VAT Invoice Template is an excel template in compliance with GCC VAT Law. You can issue VAT invoice for all 6 GCC Countries; Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE easily and efficiently using this template.

All 6 GCC countries have signed the agreement for the introduction of VAT throughout the GCC in 2018.

Businesses operating in GCC countries have to prepare for compliance with the GCC VAT Law 2018 in time.

We have created a ready to use VAT Invoice Template in Excel. The user just needs to select his country and can start issuing VAT compliance invoices to their customers.

Click here to Download VAT Invoice Template for Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE.

You can also download other UAE centric Accounting Templates like UAE Invoice Template, UAE Invoice Template in Arabic, UAE VAT Debit Note and UAE VAT Credit Note etc.

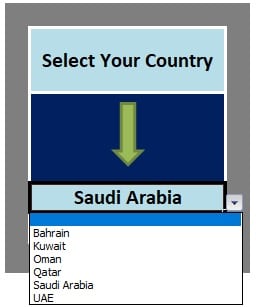

Before proceeding to the template contents, you need to select your country from the box given beside the template. See image for reference:

When you select the country, it will automatically change the currency in all cells of the template.

Now, let us discuss the contents of VAT Invoice Template in detail.

Content of VAT Invoice Template

This template consists of 2 worksheets.

- VAT Invoice Template

- Database Sheet (Customer Sheet)

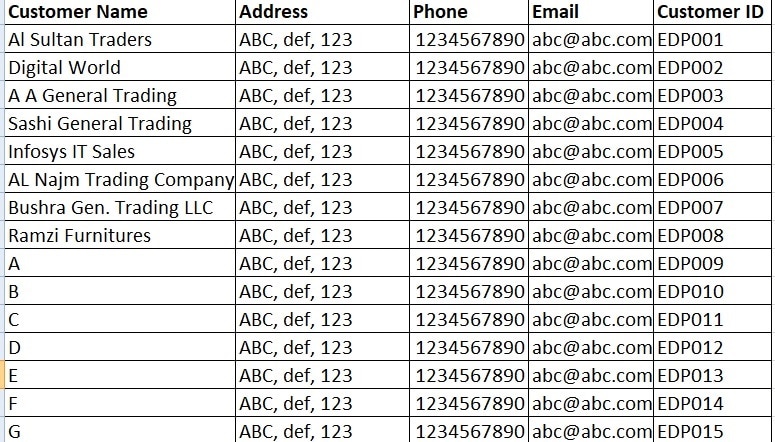

Database sheet contains the list of the names of your customers. This list is used for creating the drop-down list in customer details section of VAT Invoice Template.

The invoice Template consists of 4 sections:

- Header Section

- Customer Details Section

- Product Details Section

- Other Details Section

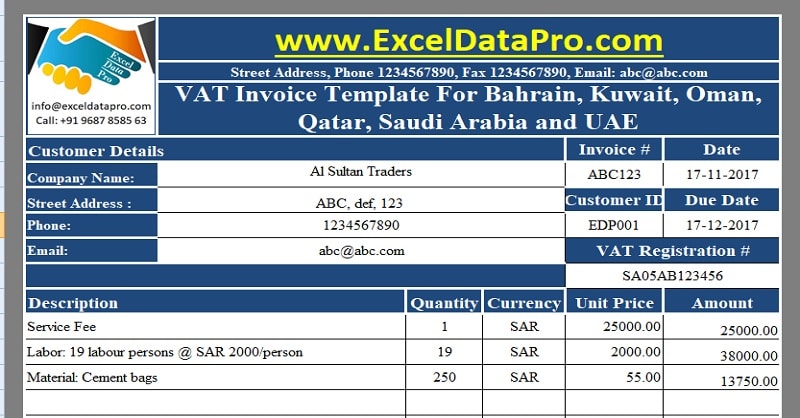

1. Header Section

The header section contains the company logo, company name and heading of the invoice ” Tax Invoice”.

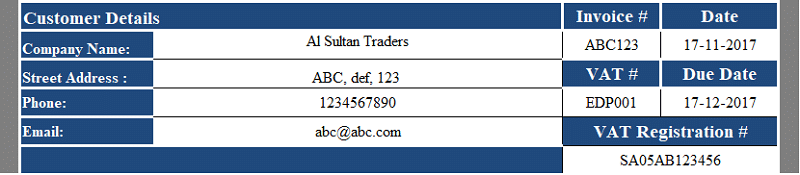

2. Customer Details Section

Customer Detail section programmed and referenced to database sheet with data validation and Vlookup function.

You can select the name of the customer from the drop-down list.

When you select the customer names, the template automatically updates other details of customers in the relevant cell.

These details include address, phone, email and customer id.

The right-hand side you need to enter the invoice number, invoice date. The due date for payment which is set to 30 days from the date of invoice will appear automatically. Then comes your VAT Registration Number.

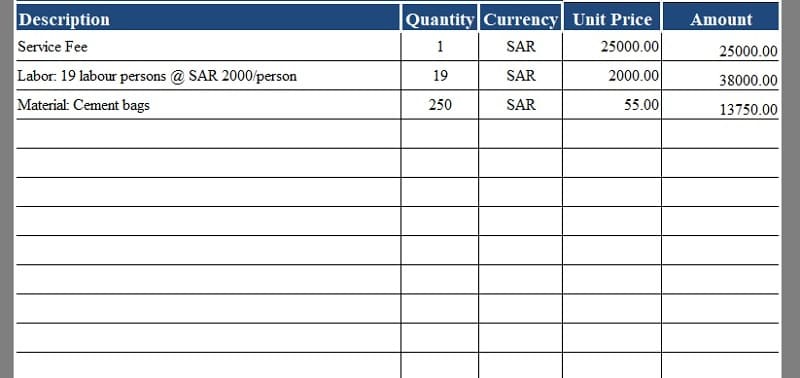

3. Product Details Sections

Product details section consists of columns of Description, Quantity, Unit Price and Amount.

The formulas used here are simple mathematical computations.

Quantity X Unit Price = Amount.

At the end, the subtotal line is given.

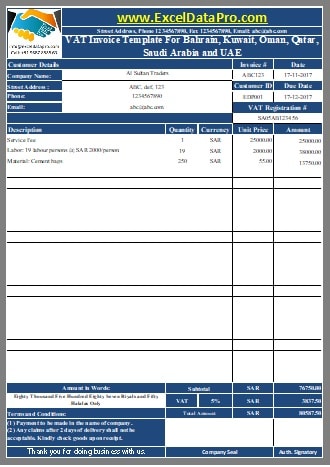

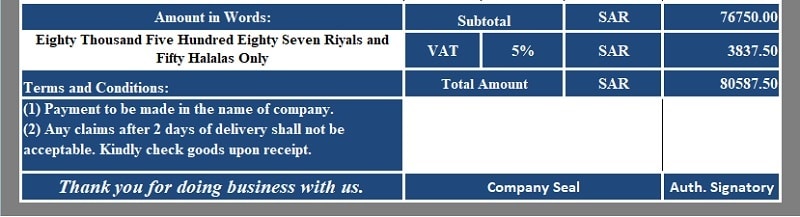

4. Other Details Section

Other details section consists of Amount in words, Terms & Conditions, VAT computations @ 5%.

In addition to that below are given space for Company seal, signature box and “Thank you” message business greeting.

It automatically computes the 5% VAT of the invoice amount and sums up the final total.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.