UAE VAT Payable Calculator provides you with the exact payable amount of VAT to Federal Tax Authority (FTA).

When you make sales you collect VAT. Credit Notes and Debit Notes issued against invoices are then adjusted while calculating VAT payable.

You are entitled to recoverable VAT input on purchases used for taxable supply. This recoverable VAT input reduces your tax liability.

In addition to that, as per the UAE VAT Law, you have to pay VAT under reverse charge under some conditions.

You can download the pdf copy of Federal Decree-Law No. (8) of 2017 on Value Added Tax from the link below:

Federal Decree-Law No. (8) of 2017 on Value Added Tax

Considering all the above points we have created an excel template for UAE VAT Payable Calculator.

You need to enter the just the taxable amount and it will automatically calculate the VAT amount as well as the exact payable amount to FTA>

Click here to download UAE VAT Payable Calculator Excel Template.

You can also download other UAE centric Accounting Templates like UAE Invoice Template, UAE Invoice Template in Arabic, UAE VAT Debit Note and UAE VAT Credit Note etc.

Let us discuss the creation of this template in detail.

Contents of UAE VAT Payable Calculator

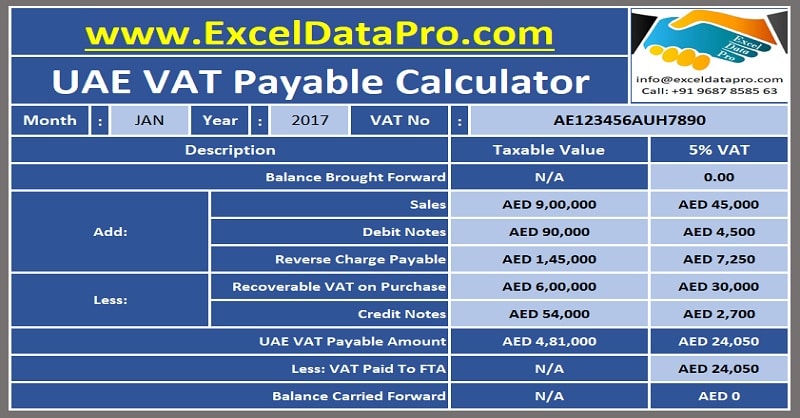

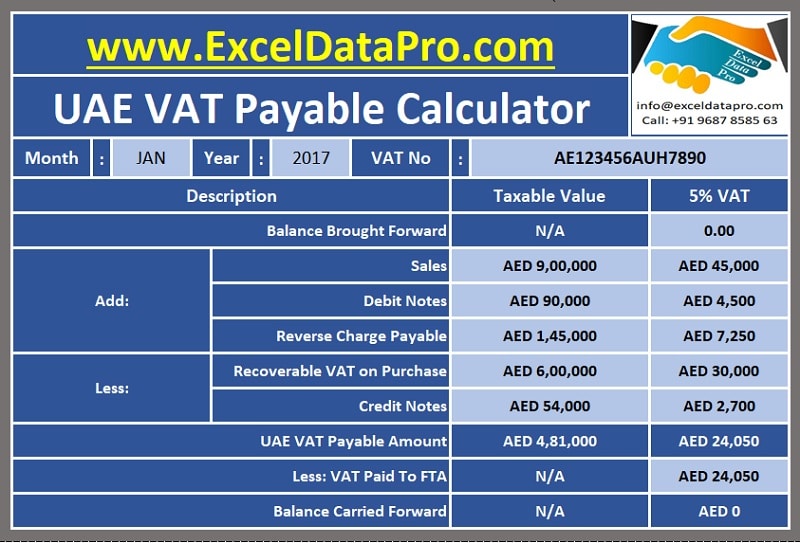

The UAE VAT Payable Calculator consists of 3 sections:

- Header Section

- Calculation Section

- VAT Payment Section

1. Header Section

The header section consists of your company name, company logo, month, year and VAT registration number.

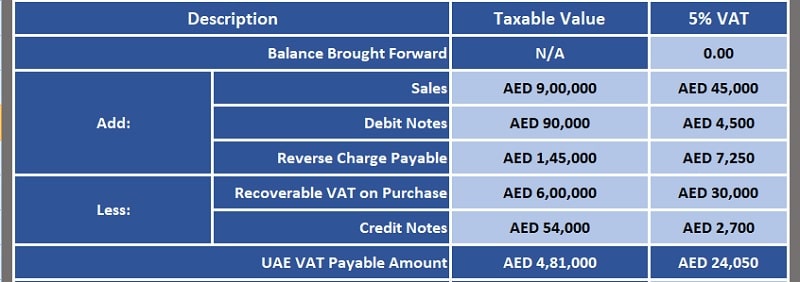

2.Calculation Section

Calculation section consists of 3 columns. Description, Taxable value and 5% VAT amount.

A user needs to enter amounts against each description and it will automatically calculate the applicable 5% VAT amount.

Balance Brought Forward: If there is any previous balance of VAT payable or recoverable VAT input it should be mentioned here.

VAT payable will be a positive amount and recoverable VAT input will be a negative amount.

Sales: Enter the taxable amount remaining after discounts if applicable in this cell. You can use our UAE VAT Sales Register Excel Template to maintain your sales.

Debit Notes: If any debit notes are issued during the month then you will have to mention the total taxable amount of all the debit notes in this cell.

Debit notes increase your liability as it increases your taxable value.

Reverse Charge Payable: IF you have imported any goods or reverse charge is applicable as per law then you have to enter the total taxable value of reverse charge in this cell.

You can use our UAE VAT Purchase Register Excel Template to maintain your purchases.

Recoverable VAT Input: According to UAE VAT law, a registered business is entitled to claim VAT paid on purchases used for taxable supply.

Hence, you will have to enter the total taxable value of such purchases in this cell.

Credit Notes: If any credit notes are issued during the month you will have to enter the total taxable value of all credit notes in this cell.

Credit notes decrease your liability as it reduces your taxable value.

UAE VAT Payable To FTA: Taking into consideration the UAE VAT Law, the UAE VAT payable to FTA is calculated.

Formula Applied:

Sales + Debit Notes + Reverse Charge Payable – Recoverable VAT Input on Purchase – Credit Notes

3. VAT Payment Section

VAT Paid: If UAE VAT payable amount a positive amount then you need to pay that amount to FTA.

Balance Carry Forward: Sometimes it happens that your recoverable ITC is greater than the amount payable. In such cases, UAE VAT Payable to FTA will be a negative amount.

Such excess amount can be adjusted in preceding tax periods and thus you can carry forward that amount.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.