Contributions made to qualified charitable organizations in the form of cash, property or services can be claimed as deductions on your federal income tax return. Such deductions are called Charitable Donations Deductions. Contributions made to an individual are not deductible as charitable donations deductions.

What Are Tax Deductible Job Hunting Expenses?

Expenses related search of a new job in the same line as travel in search of the job, printing and mailing resumes etc are called Job Hunting Expenses. IRS allows taxpayers to deduct Job Hunting Expenses on their federal tax return who are looking for a new job in the same line of work.

What Is Standard Mileage Rate? Definition & Limits

Standard Mileage Rate is a preset per mile rate set by IRS that a taxpayer can claim as a deduction on his/her tax return for using his/her vehicle for business, charity, medical or moving purposes. For any of the four purposes, you can take standard mileage rate in lieu of actual expenses incurred when calculating deductible automobile expenses.

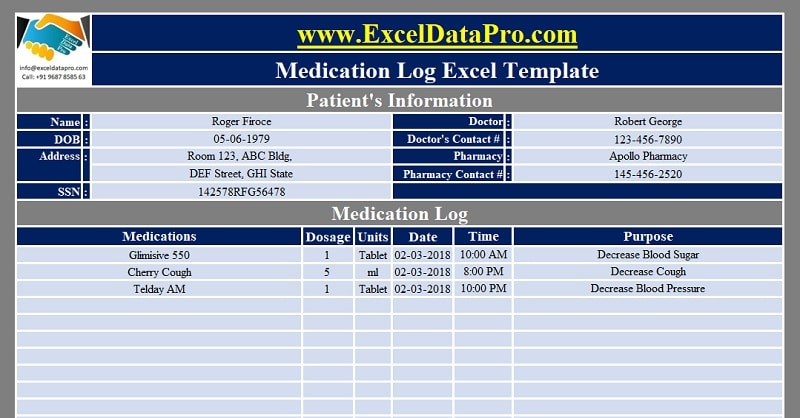

Download Medication Log Excel Template

Medication Log is a ready-to-use excel template to easily record daily medication with time, dosage, etc along with a weekly checklist of medications. This template can be useful to elderly patients who tend to forget the dosage or timings of their medications.

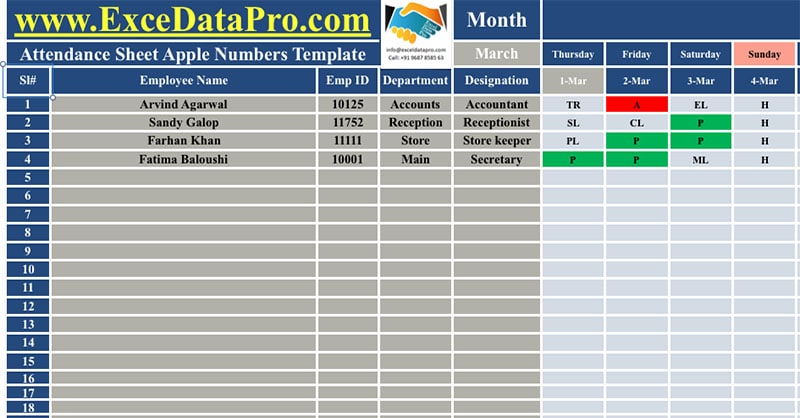

Download Attendance Sheet Apple Numbers Template

You can manage attendance of your employees now on a Mac operating system using our Attendance Sheet Apple Numbers Template for payroll and salary purpose. This template helps you to micro manages the attendance and also records monthly attendance with a summary of paid leaves, sick leaves maternity leaves etc all on one sheet. It a document […]