According to the guidelines issued by Federal Tax Authority (FTA) in relation to the contents of UAE VAT Tax Invoice, there are two types of Tax Invoice:

- Simple VAT Invoice.

- Detailed VAT Invoice.

Simple VAT Invoice will be for supply less than the specified amount.

It is issued in the case when the customers are retail consumers and don’t need to provide a VAT number.

This type of invoice is for supermarket and other retail industry.

Detailed VAT Invoice will be for supply more than the specified amount.

It is issued in the case when a registered business supplies to another registered user.

This type of invoice is for wholesalers and traders dealing in bigger quantities.

To download the Federal Decree-Law No. (8) of 2017 on Value Added Tax click on the link below:

Federal Decree-Law No. (8) of 2017 on Value Added Tax

Contents of UAE VAT Tax Invoice

1. Simple VAT Invoice

A simple VAT Invoice must the word “Tax Invoice” at a prominent place.

It must consist the details of the supplier. Name, Address and Tax Registration Number (VAT Number).

In addition to the above, it must contain, Date of issue of the tax invoice.

The complete description of goods supplied must be included.

Apart from that, the most important thing a simple VAT invoice must have is the Total Amount Payable and Total VAT Chargeable.

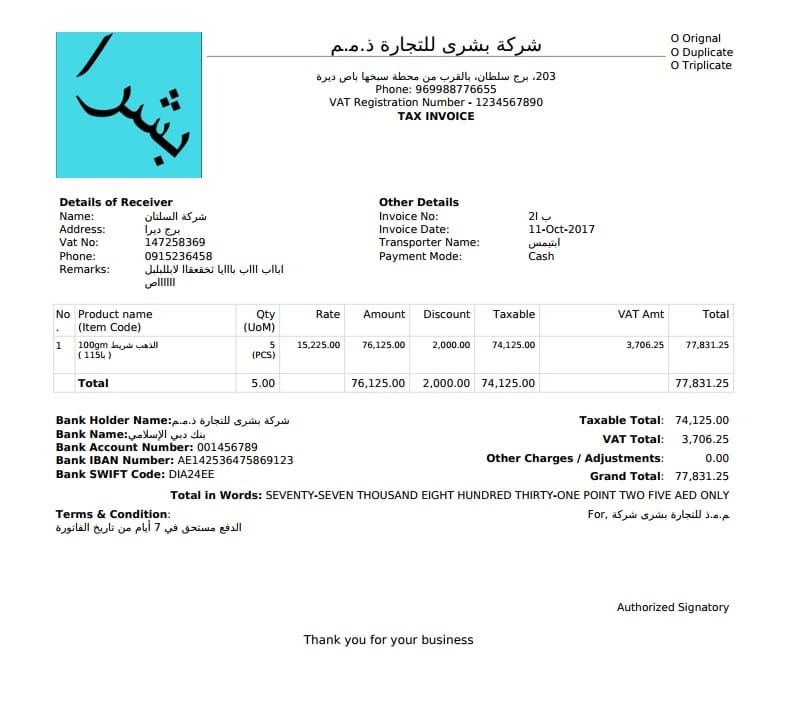

2. Detailed VAT Invoice

In addition to the above details that are in simple tax invoice, a detailed VAT Invoice will consist of the following details:

- Name, address, and TRN of the recipient.

- A unique invoice number

- Date of Supply, if it is different from the date of issue.

- Price per unit, the supplied quantity/volume, rate of tax and the payable amount in AED.

- Discount, if applicable.

- Payable Gross value of Invoice in AED.

- Payable Tax Amount in AED.

- Statement relating to Reverse Charge, if applicable.

See image below for reference:

Free UAE VAT Billing/Invoicing Software

We have created an easy to use UAE VAT Billing Software under the banner of InvoiceCRM. Click Here to know more about InvoiceCRM.

This software consists of all the above-mentioned contents of UAE VAT Tax Invoice.

You can create a detailed VAT invoice in this software in just 3 easy steps.

- Adding Your Customer

- Adding your Product

- Creating Invoice

That’s all you need to do and your UAE VAT invoice is ready.

Try the Demo Yourself

With InvoiceCRM, you can create your invoice anytime and anywhere on your PC, laptop or mobile phones. This software is totally free till Jan 2019.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.