PF stands for Provident Fund. Provident Fund means a government managed retirement benefits scheme available for all the salaried persons.

In countries like India, PF is a mandatory retirement savings scheme for salaried employees. It is similar to Social Security Program of United States.

EPFO(Employees Provident Fund Organization of India) manages the Provident fund in India

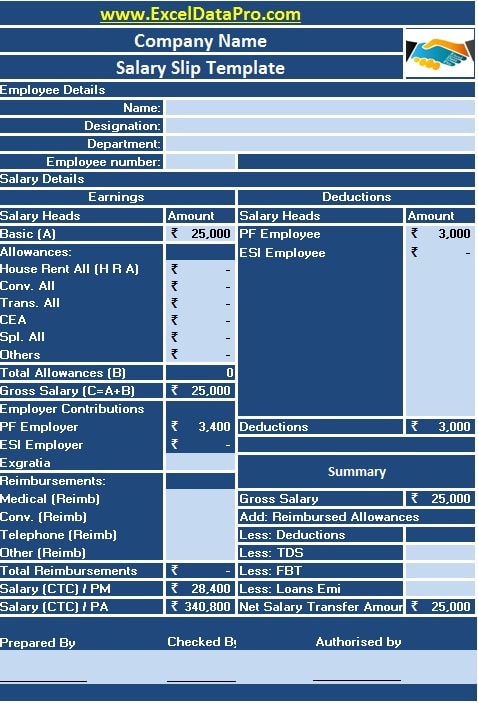

PF Calculations

12% of the employee’s basic salary is contributed every month from his/her salary along with 3.67% of basic salary is contributed by the employer to provident fund.

Usually, Salary Sheet and Salary slips consists of this term.

Additionally, you can download other accounting templates like Petty Cash Book, Simple Cash Book, and Accounts Payable Excel Templates from here.

If you have any queries please share in the comment section below. I will be more than happy to assist you.