It is mandatory by Saudi VAT Law that the Tax invoices issued by business entities in Saudi should issue Bilingual Saudi VAt Invoice. Bilingual means two languages.

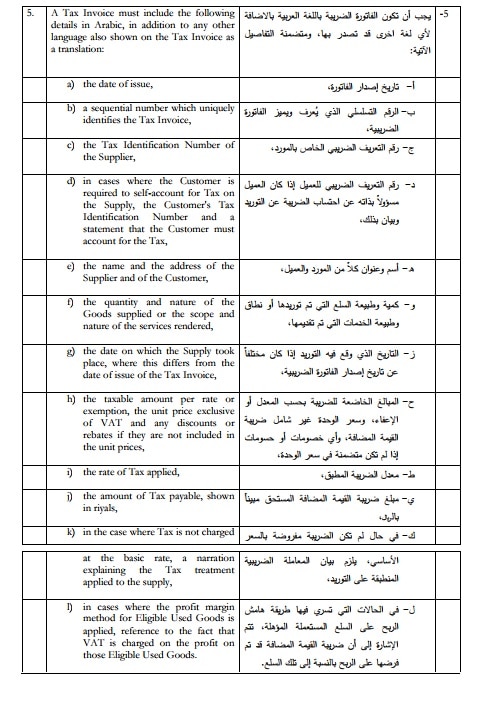

According to Article 53, Clause No.5 of Implementing Regulations under the Saudi VAT Law:

“A Tax Invoice must include the details in Arabic, in addition to any other language also shown on the Tax Invoice as a translation.”

Arabic is the national language of Saudi. Thus the bilingual Saudi VAT Invoice must contain Arabic along with any other preferred language.

Article 53 Clause No. 5 further describes the contents of Saudi VAT Invoice. See the image below for reference:

To download the Value Added Tax – Implementing Regulation for Saudi VAT Law from official VAT portal, click the link below:

Value-Added-Tax-Approved-Implementing-Regulations

To download the Value Added Tax – Implementing Regulation for Saudi VAT Law from our server, click the link below:

Value-Added-Tax-Approved-Implementing-Regulations

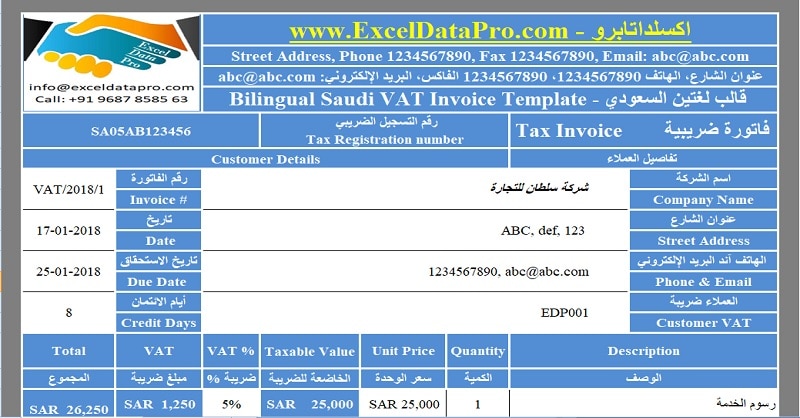

Keeping in mind the above guidelines, we have created an excel template for Bilingual Saudi VAT Invoice with predefined formulas.

The user just needs to add his details to the supplier’s details section and start using it.

Click here to download Bilingual Saudi VAT Invoice Excel Template.

You can also download other GCC VAT related templates like GCC VAT Invoice Template With Discount, GCC VAT Payable Calculator, and Bilingual UAE VAT Invoice etc.

Let us discuss the contents of the template in detail.

Contents of Bilingual Saudi VAT Invoice Template

Bilingual Saudi VAT Template consists of 2 worksheets which are as below:

- Bilingual Saudi VAT Invoice

- Customer Details Sheet.

All details in the given template are in Arabic and English language.

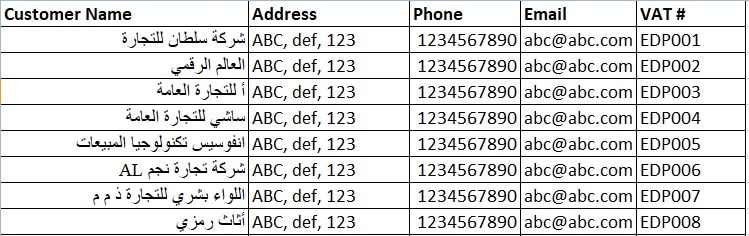

Customer Details sheet consists of details related to the customer like customer name, customer address, Custome VAT number, and contact details.

The purpose of this sheet is to minimise the manual entry in the invoice. As this sheet is linked to the invoice template using the Data Validation and Vlookup Function.

Just select the name of the customer from the dropdown list on the invoice in customer details section and it will automatically fetch the other relevant details.

Bilingual Saudi VAT Invoice consists of 5 sections:

- Supplier Details

- Customer Details

- Product Details

- Other Miscellaneous Details

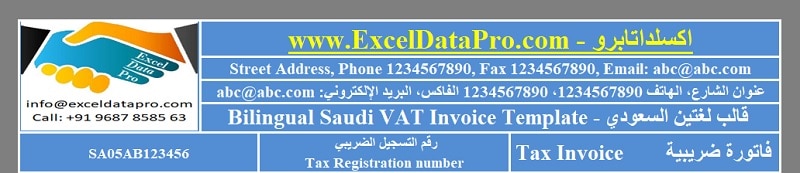

1. Supplier Details

In the header section, supplier detail like supplier’s company name, address, contact details, emails, vat number and type of invoice “Tax Invoice”.

As you can see that all details provided in this section are mandatory to be displayed by law. Refer Article 53 of VAT implementing Regulations.

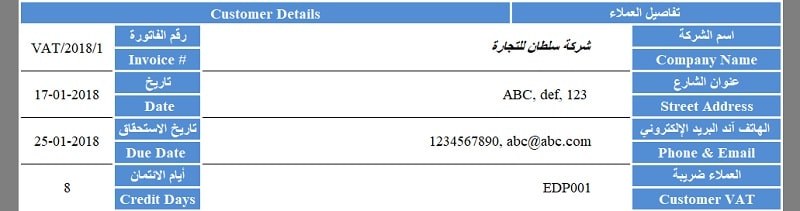

2. Customer Details

This section is pre-programmed with data validation and Vlookup. The user just needs to select the customer name from the drop-down list. It will automatically fetch other respective details the customer from the customer sheet.

Customer details consist of customer name, address, contact details and VAT number.

In addition to the above, invoice number, date of issue, the due date of payment and credit days are also given in this section.

Date of issue, Due date of payment and credit days contain predefined formulas. The date is configured using the TODAY Function.

Whereas the Due Date is configured adding the number of credit days to date of issue. Here in this template, the number of days added to the date of issue is 8 days.

Thus, the due date will display the date after 8 days from the date of issue. Credit days is the difference between the date of issue and the due date.

3. Product Details

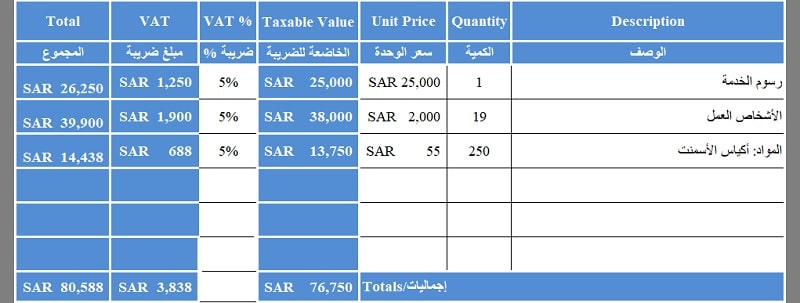

Product detail consists of the following:

Description – Details of goods or services or both supplied or rendered to the customer.

Quantity – Quantity of goods or services supplied.

Unit Price – Price per unit of the goods or services.

Taxable Value – Taxable value is the value on which the tax is calculated.

Taxable Value = Quantity X Unit Price

VAT % – Percentage of VAT applicable to the goods or services. Usually, it will be either 0% in case of zero-rated supply or 5% in case of taxable supply.

VAT – VAT amount is calculated using the following formula.

VAT Amount = Taxable Value X VAT Percentage

Total – Line total of each item.

Total = Taxable Value + VAT Amount

Columnar totals of each line are given below which displays the total of the taxable value of complete invoice, Total of VAT Amount collected against invoice and also the Final total of Invoice.

4. Other Miscellaneous Details

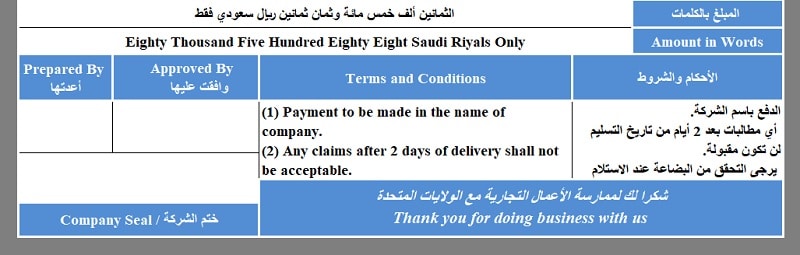

Other details include the following details of invoice:

Amount in Words

Terms and conditions

Prepared By

Approved By

Company Seal

Business Greeting

Everything in the invoice is bilingual except the numbers. The numbers can be changed to the Arabic language by changing the regional settings in the control panel.

You can use the cell locking feature in excel to save you from deleting the important formulas.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply