TDS stands for Tax Deducted at Source. It is income tax that a payer deducts from the payment of the payee. The payer deposits the tax that is collected to the IT Department. The income tax collected by the payer on behalf of the payee is known as Tax Collected at Source (TCS). Whereas the tax deducted from the payee by the payer is known as Tax Deducted At Source.

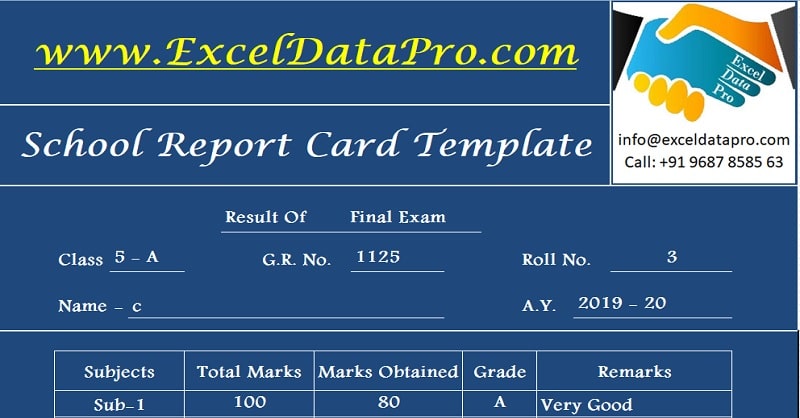

Download School Report Card And Mark Sheet Excel Template

Merely enter 9 basic details related to marks and attendance and student details. It prepares the mark sheet and report of the whole class in less than an hour. This sheet will automatically calculate the total, percentage, grades, rank, etc. Once you enter the required data you can directly print every student’s report card.

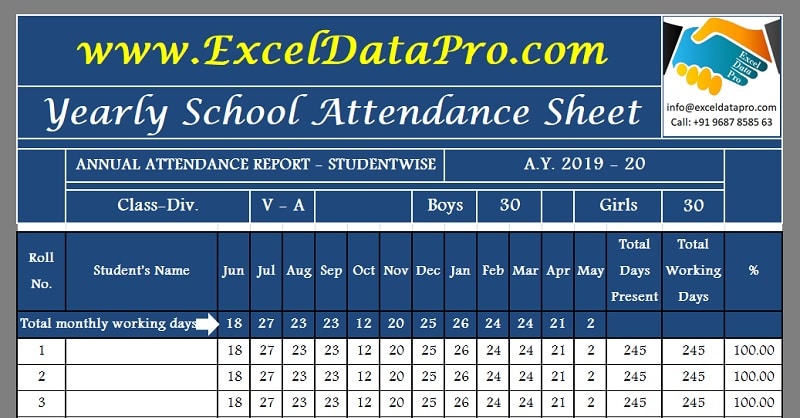

Download Yearly School Attendance Sheet Excel Template

Yearly School Attendance Sheet is an excel sheet which enables you to maintain record the attendance of a complete academic year of students present or absent of the class.

What Is Basic Salary? Definition, Formula & Income Tax

Basic salary is a fixed amount to be paid to an employee addition of any allowances or subtraction any deductions. Bonuses, overtime, dearness allowance, etc are not a part of basic salary. It is a part of your take-home salary.

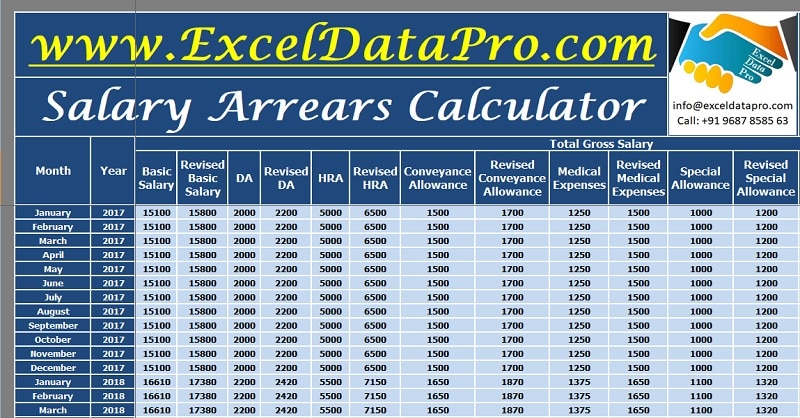

Download Salary Arrears Calculator Excel Template

Salary Arrears Calculator is a ready-to-use template in Excel, Google Sheet, and OpenOffice to calculate month wise salary arrears with salary break-up. Moreover, with the help of this template, you can calculate salary arrears up to 35 years for an employee. Just insert the desired amounts and the template will automatically calculate the arrears for you.