In our previous article, we discussed UAE VAT Invoice Template. In this article, we will discuss the Arabic version of UAE Invoice Template With VAT.

UAE has announced a standard rate of VAT @ 5% from 1st January 2018. A single rate of VAT brings simplicity. Currently, such single rate system prevails in countries like Singapore, Japan, and New Zealand etc.

VAT is an indirect tax. It is referred to a type of general consumption tax. Usually, VAT is imposed on most supplies of goods and services that are bought and sold.

A business will have to pay the government the VAT tax that they collect from their customers. You will also be eligible to receive a refund from the government for VAT tax that you have paid to your suppliers.

VAT will be applicable to the majority of transactions of goods and services unless exempted or excepted by law.

To know more about the VAT you can visit the official website of Ministry of Finance – UAE www.mof.gov.ae

We have created an Excel Template for USE Invoice Template With Arabic headings and subheadings. We have both types of readers Asians as well as Middle Easterns.

Click here to download UAE Invoice Template With VAT in Excel – Arabic.

You can download other accounting templates like Cash Book with VAT, Accounts Payable with Aging and Trial Balance from here.

Let us discuss the contents of the template in detail.

Contents of UAE Invoice Template

This template consists of 2 worksheets. Database Sheet and UAE Invoice Template

First is the UAE Invoice Template and the second one is the Database sheet of the list of our customers.

Database sheet consists of details of customers like customer id, name, address, phone and email address. The main purpose of creating this sheet to save time and simplify your work.

This sheet is linked to the UAE InvoiceTemplate. When you select the name of your customer, it will auto update all relevant details.

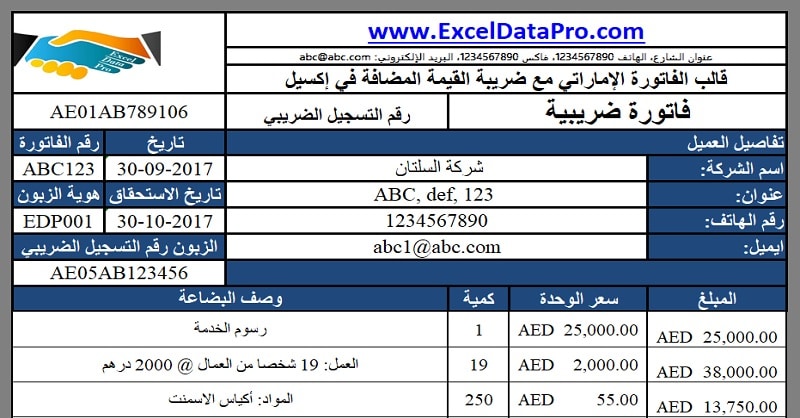

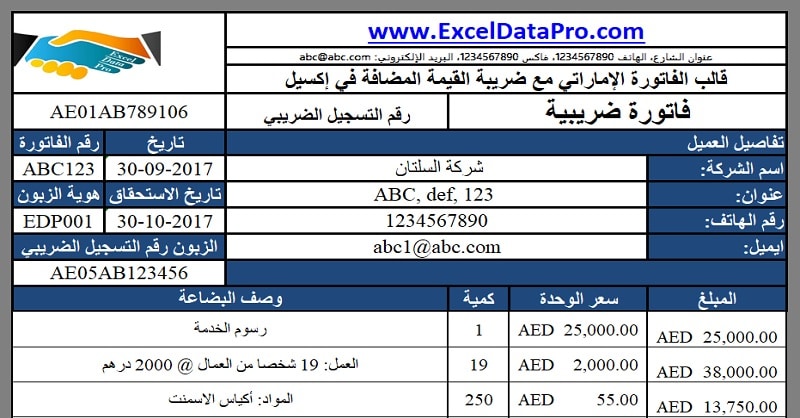

The UAE Invoice template consists of 4 sections:

- Header – رأس

- Customer Details – تفاصيل العميل

- Product Details – تفاصيل المنتج

- Other Details – تفاصيل أخرى

1. Header – رأس

Header part contains the company logo, company name, VAT number and heading of the invoice.

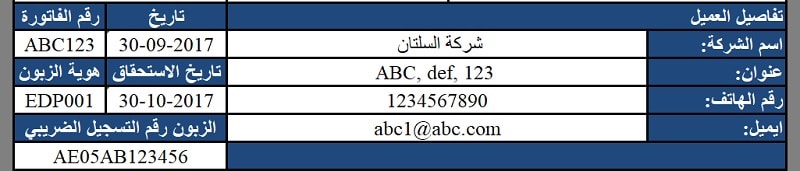

2. Customer Details – تفاصيل العميل

Customer Details section consists of all the details of customers like name, address, phone number, email etc.

You don’t have to type manually data in this section.

When you select the name from the dropdown list in customer name field, it will automatically extract details of that customer from database sheet with the help of VLOOKUP function.

Once you have updated details in the database sheet you can just easily click on the button and a drop-down list will appear.

On the right-hand side, you will enter the invoice number, invoice date, due date of payment which is set to 30 days from the date of invoice and Customer’s VAT Registration ID.

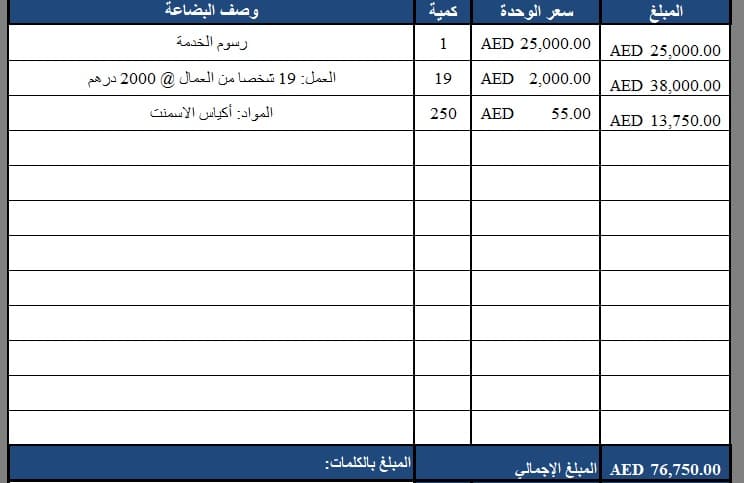

3. Product Details – تفاصيل المنتج

Product details section contains columns like Description, Quantity, Unit Price and Amount.

In the description column, enter the goods supplied or services rendered.

The second column is for quantity, third for the price and fourth for the amount.

Amount = Quantity X Unit Price

Just below the product details section, we have the subtotal.

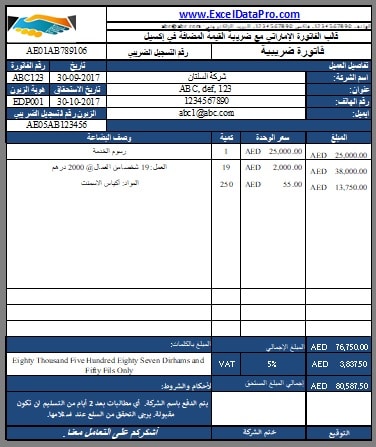

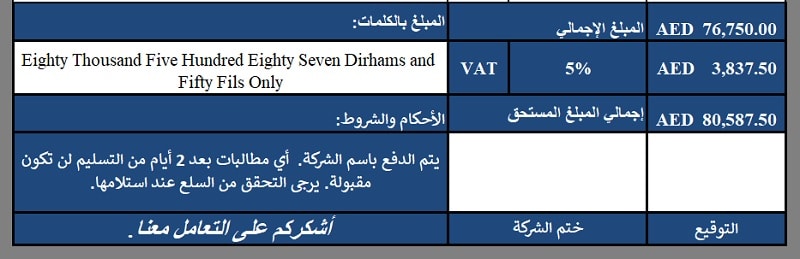

4. Other Details – تفاصيل أخرى

Other details consist all miscellaneous items like Amount in words, Terms & Conditions, VAT computations and VAT rate @ 5%, Company seal, signature box and business greeting.

As you enter the details it will automatically compute the VAT tax @ 5 % of the total amount.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.