If you are an employee having a particular job or multiple jobs as a source of income then you can calculate AGI – Adjusted Gross Income using W-2 form.

AGI – Adjusted Gross Income is an individual’s total gross income after the deduction of certain allowable expenses. AGI helps you to determine your federal/state income taxes and also your eligibility for certain tax credits.

In addition to the above, AGI also determines the contribution amounts to IRAs and other qualified savings plans.

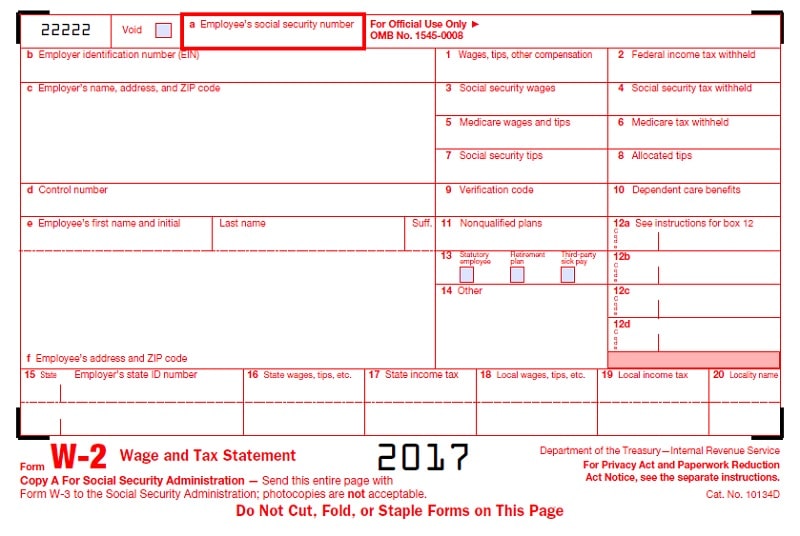

Employees receive the W-2 Forms from his/her employers at the end of every year. It consists of essential information to be reported on your federal income tax returns.

Steps To Calculate Your AGI – Adjusted Gross Income Using W-2 Form

Basically, there are 3 steps to this:

- Taking Gross Income from the W-2 form.

- Adding additional incomes from other sources.

- Subtract Allowable Deductions for which you are eligible.

1. Gross Income

You can find your gross income in box 1 of your W-2 form (total wages, compensations, and tips).

2. Adding additional incomes

Once you have your gross income, add income from other sources to it. These can include taxable interest, dividends, capital gains, royalties, alimony received, etc.

The taxable portion of retirement income from pensions and other retirement savings plans can also be added to this.

Additionally, you must also include taxable social security benefits, unemployment compensation, IRA distributions or income from self-employment.

3. Subtract Allowable Deductions

As soon as you finish adding up things, now subtract the allowable deductions for which you are eligible.

These deductions can include the deduction of health savings accounts, student loan interest, moving expenses, IRA Contributions, alimony paid, 50% of self-employment taxes, etc.

That’s it, The result derived is your AGI – Adjusted Gross Income.

You can use our Adjusted Gross Income Calculator to easily calculate your AGI.

You can also download other excel templates like Simple Tax Estimator and Itemized Deductions Calculator for easy tax calculations.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.