GST is considered to be one of the biggest tax reforms. In this article, we will learn about different types of GST Returns that are to be filed by taxpayers under the GST Regime.

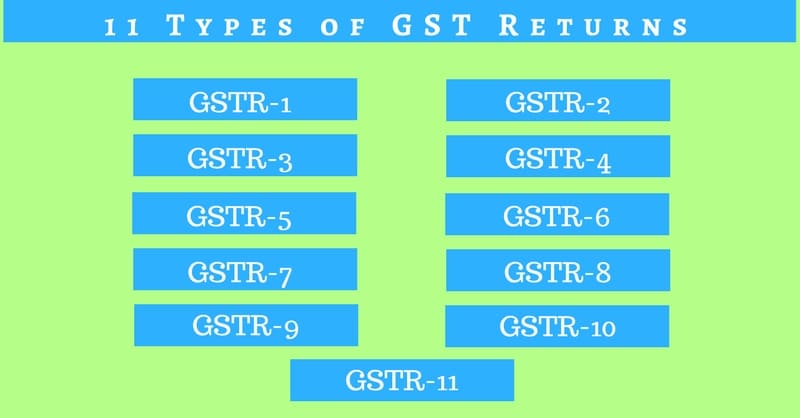

The document required to be filed by a taxpayer as per the GST law is called GST Return. In total there are 11 types of different GST Returns which are as follows:

Let us discuss each return along with its due date. Below mentioned is the complete details of all these returns which are required to be filed under the GST Law.

Note: GSTR stands for Goods and Services Tax Return.

Types of GST Returns

GSTR-1: GSTR-1 consists of the details of outward supplies of taxable goods and/or services made during the month.

In other words, it consists of the details of invoices issued in compliance with GST Invoice format.

Additionally, you can download other accounting templates like Petty Cash Book, Simple Cash Book, and Accounts Payable Excel Templates from here.

All the registered suppliers will file this return. The due date is 10th of the preceding month.

GSTR-1 is filed by every taxpayer registered under the normal scheme. If every supplier files this return with due diligence then there will be very low chances of mistakes or reconciliations.

GSTR-2: GSTR-2 is auto populated with the details of inward supplies of taxable goods and/or services made by you during the month which will be uploaded by your supplier.

You don’t need to file this return. Just check and approve the invoices and claim the Input Tax Credit if applicable.

This return is filed by all registered taxable recipients before 15th of the preceding month.

GSTR-3: GSTR-3 is the monthly return to be filed on the basis of details of outward supplies and inward supplies already filed GSTR-1 and GSTR-2.

All registered taxable persons are liable to file before 20th of the preceding month.

GSTR-4: GSTR-4 is the quarterly return for compounding taxpayers. Businesses registered under the Composition Scheme have to file this return before the 18th of the month of succeeding quarter.

Businesses registered under Composition Scheme will only file this return, unlike the normal taxpayer who will submit GSTR-1, GSTR-2, and GSTR-3.

GSTR-5: GSTR-5 is the return for the Non-Residents foreign taxpayers. It will be filed by Non-Resident Taxable Person before 20th of the preceding month.

GSTR-6: GSTR-6 is the return for Input Service Distributor. The Input Service Distributor will have to file GSTR-6 by 13th of the preceding month.

GSTR-7: GSTR-7 is the return for authorities deducting tax at source. The Tax Deductors will file it by 10th of the preceding month.

GSTR-8: GSTR-8 consists of the details of supplies and respective tax collections made through e-commerce operator.

E-commerce Operator or Tax Collector will file this by 10th of the preceding month.

GSTR-9: GSTR-9 is the annual return. It is populated according to the respective return filed by the registered person.

It has to be filed before 31st December of preceding financial year.

GSTR-10: GSTR-10 is termed as Final Return because it is the final settlement paid by the registered person whose registration has been canceled or willingly surrendered.

It is to be filed within 3 months from the date of cancellation/date of cancellation order, whichever is later.

GSTR-11: GSTR-11 consists of the details of inward supplies made by such person that is having UIN. It is to be filed before 28th of the month following the month for which statement is filed.

Conclusion

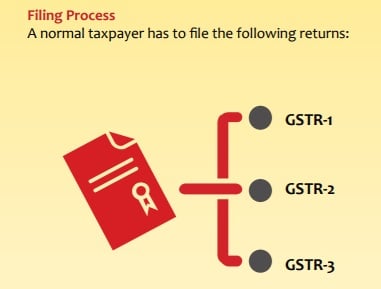

To make it simple, a taxpayer registered under the normal scheme will file only 1 GST return, that is GSTR-1. It consists of the details of outward supplies and check

In addition to that, such taxpayer will have to just check and approve the auto-populated GSTR-2 and GSTR-3 every month.

Image Source: www.cbec.gov.in

Similarly, taxpayers registered under the composition scheme, as an Input Service Distributor, a person liable to deduct or collect the tax (TDS/TCS) have separate returns.

The best part of the GST Returns is that all the returns are going to be filed online.

A common portal will be provided by GSTN, a private company in coordination with the central and state governments.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply