Saudi VAT Payable Calculator is used to easily calculate VAT payable liability by entering details of purchase and sales.

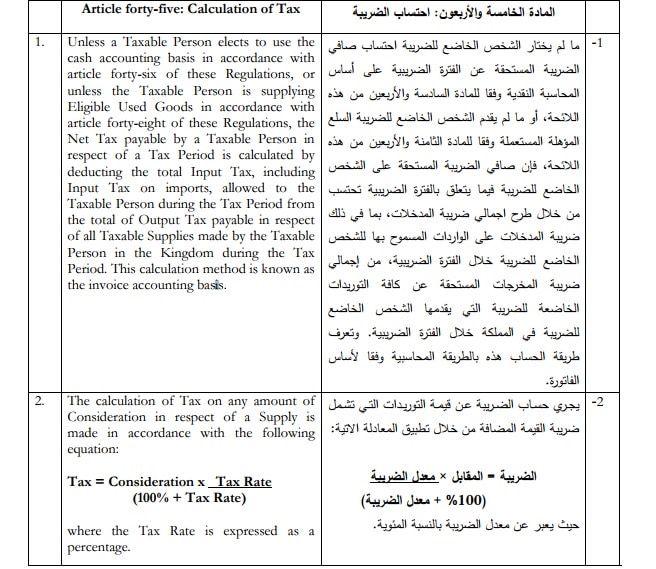

According to Article 45 related to Calculating Tax mentioned in Value Added Tax – Implementing Regulations of Saudi VAT Law:

” The Net Tax payable by a Taxable Person in respect of a Tax Period is calculated by deducting the total Input Tax, including Input Tax on imports, allowed to the Taxable Person during the Tax Period from the total of Output Tax payable in respect of all Taxable Supplies made by the Taxable Person in the Kingdom during the Tax Period”

Thus, VAT Payable = Output Tax – Input Tax.

Article 45 – Calculating Tax (Value Added Tax Implementing Regulations – Saudi VAT)

To download the Value Added Tax – Implementing Regulation for Saudi VAT Law from official VAT portal, click the link below:

Value-Added-Tax-Approved-Implementing-Regulations

To download the Value Added Tax – Implementing Regulation for Saudi VAT Law from our server, click the link below:

Value-Added-Tax-Approved-Implementing-Regulations

We pay VAT when we make purchases and collect VAT when we sell. VAT paid on purchase is our Input Tax and VAT collected on sale is our Output Tax.

According to the VAT Law, a taxpayer is eligible to claim input on purchases of the goods or services used for taxable supply. It is also called recoverable input tax.

A taxpayer has to pay VAT at the time of import of goods also. This VAT is paid under Reverse Charge Mechanism. It is also called Reverse Charge.

Considering the above points, we have created Saudi VAT Payable Calculator template with predefined formulas.

Just enter the details of sales, purchase, sales return, purchase return, imports, and exports and it will automatically calculate VAT payable to the Tax Authority.

Click here to download Saudi VAT Payable Calculator Excel Template

You can also download other VAT related templates like GCC VAT Invoice Template With Discount, Bilingual Saudi VAT Invoice, and Bilingual UAE VAT Invoice etc.

Contents of Saudi VAT Payable Calculator

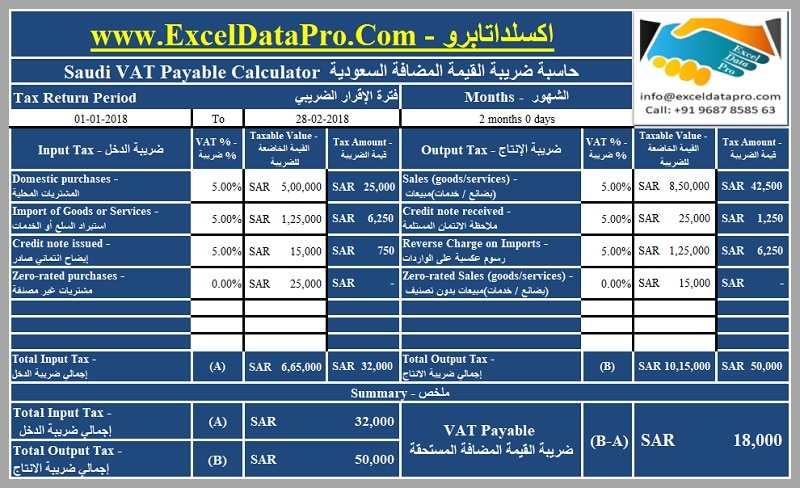

Saudi VAT Payable Calculator consists of 4 sections:

- Header

- Input VAT Section

- Output VAT Section

- Summary Section

1. Header

Usually, the header section consists of the supplier like company name, the company logo and heading of the sheet “Saudi VAT Payable Calculator”.

In addition to the above, you have to enter the Tax period for which you want to calculate the VAT liability. When you enter the tax period dates it will automatically calculate the month for you.

DATEDIF Function is used to calculate the difference between two dates.

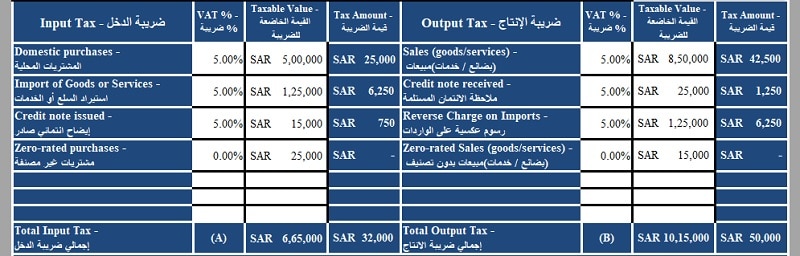

2. Input VAT Section

Input VAT section consists of following 4 columns.

First is Input VAT, second is VAT %, third is Taxable Value and fourth is VAT amount.

Under the Input VAT are following subheadings:

Domestic Purchases – المشتريات المحلية

Import of Goods or Services – استيراد السلع أو الخدمات

Credit Notes Issued – إيضاح ائتماني صادر

Zero-rated Purchases – مشتريات غير مصنفة

You just need to enter the respective amounts of the above-mentioned items in respective cells.

In VAT % column, enter the vat percentage applicable. VAT is 5 % in general. But you need to enter 0% if the purchases are zero-rated.

Taxable value is the total of each head from the books of accounts. VAT amount is calculated using the following formula:

VAT Amount = Taxable Value X VAT %

At the end, the total of input VAT is given. This cell is configured using the SUM function.

3. Output VAT Calculation Section

Similar to the input VAT section, the Output VAT section also has the same four columns.

Here in Output VAT section, there are following subheadings:

Sales (goods/services) – (مبيعات (بضائع / خدمات

Credit note received – ملاحظة الائتمان المستلمة

Reverse Charge on Imports – رسوم عكسية على الواردات

Zero-rated Sales (goods/services) – مبيعات بدون تصنيف (بضائع / خدمات)

Enter the respective amounts in the cells and it will automatically sum up for you. Subtotal of both Input VAT Section and Output VAT Section is given at the end.

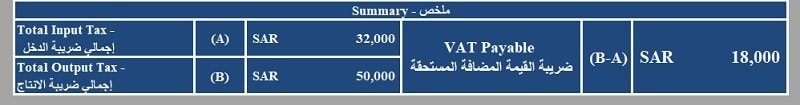

4. Summary Section

The summary section consists of final calculation of VAT that is Output Tax less of Input Tax as per Article 45 mentioned above.

VAT Payable (B-A) = Total of Output VAT (B) – Total OF Input VAT (A)

In case the amount of VAT payable is negative then it means that you have balance with the tax authority and this balance can be carried forward to next tax period.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.