21st GST Council meeting was held in Hyderabad on 9th September 2017. It was headed by our Finance Minister, Mr. Arun Jaitley.

In this article, we will discuss the key decisions made at this meeting.

Key Decisions Made in 21st GST Council Meeting

1. Dates Extension of GST Return Filing

The actual dates for filing the GSTR-1,2 and 3 were 5th August, 15th August, and 20th August. Then they were extended to September. Then again an extension of 5 days was given.

As the dates reached near, the GSTN portal started dysfunctioning. The server was unresponsive as many more people were trying to file their returns.

Due to overload on the system, the system started giving errors in filing GSTR-1. In a statement, Mr. Adhia said that the GSTN portal was able to handle only 80,000 requests.

Considering all the above points, there was no way out for government rather than to extend the due dates for filing of GST returns.

The new due dates for Filing GST returns for the month of July 2017 are as below:

GSTR-1: 10th October 2017.

GSTR-2: 31st October 2017.

GSTR-3: 10th November 2017.

GSTR-6: 13th October 2017.

For companies having the aggregate turnover of more than 1oo crores, the due date for GSTR-1 will be 3rd October 2017.

Extension of GSTR-3B

As we all know, GSTR-3B was only for the month of July and August. Now, this has been extended till the month of December. An additional return till the month of December.

Instead of decreasing the burden of businesses, the government is making things most complex.

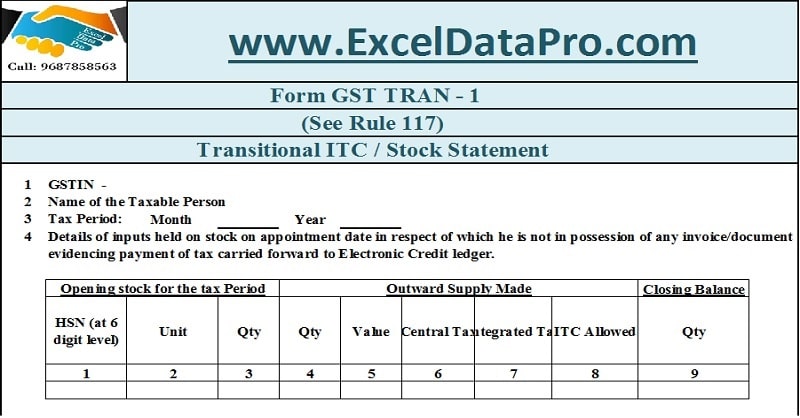

Extension In TRAN-1 and its corrections

The due date of Form GST TRAN-1 has been extended by one month. The new date will be 31st October 2017. Earlier there was no provision to revise it, now it can also be revised once.

Commencement of TDS and TCS registration

The registration of TDS and TCS registration will commence from 18th September 2017.

Other Miscellaneous Decisions

- Composition scheme can opt till 30th September 2017.

- No registration required, where the inter state supply (up to 20 lakhs turnover) of handicraft goods made under the cover of e-way bill.

- No registration required, where the inter supply (up to 20 lakhs) of Job work services made to registered persons and goods moves under the cover of e-way bill.

- GST Council will set up a committee to examine issues related to exports.

- Constitute a group of ministers to monitor and resolve the IT challenges faced during GST implementation.

You can download GST templates like GST Bill of Supply, GST Payment Voucher, and GST Export Invoice from here.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.