Definition – Alternative Minimum Tax (AMT)

Alternative Minimum Tax or AMT is a provision in Internal Revenue Code (IRC) which imposes a supplemental income tax. This tax is apart from standard income tax for those earning high-income and paying low taxes by taking exemptions and deductions.

Under AMT, the amount of taxable income is increased by adding tax-free items and disallowing of some deductions, eventually increasing your taxable income.

If AMT calculated is higher than the regular tax amount, the taxpayer has to pay additional tax on the difference amount according to the AMT tax rates specified by IRS.

The main purpose of Alternative Minimum Tax was to target high-income taxpayers who were claiming many credits and deductions, finally end up owing little or no income tax.

In simple terms, AMT was introduced to make a fair tax system which ensures that the wealthy pay their fair share of income tax no matter how many deductions they claim.

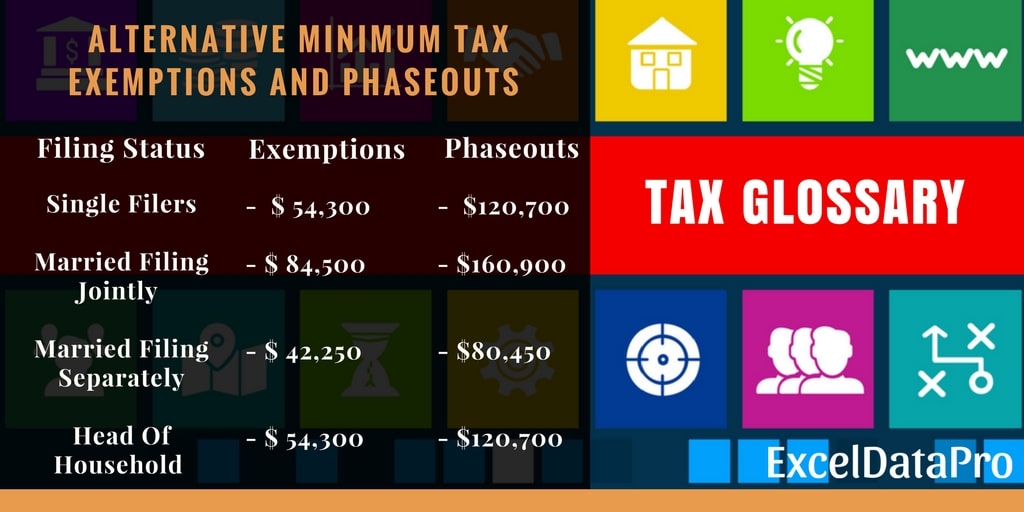

AMT Exemption and Phaseout Amounts For 2017

Similar to Standard Deductions, AMT exemption is a fixed amount exemption for calculating the alternative minimum tax.

The 2017 exemption amounts are:

Alternative Minimum Tax Rates

The first $ 186,300 of AMT your taxable income will be taxed at 26%. AMT taxable Income above $ 186,300 will be taxed at 28%.

How to Calculate Alternative Minimum Taxable Income (AMTI)?

There are 4 steps to calculating your AMTI, which are as below:

- Calculate your taxable income under the regular system. You can use our Simple Tax Estimator for that purpose.

- Add deductions and breaks you have taken under the regular system. This will determine your AMTI.

- Subtract the exemptions amount mentioned above according to your filing status.

- Applying the applicable AMT tax rate (given above), calculate your AMT liability.

Note: If the amount received under AMT calculation is higher than the regular system calculation, then the taxpayer has to pay the higher amount.

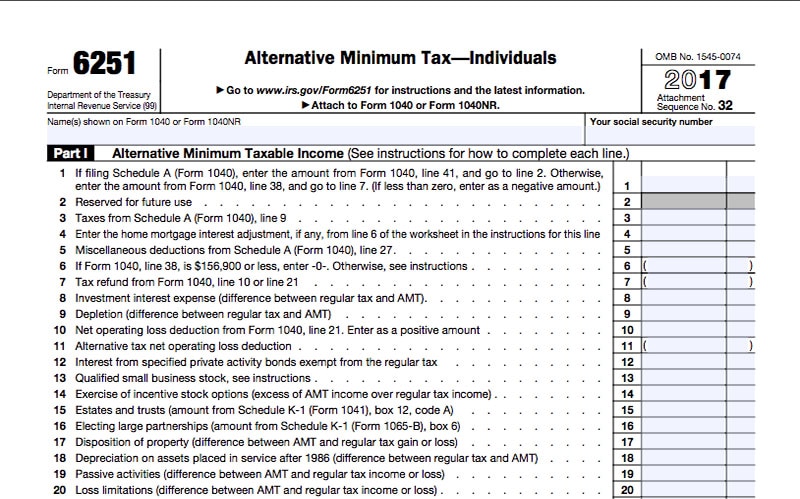

Another simple way to calculate your AMT is through Form 6251 on IRS website.

To know more about Alternative Minimum Tax click on the link below:

We have created some useful tax calculators like Itemized Deduction Calculator, 401k Calculator etc.

These templates which can help you easily calculate your federal income tax. These templates are free to download and easy to use with no limitations.

Disclaimer: Interpretation of the above topics is for education purpose and cannot be considered as a legal advice. It is highly recommendable to consult a CPA or tax consultant before going for Alternative Minimum Tax.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply