25th GST Council meeting was held on 18th January in New Delhi. Various measures were announced to improve ease of doing business. GST Council revised GST rates for Goods and Services.

To download the list in pdf format click on the link below:

Revised GST Rates of Goods – 25th Council Meeting

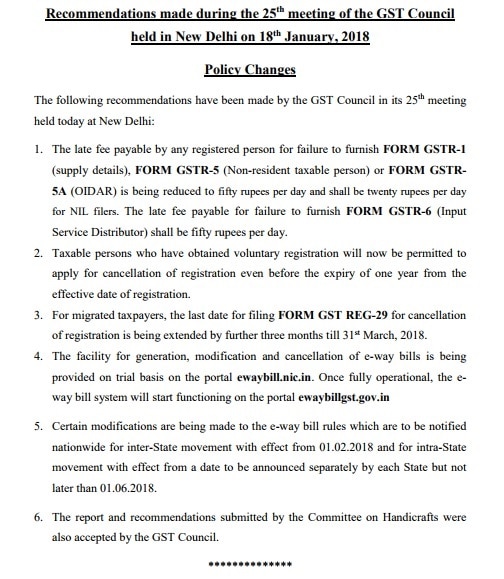

In addition to the above, following decisions were also taken:

- GSTR 3B will continue to be filed. A final decision will be taken in the next Council meet.

- E-way bill system to be rolled out from February 1. 15 states are on board for obtaining intra-state bill.

- Cess on vehicles for ambulance reduced to 0%.

- Penalty Reduced for Late Filing GST Return from Rs. 200 to Rs.50 and Rs.20 for NIL Return.

- Migrants who obtained GST registration mandatorily due to migration from VAT or Service Tax or Central Excise can cancel their GST registration before 31st March 2018.

Press Release

List of revised GST Rates for Goods for which the GST rates were changed.

List of Goods for which GST rate was reduced from 28% to 18%

- Old and used motor vehicles on the margin of the supplier, subject to the condition that no input tax credit of central excise duty/value-added tax or GST paid on such vehicles has been availed by him.

- Buses, for use in public transport, which exclusively run on biofuels.

List of Goods for which GST rate was reduced from 28% to 12%

- All types of old and used motors vehicles [other than medium and large cars and SUVs] on the margin of the supplier of subject to the conditions that no input tax credit of central excise duty/value-added tax or GST paid on such vehicles has been availed by him.

List of Goods for which GST rate was reduced from 18% to 12%

- Sugar boiled confectionary.

- Drinking water packed in 20 litters bottles.

- Fertilizer grade Phosphoric acid.

- Bio-diesel.

- BiopesticidesBacillus thuringiensis var. israelensis, Bacillus thuringiensis var. kurstaki, Bacillus thuringiensis var. galleriae, Bacillus sphaericus, Trichoderma viride, Trichoderma harzianum, Pseudomonas fluoresens, Beauveriabassiana, NPV of Helicoverpaarmigera, NPV of Spodopteralitura, Neem based pesticides and Cymbopogon.

- Bamboo wood building joinery.

- Drip irrigation system including laterals, sprinklers.

- Mechanical Sprayer.

List of Goods for which GST rate was reduced from 18% to 5%

- Tamarind Kernel Powder.

- Mehendi paste in cones.

- LPG supplied for supply to household domestic consumers by private LPG distributors

- Scientific and technical instruments, apparatus, equipment, accessories, parts, components, spares, tools, mockups and modules, raw material and consumables required for launch vehicles and satellites and payloads.

List of Goods for which GST rate was reduced from 12% to 5%

- Articles of straw, of esparto or of other plaiting materials; basketware and wickerwork.

List of Goods for which GST rate was reduced from 12% to 5% without ITC

- Velvet fabric.

List of Goods for which GST rate was reduced from 3% to 0.25%

- Diamonds and precious stones.

Apart from the above-mentioned goods for which the rates were reduced GST rates on some goods were also increased.

List of Goods for which GST rate was increased from 12% to 18%

- Cigarette filter rods.

List of Goods for which GST rate was increased from Nil to 5%

- Rice bran (other than de-oiled rice bran).

You can download GST templates like GST TRAN-1, GST Input Output Tax Report, and GST Export Invoice from here.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply