Under the US Tax Law, a fixed amount allowed by the IRS to be deducted from gross income for the purpose of Income tax is called Standard Deduction. It is a type of Allowable deductions.

The amount of Standard deduction is decided by the Internal Revenue Services (IRS). This amount varies from time to time according to the status of the taxpayer.

The amount of Standard Deduction in 2017 for Single Filers was $ 6,350, for Married filing jointly was $ 6.350, for Married filing jointly was $ 12,700 and for Head of House Hold it was $ 9,350.

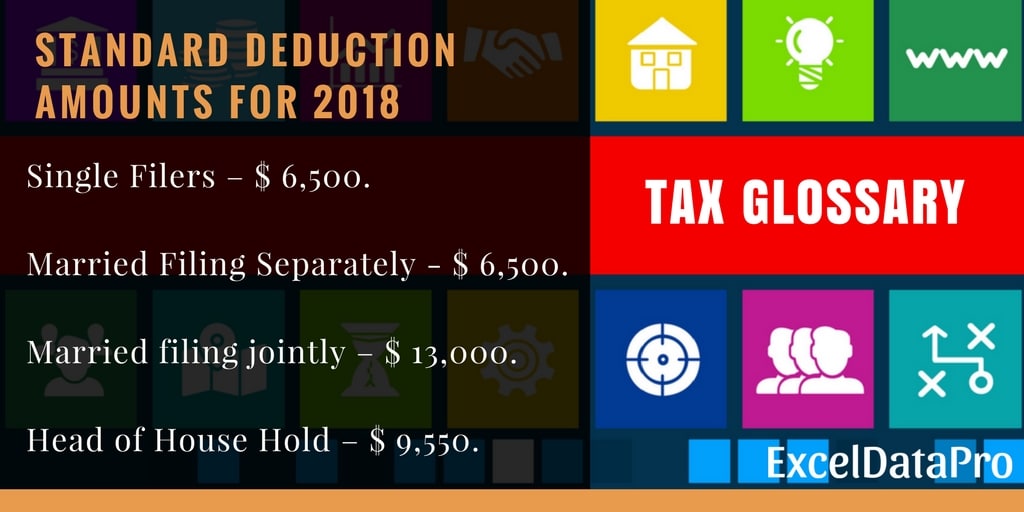

These amounts are now changed for the year 2018.

Standard Deduction Amounts for the year 2018

For the year 2018, the IRS has announced the amount for standard deductions. They are as follows:

Single Filers – $ 6,500.

Married Filing Separately – $ 6,500.

Married filing jointly – $ 13,000.

Head of House Hold – $ 9,550.

Source: www.irs.gov

Who cannot claim Standard Deduction?

Every taxpayer doesn’t qualify for standard deductions.

Single filers or married filing jointly cannot claim standard deductions who doesn’t pass the green card test or the substantial presence test during the tax year.

Similarly, married filing separately whose spouse has itemized his/her deductions are not eligible to claim the standard deductions.

An estate or trust is also not eligible for standard deductions.

When to Choose Standard Deduction instead of Itemized Deduction?

Choosing standard deductions is an easy option, but sometimes it might cost you money.

It is recommended that you take time to calculate and compare the amounts of the standard and itemized deductions.

If you find that your itemized deductions are less than standard deduction amount, then you must choose the standard deductions.

But, if your itemized deductions are more than the standard deduction amount then it is not feasible to choose this option.

We have made many free and downloadable templates which can be helpful to you for tax purposes. Some of them are listed below:

- Adjusted Gross Income Calculator

- Traditional IRA Calculator

- Roth IRA Calculator

- Income Statement Projection

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply