UK VAT Invoice With Discount is a ready-to-use excel template that helps you to issue a VAT compliance invoice with a discount for taxable goods and services with auto calculations.

Usually, retailers offer discounts to their customers. Moreover, semi-retailers also give discounts to customers for upright payments. Hence, the supplier needs to show such discounts on the invoice.

Table of Contents

Guidelines For UK VAT Invoice With Invoice

|

Invoice information |

Full invoice |

| Unique invoice number that follows on from the last invoice |

Yes |

| Your business name and address |

Yes |

| Your VAT number |

Yes |

| Date |

Yes |

| The tax point (or ‘time of supply’) if this is different from the invoice date |

Yes |

| Customer’s name or trading name, and address |

Yes |

| Description of the goods or services |

Yes |

| Total amount excluding VAT |

Yes |

| The total amount of VAT |

Yes |

| Price per item, excluding VAT |

Yes |

| Quantity of each type of item |

Yes |

| Rate of any discount per item |

Yes |

| Rate of VAT charged per item – if an item is exempt or zero-rated make clear no VAT on these items |

Yes |

| The total amount including VAT |

No |

Source: www.gov.uk

According to the rules, the rate of discount if applicable has to be shown on the invoice.

The supplier cannot provide a discount on the final invoice amount which is VAT inclusive. You need to calculate VAT on the Taxable amount. Furthermore, the VAT is charged on discounted prices.

Let us understand it with an example.

Supplier ABC sells goods worth GBP 500 to his customer offering a discount of 10%.

Therefore, the calculation will be as follows:

Sales Amount: GBP 500.

Discount: 10%.

Taxable Amount: GBP 500 – GBP 50 = GBP 450.

VAT %: 20%.

VAT Amount: GBP 90.

Final Invoice Amount: GBP 450 + GBP 90 = GBP 540.

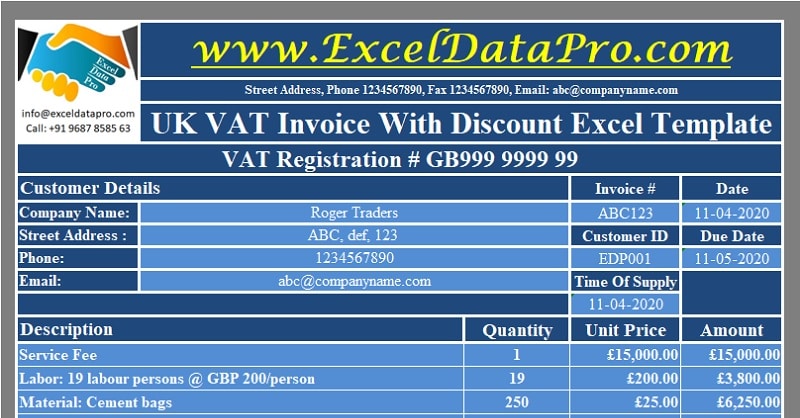

UK VAT Invoice With Discount Excel Template

We have created a UK VAT Invoice With Discount excel template with predefined formulas and formatting as per the above guidelines. Easily issue a VAT compliant invoice to your customers in just a few minutes.

Click here to Download UK VAT Invoice With Discount Excel Template.

You can also download other VAT templates like UK VAT Invoice Template, UK VAT Multiple Tax Invoice Template, UAE VAT Multiple Tax Invoice, UAE VAT Dual Currency Invoice, and UAE VAT Payable Calculator.

Content of UK VAT Invoice With Discount Excel Template

This template consists of 2 sheets, one is UK VAT Invoice With Discount Template and the other is the Customer Database sheet.

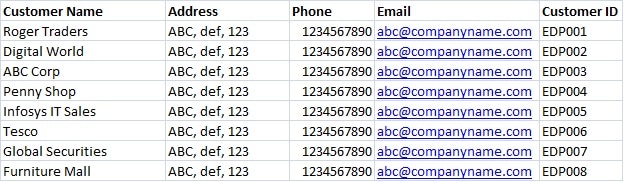

Customer Database Sheet

You can manually type the customer name and other details when your business type is retail as you have different customers every time businesses that have similar customers every time.

