Labor Cost Percentage – Definition

Labor Cost Percentage is the percentage value of money spent on labor costs against the total revenue of the company during a specific period. It is the amount the company spends on salary and benefits.

In simple terms, this metric provides an overview of the amount of investment a company makes in its employees to generate each dollar of revenue. Employee Labor Percentage shows how well a company’s pay vs performance system works.

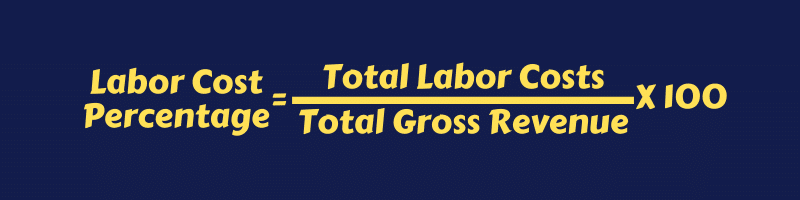

Formula To Calculate Labor Cost Percentage

To calculate Employee Labor Percentage you need to divide the total labor cost during a particular period by gross sales/revenue during the same period and multiply the result by 100.

Let us understand it with a simple example.

Example

Company: ABC Ltd

Labor Costs (1 Year): $ 1,80,000

Revenue (1 Year): $ 5,30,000

Applying the above formula:

= $ 1,80,000 / $ 5,30,000 X 100

= 33.96%

Applicability of Labor Cost Percentage

The cost of labor in small businesses is hard to control. Typically, these percentages range between 20 to 35 percent of gross sales. Percentages vary from industry to industry.

For example, labor cost/employee percentage is above 50% or more in service businesses. Whereas in manufacturing businesses, they maintain under 35%.

For a profitable business, revenue must grow faster than expenses. Labor Costs are part of operational expenses. Thus, evaluating and decreasing this metric provides helps the company to improve profitability.

An increase in this metric proves that the employees of a company are less efficient. This eventually decreases Employee Productivity.

Strategic steps like further training, automation or better technological support can help reduce it.

However, effective labor cost-cutting is very important. Reducing salaries/benefits too much can create problems. It also induces the financial burden on the company to recruit and retain productive employees.

You need to identify areas that reduce cost without hindering employee incentives and productivity.

Monitoring Labor Cost Revenue Percent along with Labour Cost per FTE helps you determine whether labor cost or reduced revenues is the actual factor affecting it.

You can also monitor this metric with Human Capital Return on Investment and Profit per FTE that will help you determine whether only the labor cost impacts the overall profitability or not.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply