SIMPLE IRA plan stands for Savings Incentive Match Plan for Employees. SIMPLE IRA plan allows employees and employers to contribute to traditional IRAs set up for employees. It is ideally suited for a start-up retirement savings plan for small employers not currently sponsoring a retirement plan.

What Is SECA Tax? Definition, Eligibility & Limits

SECA stands for Self-Employed Contribution Act. SECA is a law which mandates the self-employed small business owners to pay 15.3% Self-Employment Tax on their net income which covers their own Social Security, Medicare, and OASDI expenses.

Download Overtime Calculator Apple Numbers Template

Overtime Calculator Apple Numbers Template is an HR document created in Apple Numbers application which is helpful to easily and efficiently calculate overtime pay of your employees in just minutes. Hours worked in excess of the stipulated duty hours are called overtime hours. Companies pay their employees for the hours they have worked in excess. […]

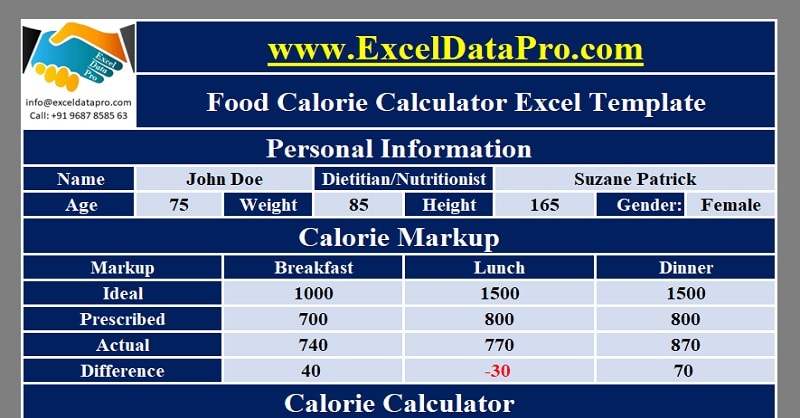

Download Food Calorie Calculator With Monthly Calorie Log Excel Template

We have created an easy to use Food Calorie Calculator With Monthly Calorie Log in excel with predefined formulas. This template will help you calculate the calories taken in breakfast, lunch, and dinner and also maintain a monthly log for the same.

What Is FICA Tax? Definition & Limits

FICA is the abbreviation of Federal Insurance Contribution Act. Federal Insurance Contribution Act is a tax provision of IRC that mandates the employer to withhold the employee’s contribution to Social Security and Medicare taxes from their paycheck and pay it along with employer’s contribution to IRS.