Definition – Allowable Deductions

According to US Tax Law, Allowable Deductions are the deductions allowed by IRS to a taxpayer to be subtracted from their gross income for a particular taxable year. They are also called above the line deductions.

Thus, deductions or expenditures allowed by IRS to be subtracted from gross income to reduce the taxable income for income tax are called allowable deduction.

Types of Allowable Deductions

There are basically 2 types of Allowable deductions:

- Standard Deductions

- Itemized Deductions

Taxpayers have a choice of taking a standard deduction or itemizing deductions. Hence, the taxpayer should use the type of deduction that results in the lowest tax.

1. Standard Deductions

Standard Deduction is a fixed amount allowed by IRS to the taxpayers.

The government sets the amount of standard deduction amount every year for each filing status. These amounts are different according to their filing status.

Single Filers – $ 6,300.

Married filing jointly – $ 12,600.

Head of House Hold – $ 9,300.

If the earning of a taxpayer is lower than these thresholds, they don’t have to pay income tax.

In addition to the standard deductions, a taxpayer can deduct some itemized expenses. Such deductions include the eligible student loan interest and moving expenses.

2. Itemized Deductions

The taxpayer adds up all the actual amounts of allowed deductions and claims the total in deductions from gross income.

In other words, the actual amount of allowed deductions is called itemized deductions.

Itemized deductions usually include mortgage interests, contributions to IRAs, property related taxes etc.

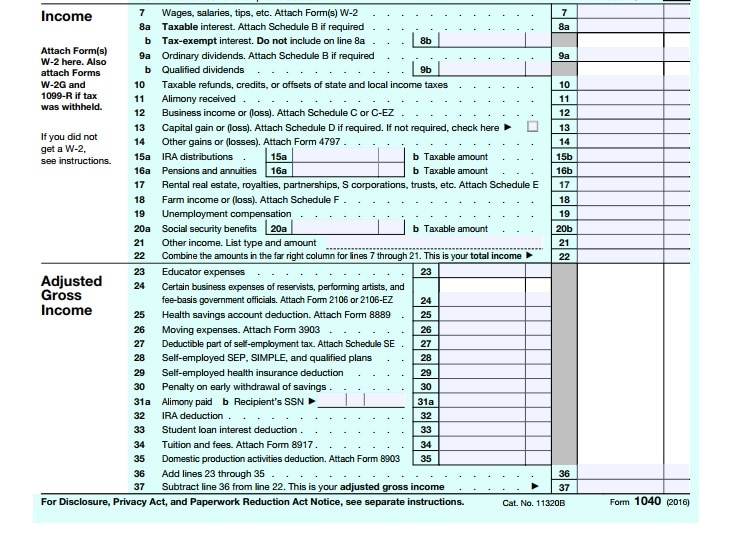

See image below for reference:

Form 1040 of Federal Tax Returns consists of all these allowable deductions at the end of the first page.

To download the form 1040 IRS website click on the link below:

The income after the standard/itemized deductions is called Adjusted Gross Income

To help our readers easily file their tax returns, we have made many free and downloadable templates.

Some of them are listed below:

- Adjusted Gross Income Calculator

- Traditional IRA Calculator

- Roth IRA Calculator

- Income Statement Projection

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Can I deduct my rent as long as I have a lease?

If your lease requires you to make property tax payments, you can deduct that portion of your rent or any property tax you pay. You can also deduct property losses from fire, theft or flood, as long as you aren’t reimbursed by your insurance provider for those losses.

Is property tax allowable deduction when computing corporate tax

Generally, companies are permitted to deduct the expenses incurred that are ordinary and necessary for the trade or business. However, expenditures that create an asset with a useful life of more than one year may need to be capitalized.