There are different types of GST Returns that are to be filed by taxpayers under the GST Regime. The document required to be filed by a taxpayer as per the GST law is called GST Return. In total there are 11 types of different GST Returns.

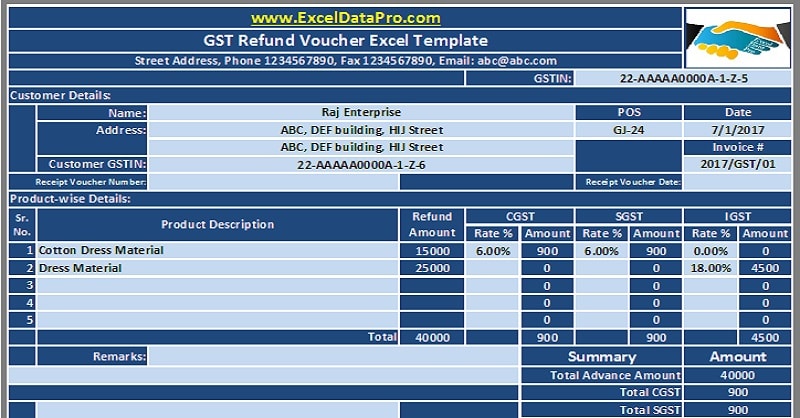

Download GST Refund Voucher Excel Template For Refunding Advance Under GST

The long awaited GST Bill has been implemented from today. A business will be liable to claim the refund of Goods and Service Tax before the expiry of two years from the relevant date in the prescribed format of GST Refund Voucher under the guidelines of the GST Council. Businessmen are eagerly searching for formats […]

What is Composition Scheme Under GST 2017?

Under the Composition Scheme, a registered taxpayer, whose aggregate turnover has not exceeded Rs. 75 Lakh in the preceding financial year will pay the tax quarterly at a rate more than 1%, 2.5% and 0.5% for the manufacturer, restaurant sector, and other suppliers respectively.

What is Reverse Charge Under GST?

Reverse Charge means the liability to pay tax by the recipient of good or services or both instead of the supplier under sub-section (3)/(4) of Section 9 of CGST Act or under sub-section (3)/(4) of Section 5 of IGST Act.

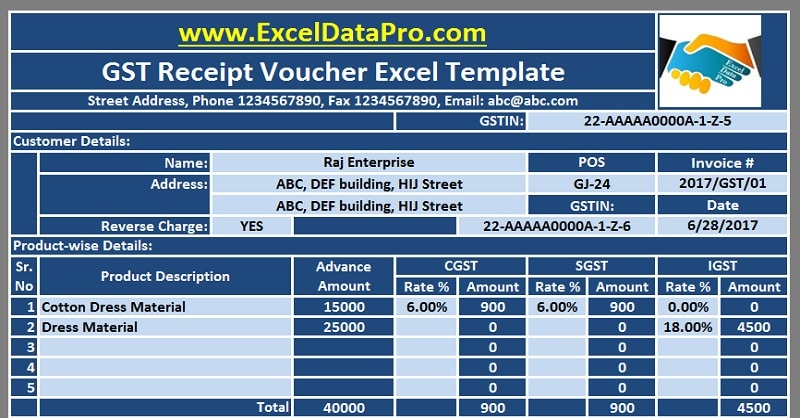

Download GST Receipt Voucher Excel Template For Advance Payments Under GST

Just a few days to go for the GST to be implemented. After the successful publishing of our GST Invoice Template and Bill of Supply, today we will publish the GST Receipt Voucher Excel Template. Receipt Voucher is third among the 8 types of invoices and vouchers under the GST regime. The government has defined […]