Conveyance allowance is a fixed allowance granted by an employer to his employees towards the cost of travel from home to work and vice-versa.

In other words, Conveyance Allowance is a type of allowance offered to employees in order to compensate their travel to and from the residence to respective work location.

It is paid to the employee only if the there is no transportation provided by the employer.

This allowance forms a part of your CTC, Net Pay, and Gross Salary. The employee gets this allowance as a part of his salary.

Tax Exemption of Conveyance Allowance

Under Section 10(14)(ii) of Income Tax Act and Rule 2BB of Income Tax Rules, Rs.9,600 per annum is exempt from tax.

It was revised in FY 2015-16 and limit was increased to Rs.19,200 per annum or Rs.1600 per month.

The employee does not need to furnish any documents or proof of receiving conveyance allowance from the employer.

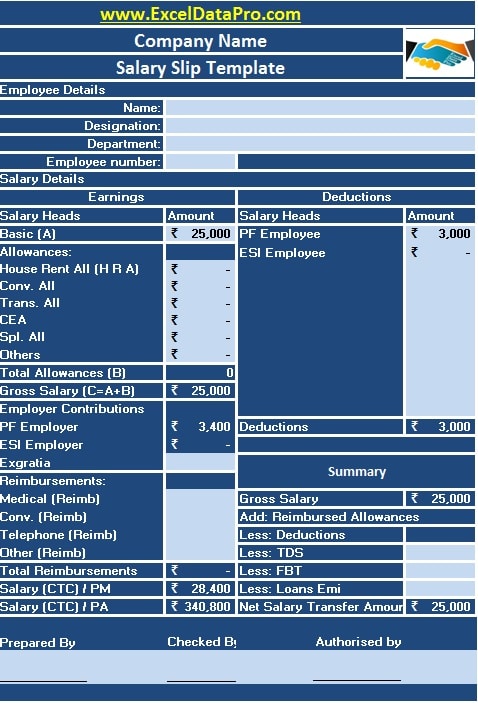

As an employee, you find this term in your Salary Slip.

You can download other accounting templates like Petty Cash Book, Simple Cash Book, and Accounts Payable Excel Templates from here.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply