During the GST registration process, many people face problems due to Mismatch of PAN details with CBDT data in GST Registration.

CBDT stands for Central Board of Direct Taxes.

The main reason for this to happen is that, while applying for PAN you might have given a different name to be displayed on the PAN Card.

For Example, I applied for PAN. My actual name in the form as per Aadhar Card is Sumeet Rahul Singh. In the PAN registration form, I preferred to keep my display name on the PAN card as Sumeet R. Singh.

While doing GST registration, if I enter my name as Sumeet R. Singh the GST portal will display an error message of mismatch of PAN details with CBDT data.

The solution to this error is very simple. Below we will discuss the step by step process in detail.

How To Solve Mismatch of PAN Details with CBDT Data In GST Registration

Follow the steps given below while you are opting for new GST registration and have the issue of mismatch of PAN details with CBDT Data.

- Go to Verify Your PAN website of Income Tax Department.

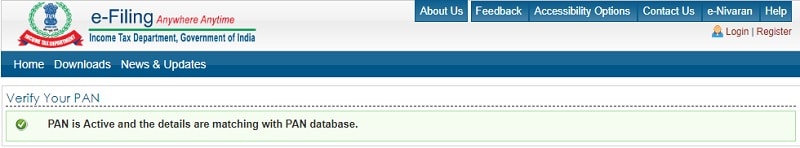

- Enter all the mandatory field like PAN, Full Name, Date of Birth, and Status. Enter Captcha Text and click on Submit.

- If your pan details match with the CBDT data it will display the following message.

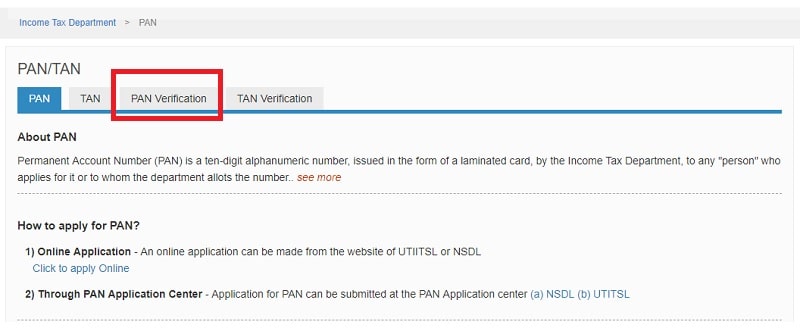

- If it doesn’t match you need to apply for a change through ITR website. Click on PAN.

- Click on PAN Verification tab.

- It will navigate you to ITR Website. You need to log in or register on this site for any verification or amendments.

- Once you have verified your details fill the exact details as shown your online GST registration form.

You can download GST templates like GST TRAN-1, GST Input Output Tax Report, and GST Export Invoice from here.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.