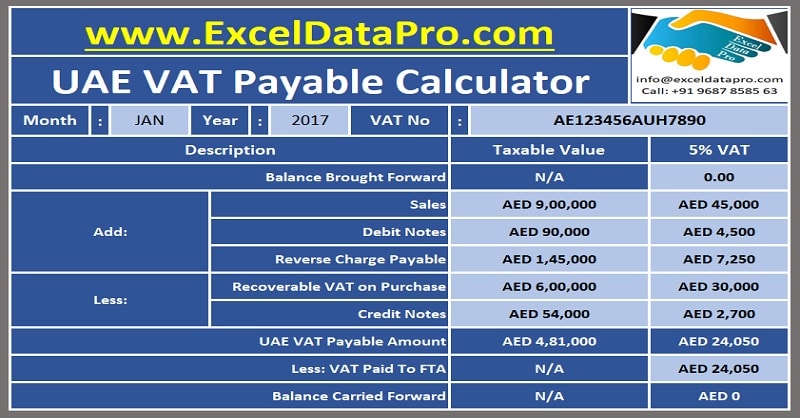

UAE VAT Payable Calculator provides you with the exact payable amount of VAT to Federal Tax Authority (FTA). When you make sales you collect VAT. Credit Notes and Debit Notes issued against invoices are then adjusted while calculating VAT payable. You are entitled to recoverable VAT input on purchases used for taxable supply. This recoverable […]

What is MAGI – Modified Adjusted Gross Income?

t is calculated by taking your AGI (Adjusted Gross Income) and adding back several deductions. These deductions can be student loan deductions, Deductions of IRA contributions, foreign income, deductions of foreign-housing, adoption expenses and deductions for higher-education costs.

Contents of UAE VAT Tax Invoice As Per the Guidelines of FTA

According to the guidelines issued by Federal Tax Authority (FTA) in relation to the contents of UAE VAT Tax Invoice, there are two types of Tax Invoice: Simple VAT Invoice. Detailed VAT Invoice. Simple VAT Invoice will be for supply less than the specified amount. It is issued in the case when the customers are […]

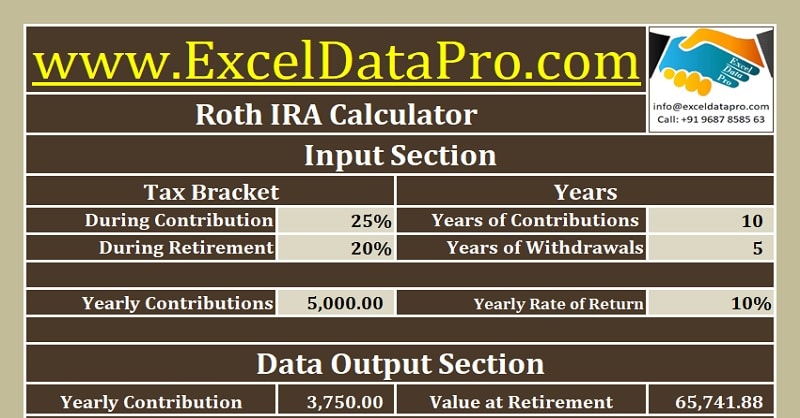

Download Roth IRA Calculator Excel Template

In this article, we will discuss the Roth IRA Calculator. This calculator helps you to decide the amount of contribution amount you need to put in Roth IRA to achieve your retirement goals. In our previous article, we have discussed the Traditional IRA Calculator. As we know, IRA stands for Individual Retirement Account. A Roth […]

What Is An IRA?

An IRA (individual retirement account or individual retirement arrangement) is a tax-favored savings account designed to help individuals save and grow funds for their retirement.