Input Tax Credit or ITC means the credit of GST tax (IGST/CGST/SGST) charged on the supply of any goods and or services that are used or intended to be used in furtherance of the sale of goods and services and includes the tax payable under reverse charge.

In simple terms, Input Tax Credit means getting the credit of the tax paid by you to your supplier on the purchase of goods or services which are in turn a part of your end product.

All the GST registered person shall be eligible to avail ITC credited to the e-credit ledger subject to compliance with the rules of claiming the ITC.

ITC will reduce tax already paid by you on the inputs at the time of paying tax on output.

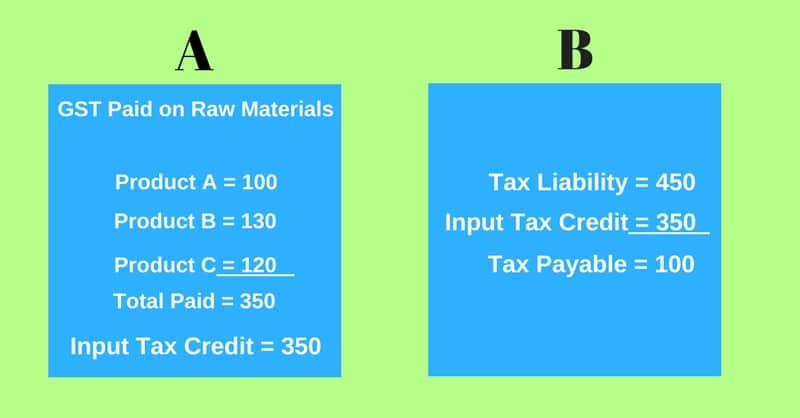

Let us understand it with an example.

Example for Input Tax Credit

You are a manufacturer and manufacture Product D in which you require 3 different raw materials. You purchase those raw materials and pay the Goods and Services Tax on all 3 products.

Now, you will only pay GST tax after deducting those earlier paid taxes to your suppliers of raw materials. Thus, your tax liability decreases with ITC.

Please note that the input tax credit will be available only if your supplier has already filed GST returns. Those returns should also contain the invoice number issued to you for the supply of raw materials.

Below image will help you understand it easily.

You can create invoices in compliance with GST Law 2017 with our GST Invoice Template.

You can also download GST Bill format or Bill of Supply for non-taxable goods and services.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply