There are mainly 8 types of GST invoices and vouchers prescribed for different types of transactions. They are as follows:

- Tax Invoice.

- Bill of Supply.

- Receipt Voucher.

- Refund Voucher.

- Payment Voucher.

- Debit Note and Credit Note.

- ISD Invoice.

- Delivery Challan.

Let us discuss the purpose of each in detail.

GST Invoices and Vouchers

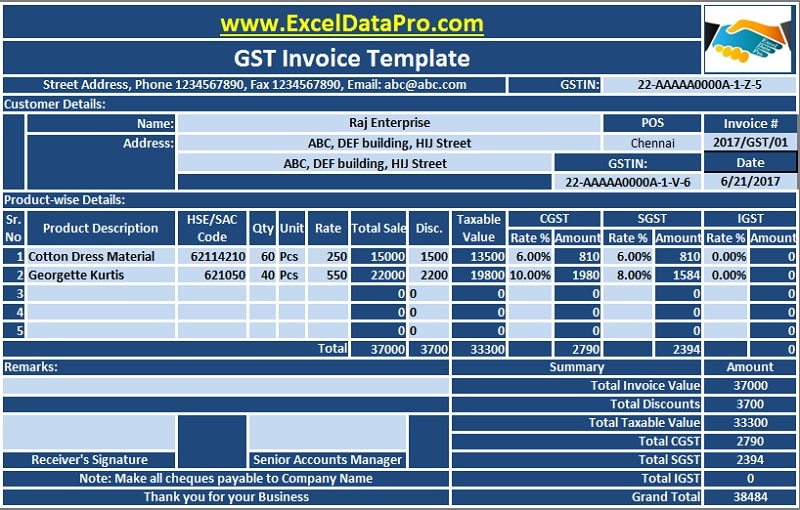

1.Tax Invoice

It is mandatory for every person registered under the GST to issue a tax invoice for all supplies effected.

A tax invoice is an invoice issued for the supply of taxable goods or services made to B2B and B2C clients. It is also issued while making inter-state stock transfers.

You can download a ready to use GST compliance Tax Invoice template from the link below:

Just enter few details and the template will compute all the rest items for you.

This template helps you to efficiently and easily issue the invoices to your clients with CGST, SGST, and IGST Computations.

It is useful for Accounts Assistant, Accountants, Audit Assistants etc.

Additionally, you can download other accounting templates like Petty Cash Book, Simple Cash Book, and Accounts Payable Excel Templates from here.

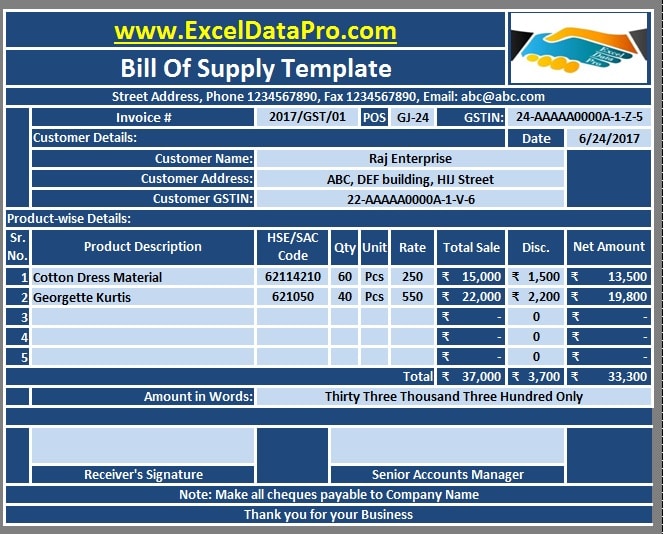

2. Bill of Supply

A bill of supply is required to be issued at the time of making supplies of goods and services that are exempt from the tax or by composition dealer.

You can download a ready to use GST compliance GST Bill format excel template from the link below:

GST Bill Format In Excel For Non-Taxable Goods And Services.

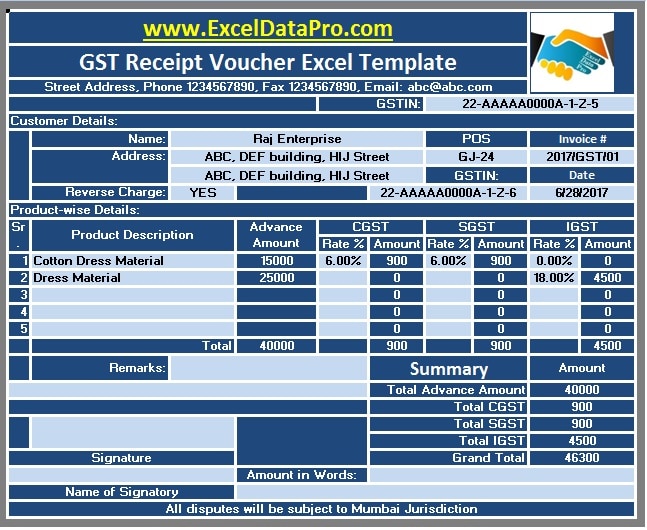

3. Receipt Voucher

A receipt voucher is required to be issued on the receipt of advance payment in respect of the supply of good or services or both.

You can download a ready to use GST compliance GST Receipt Voucher excel template from the link below:

GST Receipt Voucher Excel Template For Advance Payments Under the GST rule.

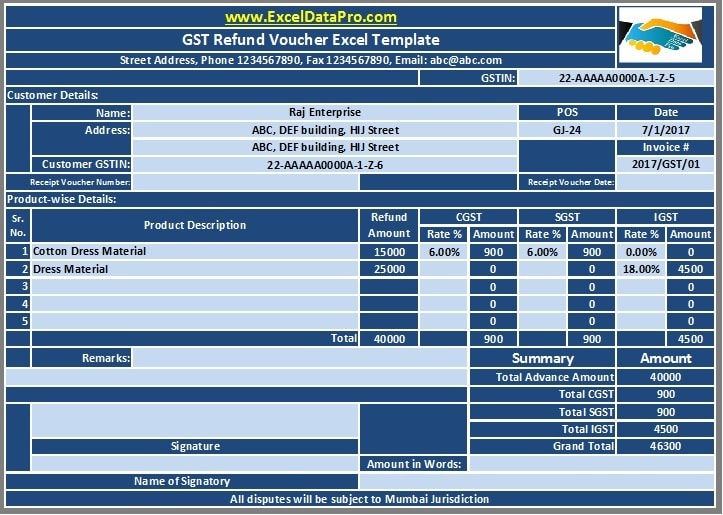

4. Refund Voucher

Refund voucher is issued when no subsequent supply has been made against the receipt voucher received as an advance.

You can download a ready to use GST compliance GST Refund Voucher excel template from the link below:

GST Refund Voucher Excel Template For Refunding Advance Under the GST.

5. Payment Voucher

A recipient liable to pay under Reverse Charge is required to issue a payment voucher at the time of making payment tot the supplier.

6. Debit and Credit Notes

The debit note is issued where an earlier issued tax invoice for the goods or services or both is found to be less than the taxable value.

The credit note is issued where an earlier issued tax invoice for the goods or services or both is found to exceed the taxable value.

A credit note is also issued when the supply of goods or services is deficient the goods are returned back to the supplier.

7. ISD Invoice

An ISD invoice is issued to distribute the input tax credit amongst the branches formed under the same PAN.

8. Delivery Challan

A delivery challan is issued in the case of transporting the goods prior to preparing of tax invoice. It is also issued for stock transfer within the state etc.

The format of all the above-mentioned items according to the provided guidelines will be uploaded in due course.

If you have any queries please share in the comment section below. I will be more than happy to assist you.