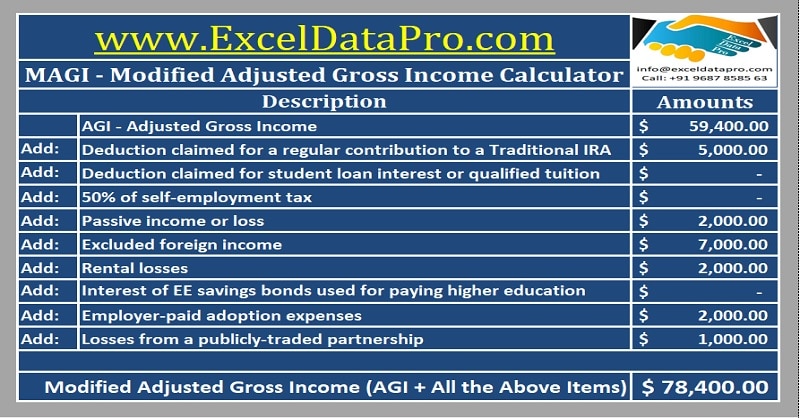

Modified Adjusted Gross Income Calculator is an excel sheet which helps you calculate your MAGI very easily and accurately. MAGI is calculated by adding back several deductions to your AGI – Adjusted Gross Income. Usually, MAGI is useful for determining the eligibility of Roth IRA Contributions as well as other IRA deductions. Several tax credits […]

What Are Allowable Deductions?

Deductions or expenditures allowed by IRS to be subtracted from gross income to reduce the taxable income for income tax are called allowable deduction.

Step By Step Guide To UAE VAT Registration Process

VAT is all set to be implemented across UAE from 1st January 2018. In this article, we will discuss the UAE VAT Registration Process in detail. FTA has urged businesses to register for VAT before Dec 4, to avoid last-minute hassles. Source: www.thenational.ae You can download the pdf copy of Federal Decree-Law No. (8) of 2017 on Value Added […]

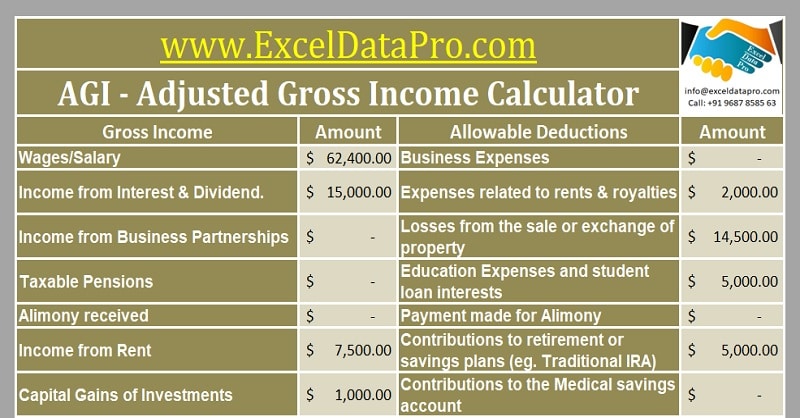

Download Adjusted Gross Income Calculator Excel Template

AGI or Adjusted Gross Income Calculator helps you calculate define your tax bracket as well as your tax liability. AGI is is the basis of several tax thresholds. It also helps to determine the eligibility for certain tax credits. AGI is your total income less of allowable deductions. We have created an easy and ready to use Adjusted […]

What is AGI – Adjusted Gross Income?

Adjusted Gross Income is an individual’s total gross income after the deduction of allowable expenses.