Alternative Minimum Tax or AMT is a provision in Internal Revenue Code (IRC) which imposes a supplemental income tax. This tax is apart from standard income tax for those earning high-income and paying low taxes by taking exemptions and deductions.

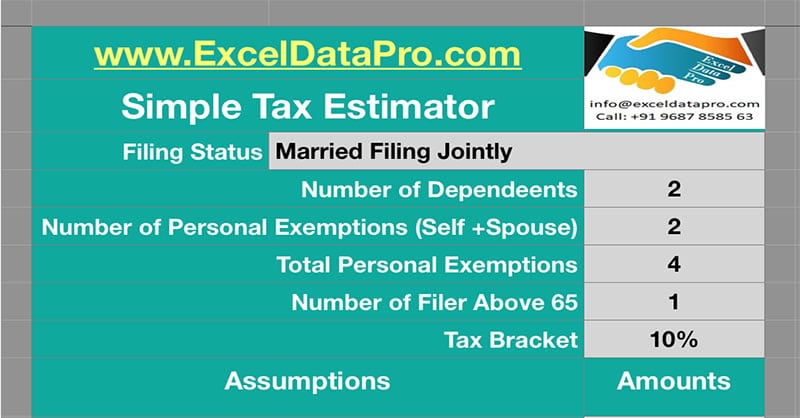

Download Simple Tax Estimator Apple Numbers Template

Simple Tax Estimator Numbers Template is a template created in Numbers for Mac users. We have already made the Simple Tax Estimator in excel for windows users. Simple Tax Estimator Numbers Template helps you to estimate your tax liability to be paid to IRS. The user just needs to enter the adjustments, tax credits, and […]

What Is MACRS? Definition, Asset Life & Percentage

MACRS is the abbreviation of Modified Accelerated Cost Recovery System. Modified Accelerated Cost Recovery System is a tax depreciation system in the United States. Modified Accelerated Cost Recovery System allows accelerated depreciation over longer time periods for the qualifying assets. MACRS was introduced in 1986.

What Is Bonus Depreciation? Definition, Eligibility & Limits

Bonus depreciation is a provision that allows taxpayers to deduct a specified percentage of depreciation on the qualifying property in the year it is placed in service. This depreciation can be 30%, 50%, or 100% according to the life and eligibility of the equipment.

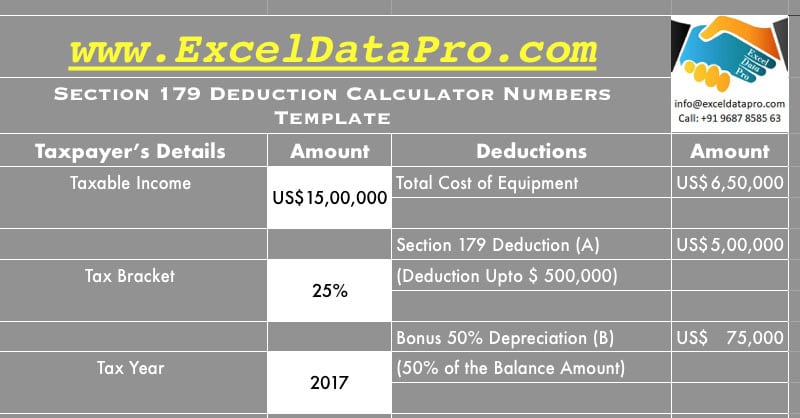

Download Section 179 Deduction Calculator Apple Numbers Template

50% of our readers demanded the Section 179 Deduction Calculator in Numbers as most of them are Mac user. Thus, we decided to make our first-ever template in Numbers. It was really enjoyable to work with Numbers. Section 179 Deduction Calculator in Numbers is a template which calculates the money amount saved by you while opting for […]