The Accounts Payable Template is a comprehensive and user-friendly tool available in Excel, Google Sheets, and Open Office Calc. This template facilitates the efficient recording of payable invoices in a single sheet, streamlining the accounts payable process. Users can easily download the template and begin utilizing it by entering their company details.

Additionally, the template includes a payment section that provides visibility into the outstanding amounts owed to suppliers for each invoice. This feature is crucial for effective cash flow management and helps businesses maintain good relationships with their vendors.

Table of Contents

What is Accounts Payable?

As per Wiki

Accounts payable is money owed by a business to its suppliers shown as a liability on a company’s balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents.

In simpler terms, an accounts payable ledger contains a detailed list of suppliers along with pertinent information such as invoice numbers, invoice dates, payment dates, and outstanding balances. This organized record-keeping is essential for maintaining financial accuracy and ensuring timely payments.

Role of Accounts Payable

Accounts Payable consists of 3 basic functions:

- Reporting and Payment of External Business Expenses: This function involves tracking and managing all external expenses incurred by the business.

- Facilitating Internal Payments: The department oversees payments related to internal operations, ensuring that all financial obligations are met promptly.

- Monitoring and Processing Vendor Payments: This includes managing relationships with vendors and ensuring that payments are processed accurately and on time.

In larger organizations, the accounts payable department also coordinates travel arrangements for employees, which may encompass advance bookings for airlines, car rentals, and hotel accommodations.

Furthermore, this department handles payments for annual maintenance contracts (AMCs) and other operational expenses necessary for the seamless functioning of the business.

Additionally, it is also responsible for distributing internal payments such as reimbursements, controlling, petty cash, and distribution of corporate taxes.

In addition to the above, the accounts payable department verifies purchases, aging analysis reports apart from vendor management.

What is Accounts Payable Process?

Accounts payable is a 4 step end-to-end process:

- Receiving the bill.

- Checking the bill details against the PO.

- Record invoices into the accounting system.

- Reviewing and making timely payments.

Moreover, an effective accounts payable process helps mitigate risks associated with fraudulent invoices or duplicate payments for the same invoice. By ensuring proper reporting of invoices, companies can safeguard their cash flow and overall assets.

Accounts Payable Journal Entries

Accounts payable consists of 2 scenarios that require journal entries: first is checking of goods against invoice and reporting the invoice into the system. The other is making payment for the invoice.

Journal Entries For Recording Invoice

Purchase A/C – Debit

To Accounts Payable A/C – Credit

In the case of a regular vendor, the Vendor account will be debited instead of purchase.

Journal Entries For Paying Invoice

Accounts Payable A/C – Debit

To Cash or Bank A/C – Credit

In the case of a regular vendor, the Vendor account will be debited instead of Accounts Payable.

Journal Entries For Purchase Return

Accounts Payable A/C – Debit

To Purchase Return Account – Credit

Journal Entries For Purchase With Discounts

Accounts Payable A/C – Debit = Rs. 10,000

To Cash or Bank A/C – Credit = Rs. 9,000

To Purchase Discount A/C – Credit = Rs. 1000

The sum of both credit amounts must be equal to the debit amount.

Accounts Payable Template

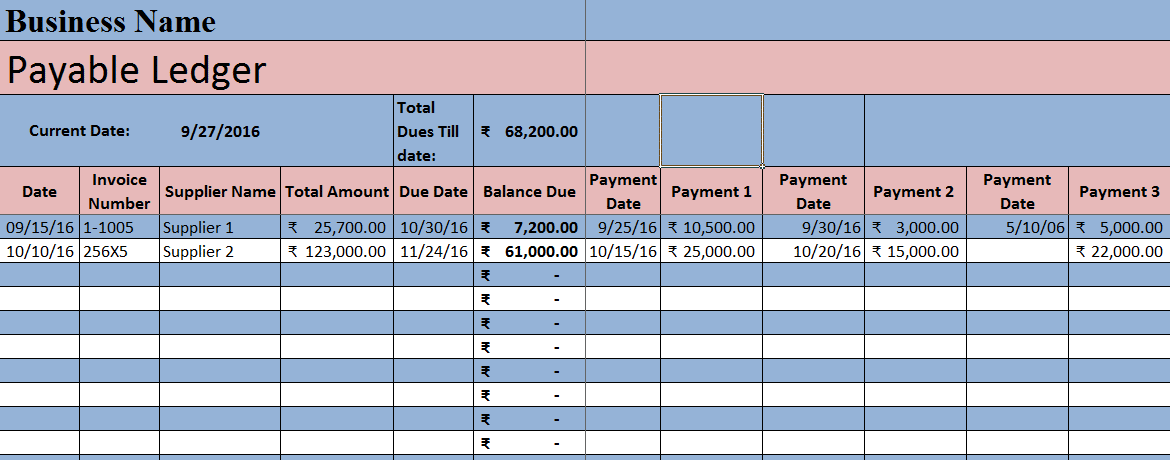

We have developed a straightforward and efficient Accounts Payable Template equipped with predefined formulas and functions. Users can input invoices directly into the template, which will automatically calculate outstanding amounts for each invoice.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

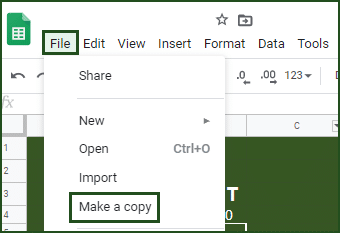

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

You can download other accounting templates like Cash Book, Petty Cash Book, and Purchase Return Book.

Let us discuss the templates

Content of Accounts Payable Template

This template consists of 2 sections: Vendor details and Payment Details.

Vendor Details

Row 1: Enter your Company/Business Name (Cells A1 to AD1). These cells should be merged.

Row 2: This row serves as the heading of the sheet (Cells B2 to BD2), which can be labeled as either “Accounts Payable Ledger” or “Creditors Ledger.”

Row 3: This row contains multiple headings as numbered below:

- The subheading for “Current Date” in cell A3.

- Cell B3 will automatically reflect today’s date using the formula =TODAY(), thus saving time by eliminating manual updates.

- The next column displays “Total Due to Date,” which calculates using =SUM(F5:F23) to provide a total balance owed to each supplier.

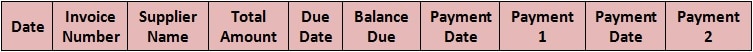

Row 4 = This row consists of subheadings for data input. For example, see the table below:

Invoice and Payment Details

Date, Invoice number, Supplier name, Amount of Bill, payment 1, and payment 2 and their respective date are details to be put while entering data.

For the Due date, you can set a function that automatically calculates several days for you and will show the exact date of payment. For this you will set the function as shown below:

= cell address which contains date + Number of days for allowed.

Here in our sheet, it is 45 days. So the formula entered is =A5+45. Copy this to all the cells below this cell, this will apply the same settings to all cells below.

Balance Amount here is calculated by deducting the total amount of bills – Sum(Payment1+payment2) etc. In this template formula used is =D5-SUM(H5+J5+L5+N5+P5+R5+T5+V5+X5+Z5+AB5+AD5).

Furthermore, you can also download Accounts Payable Template With GST(Goods and Services Tax) as well as Accounts Payable Template With VAT(Value Added Tax).

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Frequently Asked Questions

What is a Non-PO Invoice?

A Non-PO invoice refers to an invoice that lacks an associated purchase order. Such invoices must receive approval from authorized personnel before proceeding with payment processing.

Difference between account payable and bills payable?

Accounts Payable encompasses unsettled invoices owed by an organization to its suppliers. In contrast, Bills Payable refers to accepted and paid recorded bills within an organization’s financial records.

What Is Included in Accounts Payable?

Accounts payable includes a collection of short-term credits extended by creditors/vendors. Additionally, it encompasses internal business expenses such as employee travel reimbursements and petty cash transactions.

What is 3 Way Matching in Accounts Payable Process?

Three-way matching involves comparing and reconciling three key documents: the Purchase Order (PO), Delivery Receipt (or Packing Slip), and Invoice. This process ensures accuracy in financial transactions.

What is a tolerance limit concerning invoice processing?

A tolerance limit refers to minor discrepancies in invoice amounts that are acceptable based on prior agreements or industry norms; such discrepancies do not necessitate further approval for processing.

What is a debit balance recovery?

A debit balance occurs when a buyer overpays without any pending invoices from a supplier/vendor. Debit balance recovery refers to processes aimed at reclaiming such excess amounts.

How to initiate Debit Balance Recovery?

To initiate debit balance recovery, communication with the vendor regarding excess payments is essential. Settlements can be made through cash or bank transfers or adjusted against future invoices. If no further transactions occur with that vendor and recovery proves unsuccessful, it may be necessary to write off this balance.