Saudi VAT Payable Calculator is used to easily calculate VAT payable liability by entering details of purchase and sales. According to Article 45 related to Calculating Tax mentioned in Value Added Tax – Implementing Regulations of Saudi VAT Law: ” The Net Tax payable by a Taxable Person in respect of a Tax Period is calculated […]

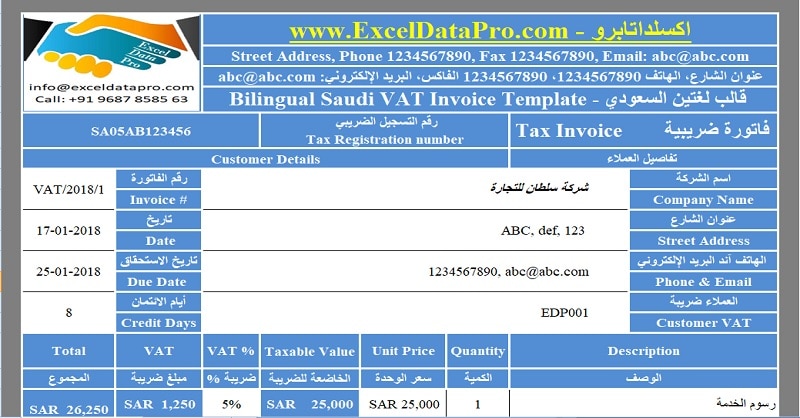

Download Bilingual Saudi VAT Invoice Excel Template

It is mandatory by Saudi VAT Law that the Tax invoices issued by business entities in Saudi should issue Bilingual Saudi VAt Invoice. Bilingual means two languages. According to Article 53, Clause No.5 of Implementing Regulations under the Saudi VAT Law: “A Tax Invoice must include the details in Arabic, in addition to any other language also […]

How to link your VAT Number Or TRN With Dubai Customs?

It is mandatory for businesses to link their VAT number or TRN with Dubai Customs that are indulged in import and export goods. (TRN stands for Tax Registration Number). VAT has been implemented in UAE since 1st Jan. In this article, we will discuss the documentation required and steps to link your VAT number or TRN with […]

Medications and Medical Equipment Subject To Tax At Zero Rate – UAE VAT

FTA has published Cabinet Decision No. 56 on Medications and Medical Equipment Subject To Tax At Zero Rate. This decision describes that under what conditions Medications and Medical Equipment will be subject to tax at zero rates. To download the pdf copy of the decision on Medications and Medical Equipments from the FTA server click below: […]

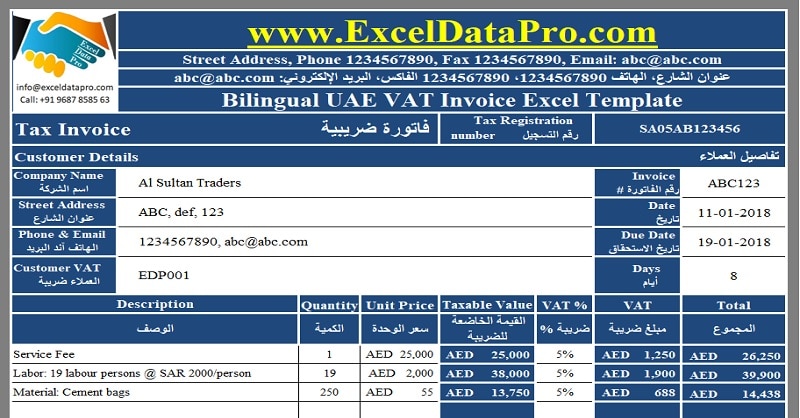

Download Bilingual UAE VAT Invoice Excel Template

Bilingual UAE VAT Invoice is an excel template with predefined formulas. It consists of every detail in the English and Arabic language.