It is mandatory to display GSTIN on name board for all registered taxpayers according to Point No.18 of Notification No. 3 /2017 – Central Tax dated 19th June 2017.

Ruling to Display GSTIN On Name Board For Dealers Registered Under Regular Scheme

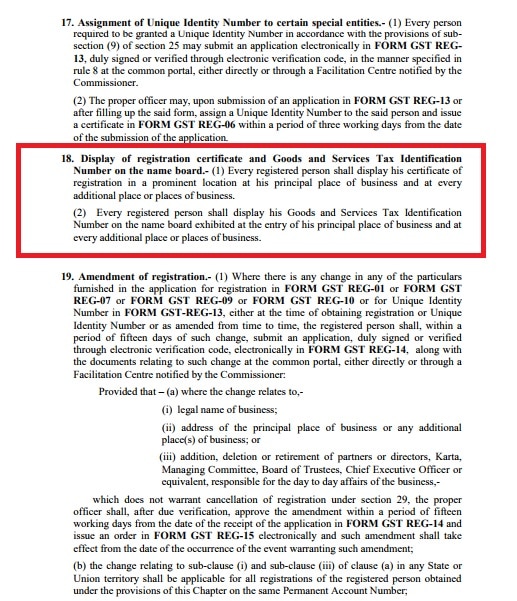

Point No.18 clearly states that:

- Every registered person shall display his certificate of registration in a prominent location at his principal place of business and at every additional place or places of business.

- Every registered person shall display his Goods and Services Tax Identification Number on the name board exhibited at the entry of his principal place of business and at every additional place or places of business.

You can download the copy of abovementioned notification from the link below:

Notification No. 3 /2017 – Central Tax

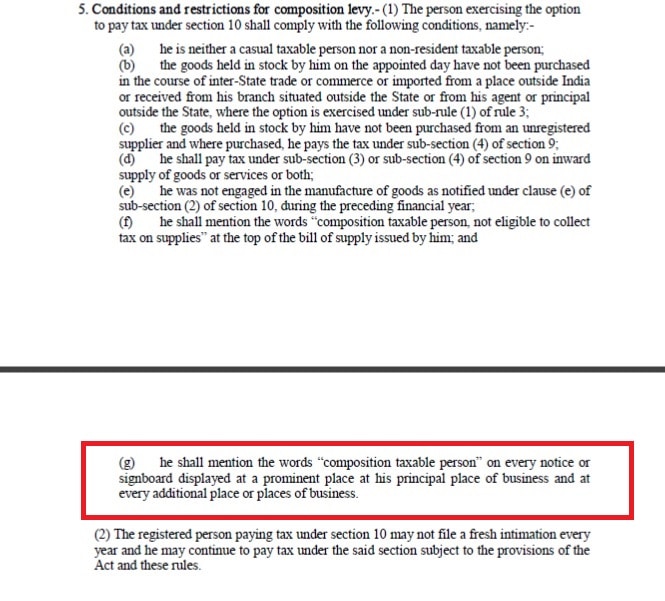

Ruling to Display GSTIN On Name Board For Dealers registered under Composition Scheme

In addition to the above, it is also mandatory for Composition dealers to display ” Composition taxable person” along with the GSTIN Number.

As per the GST Law, composition dealer is not eligible to collect tax from their customers.

They are entitled to pay a nominal amount of tax on his aggregate turnover. This tax depends on nature of his/her business. The tax percentage ranges from 1% to 5%.

Subpoint (g), Point No.5 of Notification No.3/2017 – Central Tax has clearly mentioned under Conditions and restrictions for Composition levy:

” He shall mention the words “composition taxable person” on every notice or signboard displayed at a prominent place at his principal place of business and at every additional place or places of business.”

Thus, it is now mandatory for both regular taxable person as well as composition dealer to Display GSTIN on Name Board.

To safeguard the interest of customers this provision has been given. We as customers will be able to know whether the person from whom we are buying is entitled to collect tax from us or not.

You can download GST templates like GST TRAN-1, GST Input Output Tax Report, and GST Export Invoice from here.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply