The Accounts Payable With Aging Template is a sophisticated financial instrument available in Excel, Google Sheets, and OpenOffice Calc formats.

This template provides detailed information regarding outstanding payables, making it an invaluable resource for financial professionals such as Accounts Assistants, Accountants, and Audit Assistants.

Table of Contents

What is Accounts Payable?

Accounts Payable refers to a financial document that meticulously records invoices for goods and services purchased on credit. In essence, it represents the organization’s financial obligations to creditors, which must be fulfilled within a specified timeframe.

These payables are classified as liabilities and are recorded in the current liabilities section of a company’s balance sheet. It is crucial to note that Accounts Payable is considered a short-term debt, necessitating prompt payment to avoid default and maintain the organization’s financial integrity.

In accordance with the double-entry accounting system, when a vendor invoice is recorded, Accounts Payable is credited while another account is debited. Conversely, upon payment of Accounts Payable, the account is debited, and Cash is credited.

Consequently, when you pay your Accounts payable, you will debit Account payable and credit Cash. Therefore, the credit balance in Accounts Payable should precisely equal the sum of unpaid vendor invoices, ensuring accurate financial representation.

It is worth noting that the concept of Accounts Payable extends beyond the realm of business and is applicable to individuals as well.

For instance, consumers of utilities such as electricity, telephone services, broadband, and cable television accrue Accounts Payable when these services are provided on credit, with payment due at a later date.

Failure to remit payment by the specified deadline may result in default, underscoring the importance of timely management of personal Accounts Payable.

What is Accounts Payable Aging Report?

The Accounts Payable Aging Report is a comprehensive financial document that delineates creditor balances, providing a clear overview of the organization’s outstanding debts. This report encompasses crucial information such as the total amount owed and the duration of each debt.

It typically includes invoices for inventory, supplies, and services that are essential for the business’s operational activities.

Components of Accounts Payable Aging Report

The Accounts Payable Aging Report is structured to provide a detailed breakdown of financial obligations. The initial column lists the names of suppliers, followed by a column containing invoice details such as the invoice date, invoice number, and payment date. Additionally, the report includes payment information, specifically the payment date and amount.

The subsequent section of the report focuses on aging, with each column representing a specific time frame calculated based on the date and payment terms. Typically, an aging report utilizes a 30-day increment system.

You need to define columns that will display the outstanding amount of the respective time frame. These columns may include the following depending on your requirement:

- Current Outstanding (0 to 30 days old).

- Outstanding Amount Past Due Date 1-30 days.

- 31 to 60

- 61 to 90

- Over 90 days

Importance of Accounts Payable Aging Report

The Accounts Payable Aging Report, also referred to as the Aged Creditors Report, serves as a vital tool for monitoring and managing the age of outstanding payables within an organization.

This report facilitates timely decision-making, enabling businesses to maintain positive relationships with suppliers and vendors while simultaneously reducing overall liability.

Furthermore, the report aids in identifying opportunities for early payment discounts, potentially leading to cost savings for the organization. By providing a clear overview of upcoming financial obligations, the Accounts Payable Aging Report also plays a crucial role in predicting future cash flow requirements, thereby contributing to more effective financial planning and management.

Accounts Payable With Aging Template

I have created an Accounts Payable Template with advanced functions. With Accounts Payable Template you can efficiently and easily record entries. This template generates a vendor wise/creditors wise report in few clicks.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

You can download other accounting templates like Budget With Charts Template, Checkbook Register Template, Personal Budget Template, and Purchase Order Template from our website.

Let’s discuss the template contents in detail.

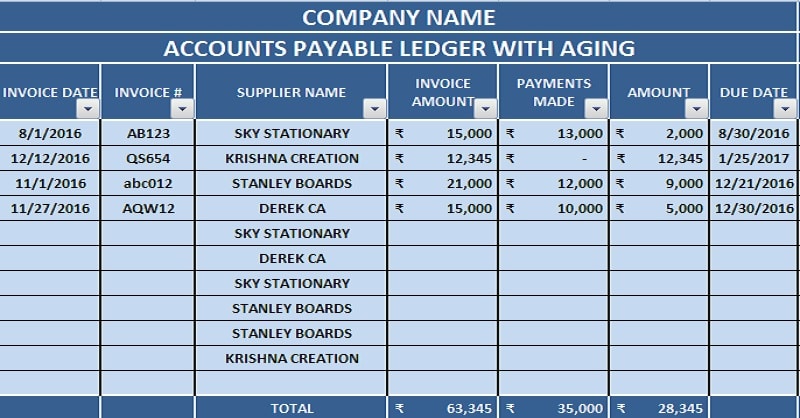

Contents of Accounts Payable With Aging Template

This template consists of two sections: Header Section and Data Input Section

Header Section

In the Header section, the right-hand side consists of the Company name and name of the Ledger of Accounts Payable.

