As we all know that business issues an invoice to his customers for goods or services rendered. In this article, we will discuss the UAE VAT Tax Invoice format. UAE stands for the United Arab Emirates.

Earlier GCC countries were considered as tax heavens and this was the reason for their speedy nourishment. Almost all the big Fortune 500 companies or leading MNC have their offices in UAE.

The UAE was among the first GCC member states to publicly announce the introduction of the VAT. The UAE VAT Law will be introduced and implemented across UAE on 01 January 2018 at a rate of 5%.

To know more about the VAT you can visit the official website of Ministry of Finance – UAE www.mof.gov.ae

UAE VAT Tax Invoice Excel Template

We have created an excel template for UAE VAT Tax Invoice. You can easily issue the invoice to your customers with the help of this template.

Click here to Download UAE VAT Tax Invoice Excel Template As Per The Federal Law 8 of 2017 on VAT.

You can also download other UAE centric templates like UAE VAT Multiple Tax Invoice, UAE VAT Dual Currency Invoice, GCC VAT Invoice Template With Discount and UAE VAT Payable Calculator.

Content of UAE VAT Tax Invoice Template

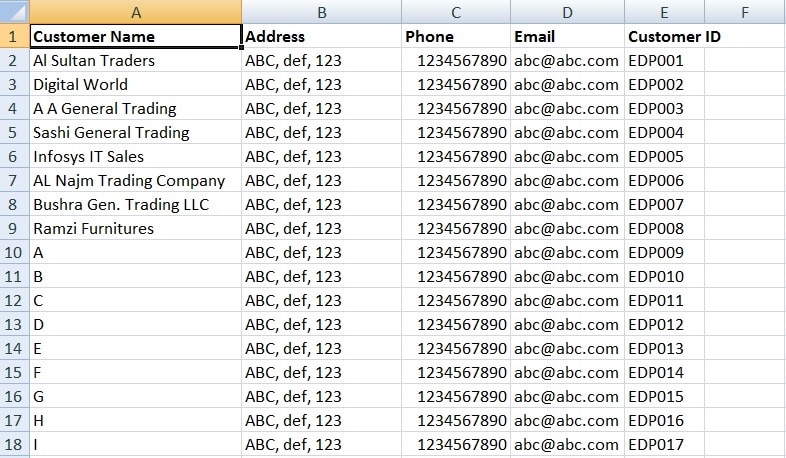

This template consists of 2 worksheets. The first one is the Tax Invoice Template and the second one is the Database sheet for listing your customers.

The database sheet contains the list of the names of your customers. These customers are those whom we issue the invoices for the goods supplied or services rendered.

The Tax Invoice template contains the Performa of the Invoice.

Let’s discuss the template contents in detail.

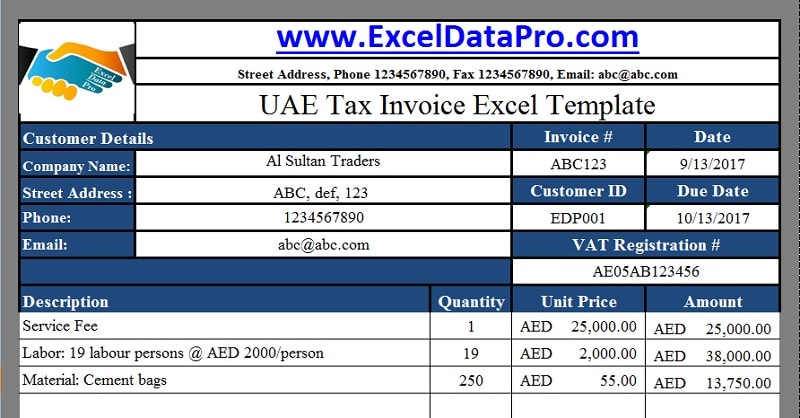

It consists of 4 sections:

- Header

- Customer Details

- Product Details

- Other Details

1. Header

The header part contains the company logo, company name and heading of the invoice.

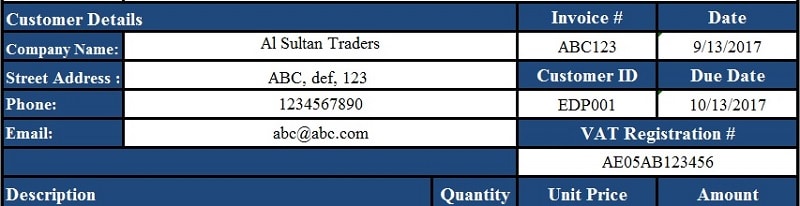

2. Customer Details

Then, there is the Customer details section. This section is connected with data validation and the VLOOKUP function to the database sheet.

Therefore, when you select the name of the customer it automatically updates the Address, phone, email, and customer id.

Once it is updated in the database sheet you can just easily click on the button and a drop-down list will appear.

On the right-hand side, enter the invoice number, invoice date, due date of payment which is set to 30 days from the date of invoice and your VAT Registration ID.

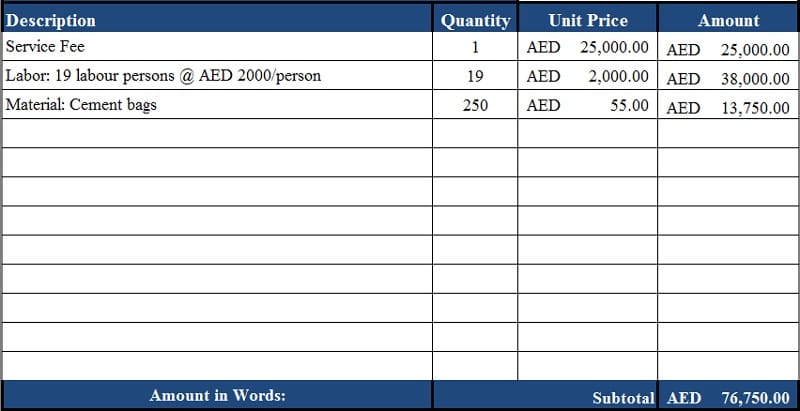

3. Product Details

The product details section contains columns like Description, Quantity, Unit Price and Amount. Simple mathematical computations are applied. Quantity X Unit Price = Amount.

Quantity X Unit Price = Amount.

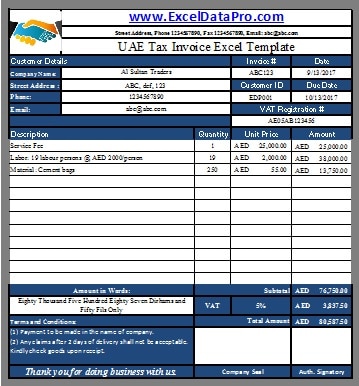

Just below the product details section, there is the subtotal.

4. Other Details

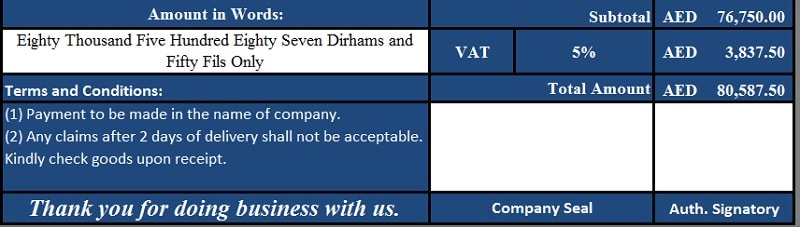

Other details section consists of Amount in words, Terms & Conditions, VAT computations @ 5%, Company seal, signature box and “Thank you” greeting.

It will automatically compute the % with the Subtotal amount and sum up for the final total.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Please provide invoice format for invoices raised in currency other than AED. Thank you in advance.

Dear Teja, Please specify your requirement. Where are you located and which currency exactly do you require? We will be happy to provide it to you.

Dear Fahim, we are mostly invoicing in USD currency, we are located in Musaffah, Abudhabi, please can you send us the sale invoice format, bcoz as per FTA ” The currency to be used in a Tax Invoice is UAE Dirham. If the supply is in a currency other than UAE Dirham, the amount shown in the invoice should be converted to UAE Dirham according to the exchange rate approved by the Central Bank as on the date of supply”. please clarify

You will have to make a dual currency invoice for this purpose. It will be published next week on our website.

Thanks a lot for your prompt response,

Dear Fahim, please can you let me know whether you have published the dual currency ?, so that i can change my software accordingly,

thanks in advance

Yet not published. It will be published in a day.

Hi Karnan, The dual currency invoice template has been published. Here is the link: https://exceldatapro.com/uae-vat-dual-currency-invoice/

Dear Fahim, I have downloaded your Dual curr Inv format & sent to our IT dept for updating our invoice format,

Thanks a lot for your help,

From where to get the UAE Central bank approved rates?

Please contact VAT authority or central bank for the rates.

Kindly provide me an invoice template for government entities in saudi arabia.

Your requirement has been noted and will soon update on it.

Kindly provide me an invoice template for government uae

Usually, the same format of the invoice is used for the government too. If you have any specifications please do let us know. in detail what it should contain.

Whether VAT should be charged on total before discount or after.

As per accounting rules, the vat is charged on the amount after deduction of discount.

lets suppose in an invoice there are 3 items 1 is a taxable item while 2 are not then what would be the invoice formate?

As there is single tax percentage applicable invoice format will be this as given in the article. In case of multiple tax items in a single invoice or as your case is, a multiple column tax invoice shall be used where there will be a separate column for each item to mention the percentage applicable. We will soon publish invoice format with multiple taxes column.

Dear Fahim , did u publish invoice format with multiple taxes colum , please leave me the link thanks

This weekend, that is tomorrow it will be published and will be notified to you. Thanks

UAE VAT Composite Supply Invoice Template

https://exceldatapro.com/uae-vat-composite-supply-invoice/

Assalam walekum, sir could please provide me a sample of long term contract progress invoice sample with retention valuation 1&2

Which is comply with FTA in UAE

Thanks in advance

Dear Naimuddin, With reference to your query, you can download the UAE VAT Progress Billing Invoice Template from the below link.

https://exceldatapro.com/uae-vat-progress-billing-invoice/

is this vat format compulsory for invoice from next year ? if i use my old printed invoice with addition of TRN number and vat 5% amount in last row (by handwriting) is allowed or not ?

The FTA has announced the guidelines which are clearly mentioned in the law. If your invoice has all those things there is no issue using it. But if not you need to follow the guidelines.

Thanks a lot. Very kewl gesture.

Dear

I believe I need to mention company TRN and client TRN in the invoice as well?m I right?

You are right. You can find the revised template on the given link below with TRN. Thanks

https://exceldatapro.com/gcc-vat-invoice-template-with-discount/

Dear Sir

Thank you very much for the invoice formats.

Can you please advice me how to add a new customer in the data base sheet for preparing the invoice. if i am adding a new customer, it is not displaying in the invoice templates.

Happy to hear that it was useful to you. If you have added the cells to the customer database sheet, you need to change the data validation and Vlookup range. Doing this will help you see your added customers. Currently, data validation source formula is =’Customer Database ‘!$A$3:$A$23. Change it up to the cell you have added. Similarly, Vlookup table array will also change. Thanks

Thanks dear for sharing this valuable information

dear can we asked about the format for the insurance policy(vehicle insurance) for brokers as company already charging vat on policy, how the broker can record and issue the vat invoice

Happy to know that the information was useful to you.

According to best of my knowledge, vehicle insurance is under 5 % vat. So the service provider is also the same at 5 %. Your services rate will be fixed and you need to pay VAT on the same.

Usually, the invoice format will be same. But if you have any special kind of format which is used in the insurance industry, then send us the image we will try to work it out in excel.

Dear,

Thanks for your good information

Kindly I want to know do you have any format for VAT or Tax Return

thanks

YHi Hamid, Thanks for the appreciation. Happy to know that it was helpful to you. I have explained the UAE VAT Return format in my recent article. Click on the link below to read it:

https://exceldatapro.com/uae-vat-return-format/

You can help us by sharing the articles with your friend and colleagues on different social media accounts.

Thanks and Regards

we are in a free zone /designated zone area. but i am confused what to put in our invoice. as per FTA it should be zero-rate. but some say it should mention a statement “recipient accountable for vat via RCM” for deliveries to mainland. but how about our deliveries to Free Zone/ Designated Zone? do i have to mention the same statement or just zero -rate it?

No need to mention the same statement. just zero -rate it.

Hi sir, me also in the same inside free zone company. If i want issue invoice to same inside free zone customer without VAT, so my doubt is if we issue invoice with zero rate need to mentioned TRN nunber of Customer and invoice heading only (Invoice or TAX invoice ) ?? Can u please clarify this ?

Zero-rated supply requires TRN and will be issued on Tax Invoice.

Hi Good morning hope all is well. Kindly share a sample of progress invoice with “deduction of advance payment and retention”. Because I am confuse if the VAT will apply before the deduction or after the deduction. I saw your reply in previous comments in VAT Progress Billing Invoice but there is no deduction such as retentions and advance payment.

With reference to your query, the template consists of advance payment options. The retention is not given. You can add that in the second section in place of adjustments.

Other currency invoices should be convert into AED as per the UAE central bank rates, but there is no rates mention on central bank website.

Please check the query with FTA. You can email or call them on below given details:

Call center: 600 599 994

Phone: 04-7775777

Email: info@tax.gov.ae

Hi,

Sir as we are running a labour supply company,How should be the invoice and credit note.As these thins mentioned ( Description,Hours,Amount,Absent Deduction,VAT 5 %,Total Amount )

Providing Labour supply comes under service providing. It should contain either number of labors provided or hours whatever be your operating scenario. Less of deductions and the VAT should be charged on balance amount will 5 % concluding the final invoice amount.

Hi Mr Fahim,

do you have the template for submitting VAT report to the federal government every quarter? The one for VAT received from sales and VAT paid to supplier. Thank you very much

Following templates can be helpful for your purpose:

https://exceldatapro.com/uae-vat-payable-calculator/

https://exceldatapro.com/uae-vat-sales-register/

https://exceldatapro.com/uae-vat-purchase-register/

hello

we are spare parts trucks company, we want to how to make prefect vat invoice

With reference to your query you can download invoice template from the link below:

https://exceldatapro.com/uae-vat-multiple-tax-invoice/

Salam Fahim,

We are a small media business with turnover less that 200,000 last year but we expect to do better this year and have registered for UAE VAT. We make about 10 invoices in a year and each job is different. Is there a simple format for tax invoice which we can use??

For VAT we have made around 12 different vat templates. You can choose out of it whichever is convenient for you. Click on the link below to know different templates:

https://exceldatapro.com/templates/vat-templates-uae/

According to my knowledge, this template can be best suitable for you:

https://exceldatapro.com/uae-vat-multiple-tax-invoice/

Hello…we have a warehouse rental business . Kindly give us an idea for VAT Invoice thank you

General VAT invoice can be made. There are many invoice templates on our website. you can choose that suits your requirement. I would suggest the following:

https://exceldatapro.com/uae-vat-multiple-tax-invoice/

Dear Mr. Fahim,

Many thanks for your convenient and handy VAT invoice format. Its very easy to work with. I have two suggestion; would be glad if you consider them;

1. Can the amount in words be automatically updated with the amount in figures (with the excel functions if any)

2. Just like the database for Customer selection; can there be a database for items of goods too. Like the Item of inventory. Just have to select it from the drop down box; like the customer name.

Thanks& Regards!

Prashant

Glad to hear that. Your request has been noted and required template will be soon published on our website. Help us by sharing our content on different social media. It will be highly appreciated. Thanks

Hello…we have a car rental business . Kindly give us an idea for VAT Invoice thank you.

Request noted and the VAt invoice template for Rent a Car Busines will be published today on our website and will notify you.

https://exceldatapro.com/uae-vat-invoice-format-for-rent-a-car-business/

Car Rental Business VAT Invoice Format

https://exceldatapro.com/uae-vat-invoice-format-for-rent-a-car-business/

Good morning

Is there a proven VAT compliant financial accounting package for Real Estate

( Commercial Rental).

Would appreciate your assistance.

No dear we don’t deal in any software. Tally and Quickbooks are working fine in UAE for VAT. You can take a trial and check which one suits your needs. Thanks

Good morning,

We request you kindly publish UAE VAT audit file template.

It will be highly appreciated. Thanks

Working on it. Noted and will be uploaded on the website once it is complete.