A 401k retirement plan is a type retirement plan that can only be sponsored by an employer, in which employees can save and invest a specific portion of their paycheck before taxes.

How to Calculate AGI – Adjusted Gross Income Using W-2?

If you are an employee having a particular job or multiple jobs as a source of income then you can calculate AGI – Adjusted Gross Income using W-2 form. AGI – Adjusted Gross Income is an individual’s total gross income after the deduction of certain allowable expenses. AGI helps you to determine your federal/state income taxes […]

What Is Child Tax Credit? Federal Income Tax Return

Child Tax Credit is a provision of US Federal Income Tax Law, where parents having dependent children under the age of 17 can claim a tax credit up to $1000 per qualifying child. Like other tax credits, the Child Tax Credit is a type of credit which reduces your tax liability and help the parent or guardians to easily raise their dependent children.

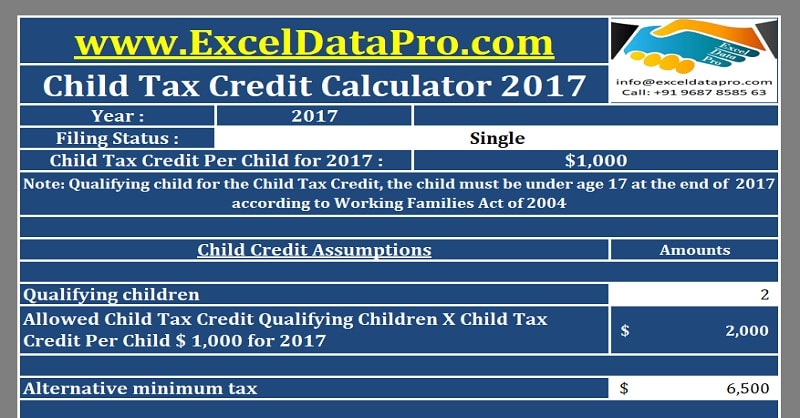

Download Child Tax Credit Calculator Excel Template

Child Tax Credit Calculator is an excel template that can help you to easily calculate your Child Tax Credit amount. Child Tax Credit is a provision in federal income tax that offsets the many expenses related to raising children. The phase-out begins at an adjusted gross income of $ 75,000 for single and head of […]

What is Withholding Tax? – Federal Income Tax

Withholding Tax is the amount of income taxes deducted from your paycheck by your employer and directly paid to the government on your behalf. Withholding taxes is a way to collect tax at the source of income instead collecting income tax later.