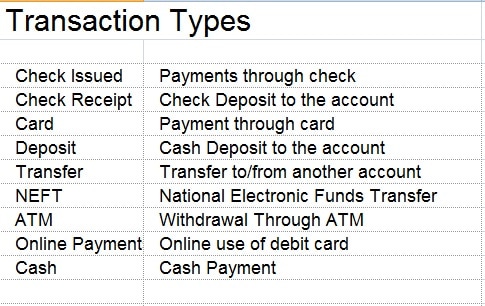

The Datasheet consists of lists of the type of transactions. This list is used for creating the dropdown menu in the Checkbook Register Template.

Checkbook Register

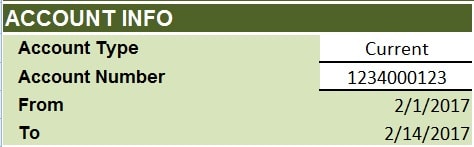

At the top, there is the heading of the sheet. Insert the following Account Information:

Type: Specify the account type (e.g., Checking, Current, Savings, Personal)

Number: Enter the corresponding account number

From: Start date (Formula: =A15, referencing the first date in the data input section)

To: date (Formula: =MAX(A15:A41), referencing the last date entered)

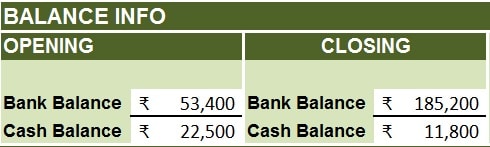

Insert opening and closing balances in the balance info section on the right side.

Opening: Initial balance of Bank and Cash as per records

Closing: Final balance of Bank and Cash as per records

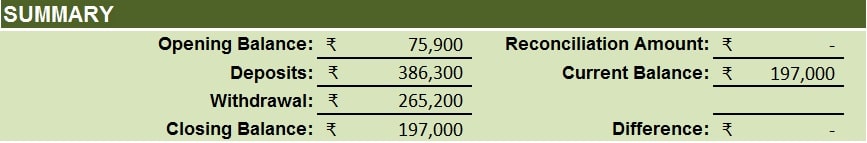

In addition to the above, it consists of the summary section. It displays all balances automatically as it contains predefined formulas. Hence, you don’t need to input any data.

Opening Balance: Reflects the opening balance from the Balance section

Deposits: Total of Deposits column in the Data input section

Withdrawal: Total of Withdrawals column in the Data input section

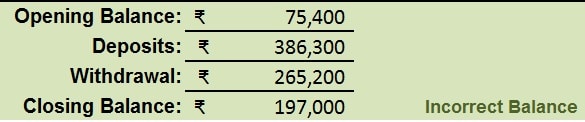

Closing Balance: Reflects the closing balance from the Balance section. If inconsistent with the data input section, it displays “Incorrect balance”

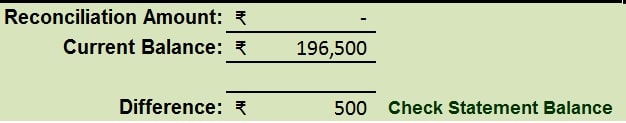

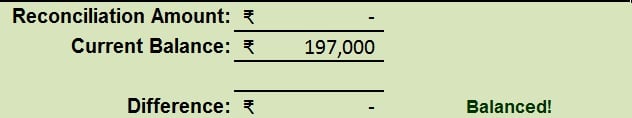

Reconciliation Amount: Displays outstanding entries marked with “R”

Current Balance: Displays the ending account balance based on user-entered data

Difference: Shows any discrepancy. Displays “Check Statement” if a difference exists, or “Balanced” if not

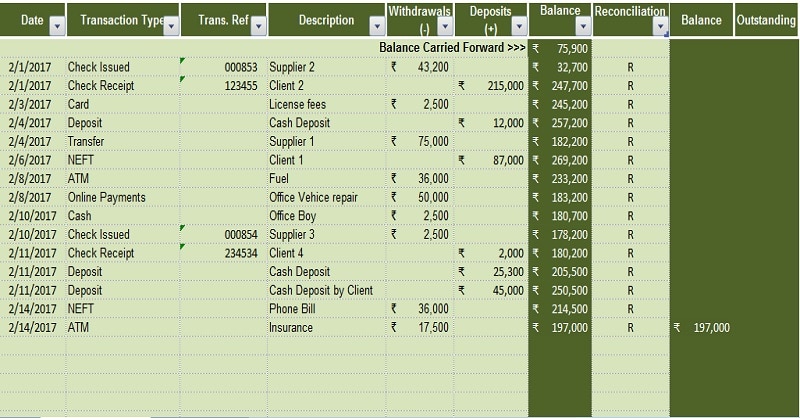

Checkbook Entry Section

In this section, the user needs to enter the transaction details as and when they occur during the period.

It contains the following column headings:

Date: Date of transaction

Transaction Type: Contains the Transaction types like deposits checks issued, checks receipt, ATM, NEFT, etc. You can select the type of transaction from the drop-down menu.

Trans. Ref: You can put any reference or check numbers in this column.

Description: Description of the payment or receipt

Withdrawals: All the withdrawal entries are to be entered in this column.

Deposits: All the deposit entries are to be entered in this column.

Balance: Balance will show you the balance after each transaction by adding or deducting the deposits and withdrawals.

Reconciliation: In this section, you need to enter “R” if you find the entries in the bank statement.

Balance and Outstanding: No entries are to be made. These cells are given predefined formulas. The balance column shows the end balance and the Outstanding column shows the non-reconciled entries.

Printable Checkbook Register

Click here to download the Printable version of the Checkbook Register.

Let’s discuss the template contents in detail.

How To Balance A Checkbook Register?

- Find the current balances.

- Record all inward and outward transactions.

- Define the type of transaction and add a description to each transaction.

- Reconcile and match transactions with your bank statements weekly, biweekly, fortnightly, or monthly.

We thank our readers for liking, sharing, and following us on different social media platforms, especially Facebook.

If you have any queries or questions, share them in the comments below. I will be more than happy to help you.

Frequently Asked Questions

What does it mean to balance your checkbook?

Balancing a checkbook refers to the process of ensuring that all transactions recorded in your personal checkbook register correspond accurately with those listed on your official bank statement.

How often should you balance your checkbook?

While monthly balancing is generally recommended, the optimal frequency may vary depending on the volume of transactions. Some individuals or businesses may find it beneficial to balance their checkbooks on a weekly or bi-weekly basis to maintain more precise financial control.

What is the danger of not balancing your bank account?

When you don’t balance your checkbook regularly, it increases the risk of penalties and unnecessary charges by the bank. It also puts forth the risk of being overdrawn while your account has sufficient funds.

How to record Interest Earned as well as service charges in a checkbook register?

Interest earnings and service charges, which are typically applied based on the bank’s account policies, should be recorded during the reconciliation process of your checkbook register. This ensures that these entries align with the bank’s official records and maintains the accuracy of your personal financial documentation.