Definition – Federal Income Tax Brackets

Federal Income Tax Brackets are the range of income according to which the percentage of the tax rate is decided and paid to the government by the taxpayer on his taxable income.

The taxpayer doesn’t pay taxes on his total income but pays on his taxable income which is less of exemptions and allowable deductions.

These brackets are decided by IRS every year adjusting the inflation and other factors.

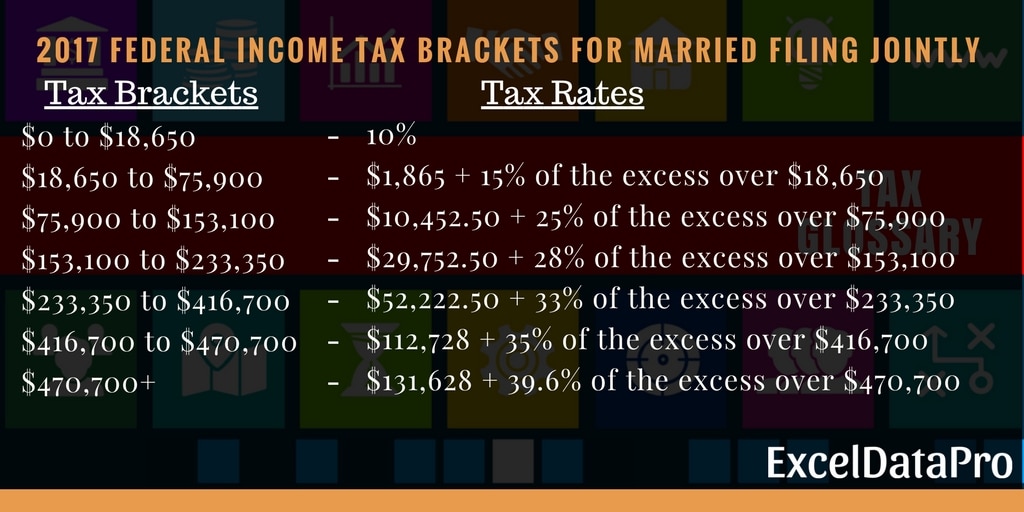

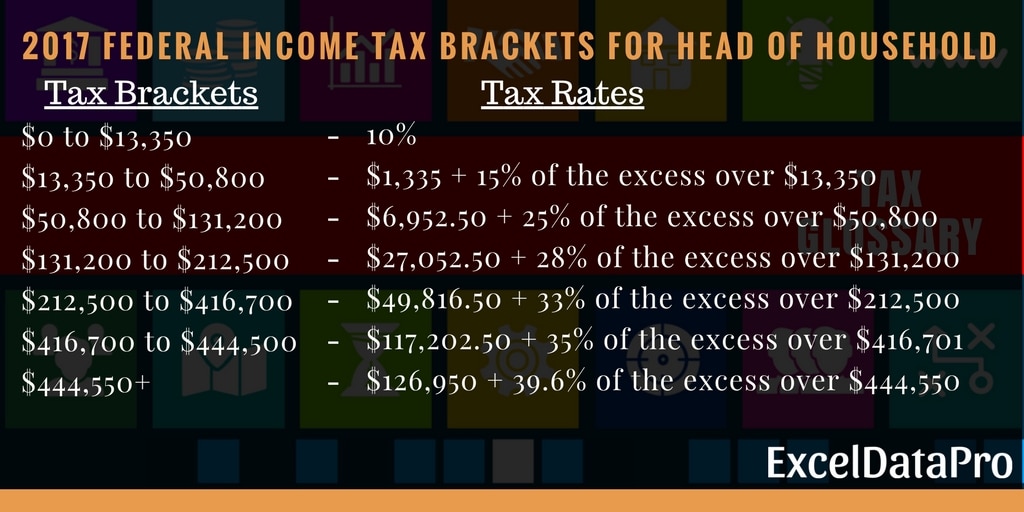

These brackets differ according to the taxpayer’s filing status. federal income tax brackets are different for an individual, for married filing jointly, for married filing separately and the head of household.

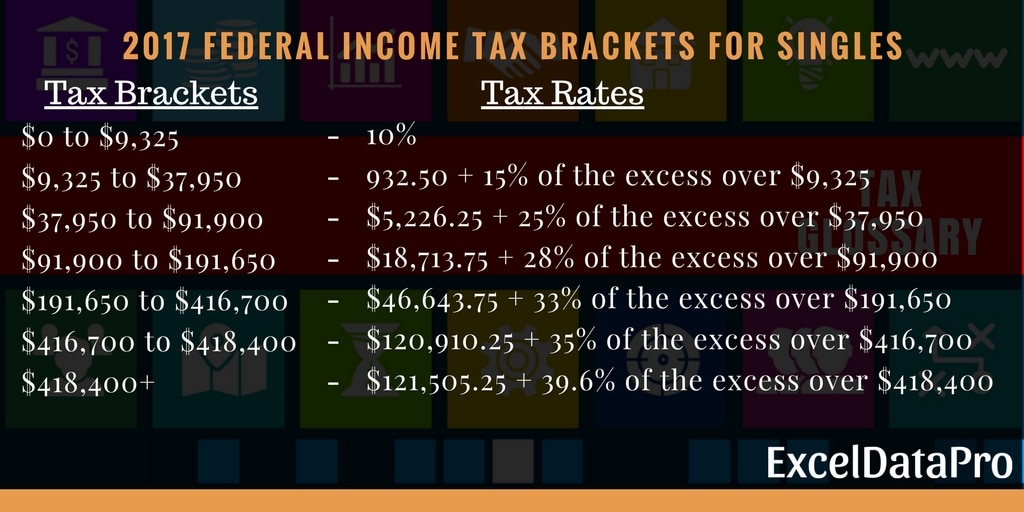

There are total 7 tax rates; 10%, 15%, 25%, 28%, 33%, 35% and 39.6% for every taxpayer. The income range or brackets differ according to their filing status.

Let us discuss them in detail.

Federal Income Tax Brackets for 2017

There are 4 types of filing status:

- Single Filers / an individual filer.

- Married Filing Jointly

- Married Filing Separately

- Head of Household

2017 Federal Income Tax Brackets for Single/Individuals

2017 Federal Income Tax Brackets for Married Filing Jointly

2017 Federal Income Tax Brackets for Head of Household

Source: www.irs.gov

How to calculate Federal Income Tax?

Usually, people make mistake in calculating the tax amount. When we say 15%, people tend to calculate 15% of the total taxable income.

For example, your taxable income is $ 25,000. You fall under the bracket of 15% tax rate. Your income is between $ 9,325 to $ 37,950.

Wrong Calculation Method

= 15% of $ 25,000 = $ 3,750.

Right Calculation Method

For the first $ 9,325 you will pay the 10% amount and 15% of the amount of income that above $ 9,325.

= $ 932 + 15% of ($ 25,000 – $ 9,325)

= $ 932 + 15% ($ 15,675) = $932 + $ 2,351 = $ 3, 283.

There is a difference of about $ 467. The difference will increase more in higher tax rates.

You can download excel templates like Simple Tax Estimator, Itemized Deductions Calculator, and Income Statement Projection for easy tax calculations.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply