Adoption Tax Credit Calculator is a ready-to-use excel template that helps you to calculate the Adoption Tax Credit for 4 different scenarios.

With this template, you can calculate the adoption credit for the adoption of a domestic normal and special needs child and foreign normal and special needs child.

Furthermore, this template can be used for any year. All you have to do is to enter the adoption credit limit and the applicable year. This template is available in excel as well as Open Office Spreadsheet.

Adoption Tax Credit is a provision that provides the taxpayer the opportunity to deduct the expenses spent in the adoption process. A taxpayer can only the qualified expenses approved by the IRS.

To know more about the amount of available credit, phase-out limit, eligibility of child click on the link below:

Adoption Tax Credit – Definition, Limit & Eligibility

Table of Contents

Adoption Tax Credit Calculator Excel Template

We have created a simple and easy Adoption Tax Credit Calculator Excel template with predefined formulas and formatting. Enter your actual incurred expenses for the adoption process. It will automatically calculate the claimable adoption credit for you.

Click on the below button to download the desired file type for Adoption Tax Credit Calculator:

To claim the adoption credit use Form 8839 and will have to submit along with your Federal Tax Return.

Additionally, you can download Federal Income Tax Excel Templates like Itemized Deductions Calculator, Schedule B Calculator, Child Tax Credit Calculator from our website.

Let us understand the contents of this template and how to use this template.

Contents of Adoption Tax Credit Calculator Excel Template

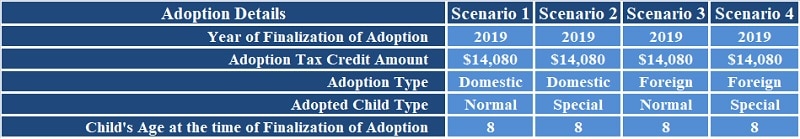

This template consists of 2 sections: Adoption Details and Adoption Tax Credit Calculations.

Adoption Details

Adoption details consist of the following:

Year of Finalization of Adoption

The claim depends on the type of adoption. For domestic adoption, the expenses paid before and during a particular year can be claimed in the following year of payment.

You can claim even if the adoption has not finalized or even an eligible child is not identified.

In the case of foreign adoption, expenses paid before and during the year can only be claimed in the year when the adoption becomes final.

Maximum Adoption Credit Amount

IRS changes the adoption credit limit every year. The credit limit for the year 2019 is $ 14,080. Insert the amount that is applicable for the respective year you plan to take this credit.

Parents adoption a normal eligible child, you can claim actually spent qualified expenses up to $ 14,080. Parents adopting an eligible special needs are eligible for the maximum amount of $ 14,080 credit in the year of finality.

Adoption Type

Select the type of adoption from the dropdown list. It can be either domestic or foreign. Rules are different for both types of adoption.

Adopted Child Type

Similar to the above, rules for availing the credit are different as per the adopted child. Select the type of child from the dropdown list.

Child’s Age at the time of finalization

Insert the age of the child at the time of the finalization of the adoption. A child is only eligible for adoption credit if he is under the age of 18 who is a U.S. citizen or resident (including U.S. territories) or a non-US citizen.

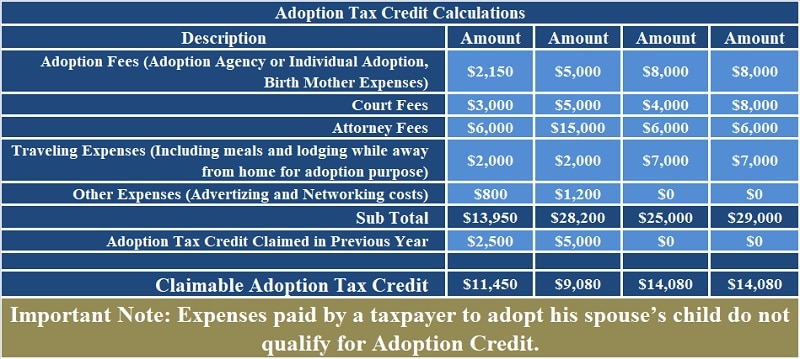

Adoption Tax Credit Calculations

This section consists of the actual calculation of this credit. Insert the following amount and it will calculate credit amount for you.

Adoption Fees (Adoption Agency or Individual Adoption, Birth Mother Expenses)

Court Fees

Attorney Fees

Traveling Expenses (Including meals and lodging while away from home for adoption purpose)

Other Expenses (Advertizing and Networking costs)

The taxpayer cannot claim expenses you received under any federal, state or local program. Any expenses that violate federal or state laws or surrogate parenting arrangements cannot be claimed.

In addition to that, adoption expenses of your spouse’s child or expenses reimbursed by the employer are also not eligible for the claim. Moreover, any deduction or credit taken under the federal income tax law or provision cannot be claimed.

In the end, if you have taken any credit in previous years, then you have to insert the amount in the second last column. It will be adjusted against the total credit limit.

Explaining Different Scenarios

Domestic Normal Child

In case of normal domestic child adoption, you get actually spent amount up to $ 14,080 after deducting any credit availed in previous years.

Domestic Special Needs Child

You are eligible for the complete credit amount of $ 14,080 even if the expenses are low. If the expenses are higher than the limit then also you are eligible for $ 14,080.

Foreign Normal Child

For adopting foreign normal child, the actual incurred expenses can be claimed up to $ 14,080. But they are only claimable in the year of finalization.

Foreign Special Needs Child

Similar to the above, adopting a foreign special needs child, the applicable rules will be the same.

We thank our readers for liking, sharing and following us on different social platforms.

If you have any queries please share in the comment below. We will be happy to assist you.

Leave a Reply