On the left-hand side, the Balance of Accounts Payable amount as of today’s date is given. Thus, Balance amount = Total of Invoices – Payments.

The date column will automatically take the current date of the system. Current date formula =Today() is given.

Data Input Section

The data input section consists of the following subheading for data entry of payable invoices:

Invoice Date: The date of issuance for the creditor’s invoice.

Invoice #: The unique identifier assigned to the creditor’s invoice.

Supplier Name: The legal name of the creditor’s company or individual.

Invoice Amount: The total amount due, expressed in the designated currency.

Payments made: Any partial or full payments already remitted.

Amount: The outstanding balance, calculated by subtracting payments from the invoice amount (formula: =D5-E5).

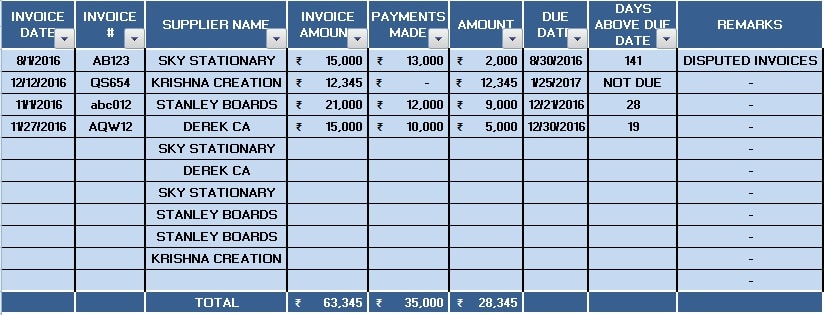

Due Date: The final date by which payment must be made to the creditor.

Days Above Due Date: This field indicates the number of days beyond the due date. If the due date has not yet arrived, it displays “NOT DUE”.

I have added a formula with an IF Statement here.

The formula utilized is: =IF(TODAY()-G5<=0,”NOT DUE”, (TODAY()-G5))

Remarks: A field for noting any disputes, discrepancies, or relevant comments.

The last line consists of the totals, where simple column totals are given using the SUM formula.

All the subheadings in the data input section are created with a table. Thus, it allows you to generate a creditor wise, date wise, etc query/report as required.

You need to simply click on the drop-down button in a subheading and select the criteria of the report.

Other Account Payable Templates

Simple Accounts Payable Template

Accounts Payable Template With GST

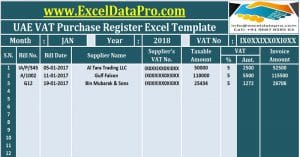

Accounts Payable Template With VAT

We thank our readers for liking, sharing, and following us on different social media platforms, especially Facebook.

If you have any queries or questions, share them in the comments below. I will be more than happy to help you.

Frequently Asked Questions

What Is the Accounts Payable Turnover Ratio?

The accounts payable turnover ratio is a financial metric utilized by businesses to quantify the efficiency with which they settle their obligations to suppliers. This ratio represents the frequency with which a company pays off its accounts payable within a specified time frame. It serves as an essential indicator of a company’s liquidity and its ability to manage short-term credit effectively.

What Is the Formula to Calculate Accounts Payable Turnover Ratio?

Total Supply Purchases

————————————————————————————————————-

(Begining Accounts Payable Balance + Ending Accounts Payable Balance)/2

What is the average payment period?

The average payment period, also known as the days payable outstanding (DPO), refers to the average number of days a company requires to settle its credit purchases. This metric is calculated using the following formula:

(Accounts Payable / Total Annual Purchases) x 360

Difference between Accounts Payable Aging and Accounts Receivable Aging.

- Accounts Payable Aging represents a liability, indicating the money your business owes to others. It categorizes unpaid supplier invoices based on the length of time they have been outstanding.

- Accounts Receivable Aging, conversely, is an asset, representing the money owed to your business by customers. This report classifies unpaid customer invoices according to their age.

Is a higher payment period good for Accounts Payable?

From a financial perspective, a higher payment period for accounts payable can be advantageous. It allows a business to retain cash for a longer period, potentially improving liquidity and providing opportunities for more effective cash utilization. This extended cash cycle can contribute to enhanced working capital management and potentially increased profitability.

However, it is important to consider the potential drawbacks of an extended payment period. Prolonged delays in settling accounts may strain relationships with suppliers, potentially leading to disruptions in the timely delivery of goods or services. Moreover, consistent late payments may raise concerns among suppliers regarding the company’s financial stability and ability to meet its obligations.