It consists of a list of your customers. These customers are those whom we issue the invoices for the goods supplied or services rendered regularly.

This database sheet is further used to create a dropdown list in the invoice template. Insert your customer details once when you are making the first sale and it gets added to the dropdown list.

This enables the user to save time by just selecting the name fo the supplier and the sheet automatically fetches the customer details on the invoice.

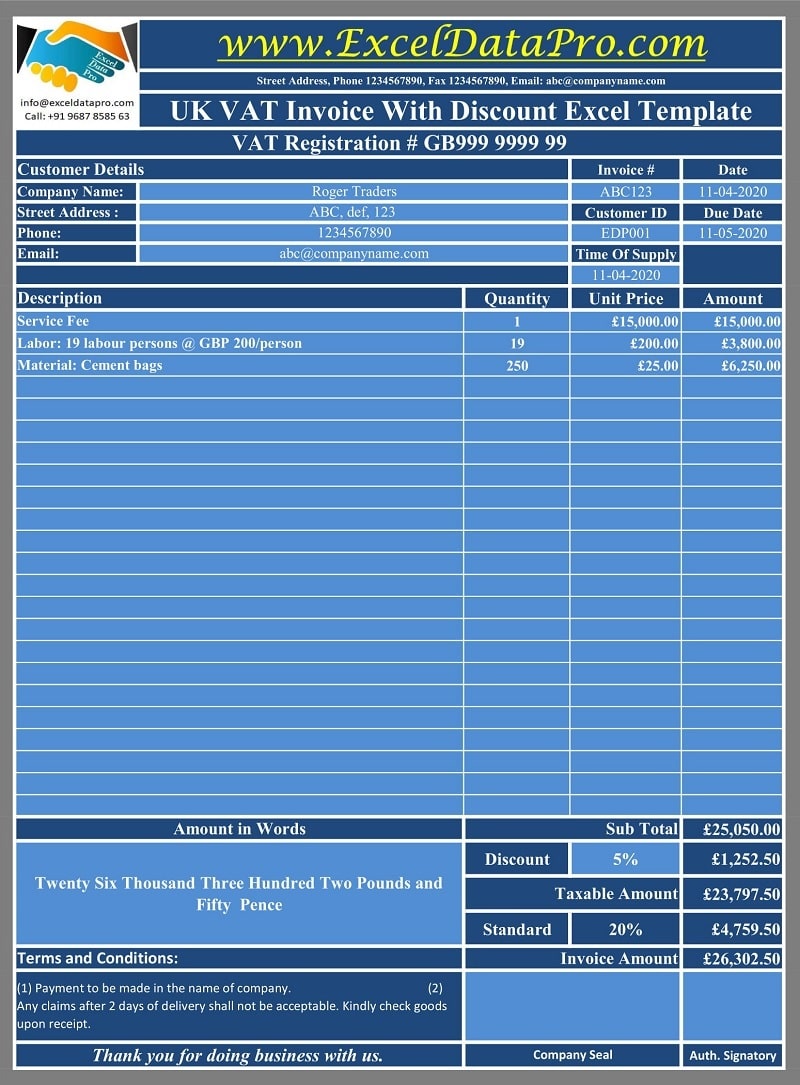

UK VAT Invoice With Discount Template

The UK VAT Invoice With Discount consists of the Performa of the invoice as per the government guidelines. It consists of the following 4 sections.

Header Section

The header section consists of your company’s logo, name, VAT Registration Number and the heading of the invoice. Insert your logo, name and VAt registration number along with your address. This entry is made only one time.

