Many businesses want to change Email and Mobile number on GST portal as they registered for GST through CAs or Tax professionals/consultants. While registration During the registration process, CAs and tax consultants put their email and mobile number for easy verification. It is advisable to change email and mobile number to safeguard your interest and avoid […]

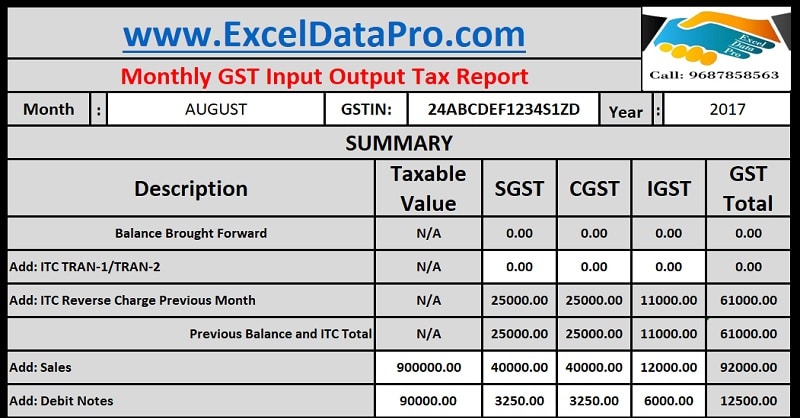

Download Monthly GST Input Output Tax Report Excel Template

We received requests from our readers for making Monthly GST Input Output Tax Report in which they can maintain and carry forward their previous month’s balance of ITC as well as reverse charge. Previously we have created a template GST Input Output Tax Report for maintaining your GST sales, purchase, credit note, debit note and […]

Part 2 – Clarifications Made By GST Council

In our previous article, we discussed some clarifications made by GST Council. Here we will discuss Part 2 of the clarifications made by GST Council. People are facing many problems in registration and filing of returns. Hence, the GST Council issues notifications or announce clarifications on their twitter handle for such queries. The main reason […]

10 Important Clarifications Made By GST Council

Recently after the 21st Council meeting and the queries raised by taxpayers, GST Council has made some important clarifications through their Twitter handle. Clarifications made by GST Council via Twitter Handle @askGSTech & @askGST_GOI GSTR-3B 1. Those registered taxpayers who haven’t paid their GSTR-3B tax liability for the month of July 2017 and have only […]

Charitable And Religious Trusts Under GST Regime

In this article, we will discuss tax-ability of Charitable and religious trusts under GST regime. Under the GST regime, the provisions relating to taxation on activities of NGOs, charitable and religious trusts have been taken from the service tax provisions. The Notification No.12/2017-Central Tax of 28th June 2017, exempts services provided by an entity registered […]