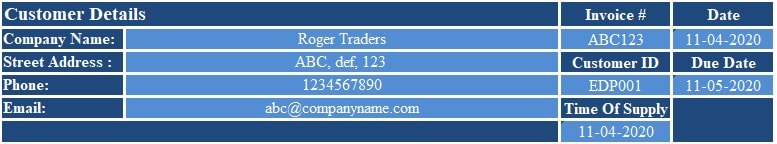

Customer Details

The customer details section consists of the client’s details as below:

Company Name

Street Address

Phone

Email

Invoice

Date

Customer ID

Due Date

Time Of Supply

The customer details section is formatted with data validation to create the dropdown list. Once you select the name of the customer from the dropdown list the sheet automatically fetches relevant details with the help of the VLOOKUP function.

In addition to that, on the right-hand side, you need to manually enter the invoice number. The Invoice Date is automatically drawn using the TODAY function.

Due date of payment is calculated adding 30 days. You can change it according to your requirements. If it is not applicable then insert the invoice sate or leave blank. and time of supply or tax point.

Time of supply is used when the supply of goods or services date is before the invoice date. Insert manually if it is different or else leave blank.

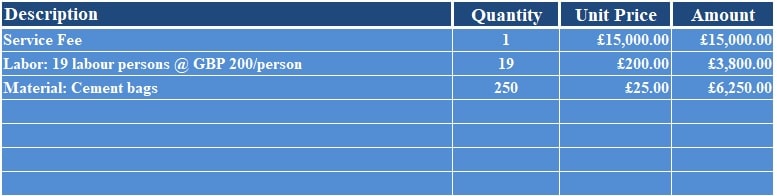

Product Details

The product details section consists of the following columns:

Description: Insert description of goods or services to your client.

Quantity: Quantity of the product.

Unit Price: Price per product.

Amount: This column shows the total amount of supply per item using Quantity multiplied by Unit Price. The final total of this column us the taxable amount.

Other Details

Other details section consists of the following:

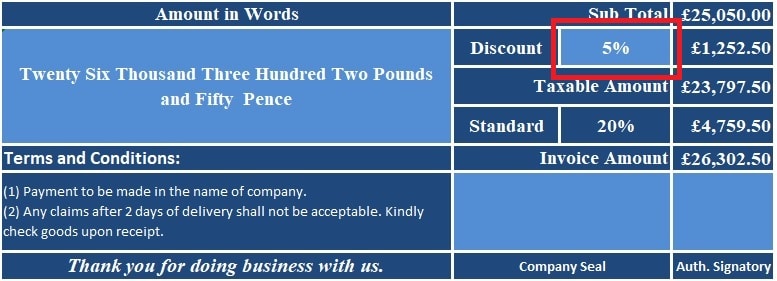

Amount in words: No need to insert anything here. It will automatically convert the amount in words using Spell Number GBP.

Terms & Conditions: Insert your invoice terms and conditions.

Discount: Insert the discount percentage and it calculates the discount amount on the subtotal amount.

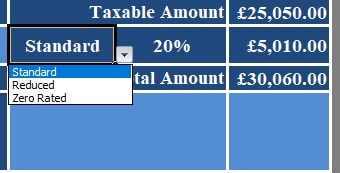

VAT computation: Select the type of VAT from the dropdown list. If you select Standard, the cell next to it will display 20% and if you select Reduced then it will display 5%. When Zero-rated is selected the cell will display 0%. The VAT amount is calculated based on the percentage.

Taxable Amount X VAT % = VAT Amount

VAT Amount + Taxable Amount = Final Invoice Amount

Company seal: A blank space is given for the company seal. After printing the invoice you can stamp here.

Signature: A blank space is given for the authorized signatory. After printing the invoice the authorized personnel can sign the invoice here.

Thank You Note: Insert a thank you note of your choice here.

That’s it and your UK VAT Invoice With Discount is ready to print. It can be helpful to small and medium scale businesses to issue VAT compliance invoices with a discount to their clients.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply